How far will the Greens go?

6 min readTable of Contents

The thriller about the vote on the BTC ban as part of the EU MiCA regulation directive went well for the time being. With 32 to 24 votes, the EU Parliament did not adopt the BTC ban paragraph. Now one must hope that the Greens, Left and Social Democrats do not continue to block the approval process. Finally, the BTC opponents could still veto the rapid MiCA implementation, which is currently assumed.

No matter what the outcome, an aftertaste will remain. The BTC opponents in the EU Parliament show little willingness to deviate from their clientele politics and to face an objective discussion. In particular, the Green camp is uncompromising with regard to the supposed environmental sow BTC.

The importance of MiCA

The parties mentioned are thus jeopardizing the rapid implementation of an important crypto regulatory initiative. MiCA would not only increase consumer protection in the EU, but also give companies and investors more legal certainty. Important guidelines for an up-and-coming industry in Europe.

The state would also receive more access rights and information from crypto service providers, for example to be able to impose sanctions on Russian oligarchs. From anti-money laundering to higher environmental standards, MiCA would represent an important step forward for uniform crypto standards in Europe.

The scandalous calculus of the Greens

All of the points mentioned above did not seem to be as important to the Greens as the goal of banning BTC. In doing so, they consciously take the risk of postponing important regulatory decisions for several months, even years, just to engage in obvious patronage politics. Even knowing that a ban on BTC would be overturned by the Commission and the Council of Ministers at the latest in the trilogue, political games like the one in the Brussels sitcom “Parliament” from the ARD media library.

After the BTC ban was already removed from the MiCA decision paper, the BTC opponents submitted a last-second amendment entry for a BTC ban on Friday, March 11th, i.e. the last working day before the vote on March 14th . Apparently consciously calculating that over the weekend people would have better things to do than grapple with regulation and so the change would go unnoticed.

The slightly different weekend

Luckily, the amendments were made public, so the blockchain scene reacted to them on Saturday. We at BTC-ECHO have published a list of all German EU parliamentarians and the blockchain interest group Hanseatic Blockchain Institute eV has come up with a quick one position paper written with the participation of numerous blockchain experts.

Entrepreneurs, lawyers, university teachers and other professional groups involved in the further development of the crypto economy were allowed to sacrifice their weekends for this. The extent to which public pressure was decisive for the vote against the BTC ban cannot, of course, be assessed afterwards.

Consequences of a BTC ban

As unlikely as a BTC ban is, the consequences would be devastating and would thwart the intentions of the MiCA regulation and climate policy. The current delay in MiCA alone is causing great damage, for which the aforementioned BTC opponents are responsible. The following effects could be expected if the EU decided to ban BTC after all:

1) Money laundering and tax evasion

Crypto services like BTC trading would shift to foreign exchanges with lower regulatory standards. Standards of the highly regulated crypto companies with a BaFin license, such as you Coinbase would be replaced by deregulated offshore companies in the Cayman Islands and Co.

The control of European and national authorities in Europe would be reduced. More loopholes for tax avoidance would be created and lower KYC and AML obligations would encourage crime. The possibility of enforcing sanctions by obliging European crypto exchanges to freeze digital assets is also being thrown overboard with a BTC ban.

2) Race to the Bottom: Consumer Protection

Legal certainty for consumers would hardly exist, since as a BTC investor from the EU it is difficult to sue companies from dubious jurisdictions. Some non-European crypto service providers do not even have an imprint. The risk of falling for unfair business practices or even being caught by fraudsters would be significantly higher.

3) Brain drain and less tax revenue

Many crypto service providers from the EU would be forced to emigrate. This would benefit regions such as Switzerland, Singapore or the USA. On the one hand through highly qualified jobs that are newly created and on the other hand through the resulting tax revenues. Europe would then repeat the same mistake as it did with the Internet. The most influential and largest companies from the blockchain sector would again emerge in the USA or Asia and not in Europe.

4) Goodbye climate protection

Basically, very little BTC mining takes place in the EU, which is why a BTC mining ban would have little effect. Instead, any effort to promote mining from renewable energies in the EU would be put to a halt. Dirty coal-powered mining in Kazakhstan, on the other hand, would benefit.

So instead of demanding CO₂-neutral mining in the EU through strict legal requirements, a BTC ban does exactly the opposite. Especially since one should not equate power consumption with CO₂ emissions. The CO₂ emissions from BTC mining are negligible at 0.05 percent, i.e. one two-thousandth of the total global CO₂ emissions.

It goes without saying that BTC mining should only take place from renewable energies. However, BTC mining companies now have to prove that they are green in order to collect sufficient investor funds. As a rule, new energy sources are also tapped into instead of “tapping” existing ones. In addition, it should not be forgotten that the further development for mining graphics cards, which is trimmed for energy efficiency, benefits various electronic devices such as laptops, cars, etc. Should mean that the efficiency gains through the research taking place can reduce the electricity consumption from various other industries. To be fair, one has to admit that the latter is a theoretical assumption that cannot yet be scientifically proven.

BTC ban: Regardless of losses

The efforts of some MEPs to ban BTC can hardly be surpassed in terms of ignorance and arrogance. Instead of setting high sustainability standards, people prefer to swing the ban club. The result would not be climate protection, but EU countries falling behind in international competition and greater environmental pollution due to lower standards in non-EU countries.

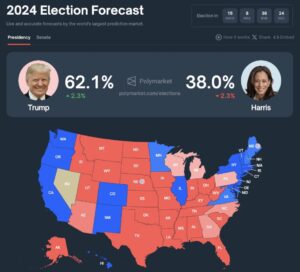

With the intended death regulation and the goal of launching a global wave of bans against BTC, the loss of assets of millions of people is consciously accepted. A market capitalization of 800 billion US dollars is currently at stake, which according to the ban supporters should tend towards zero.

Moral hubris

The Greens, in particular, are ushering in a turning point. Apparently, what is useful and thus legitimate for consuming electricity should no longer be decided by the individual or company, but by the state. It remains to be seen which applications the Greens want to ban in the future. Who knows, if there are enough Christmas grouches among the EU parliamentarians, the Christmas lights could be next. With the killer argument “climate” the Greens have lost their objectivity – ideology instead of arguments.

Accordingly, it is to be hoped that the Liberals and Christian Democrats will continue to assert themselves in the MiCA debate in the EU Parliament and will be able to avert further efforts by the Greens, Left and Social Democrats to ban BTC.

Rapper French Montana resolves conflict with 50 Cent and enters the metaverse