Cryptocurrencies have become a hot topic for the Federal Reserve (Fed). So much so that for the first time, the topic was the subject of one of his surveys, which aim to better understand consumer experiences with this payment method.

The most recent of these surveys is called “Economic well-being of US households in 2021”. Conducted in May, the survey surveyed 11,000 adult Americans between October and November 2021. Of that total, about 13% use cryptocurrencies as investments.

Another part of this total has cryptocurrencies as a means of payment. But this is a very small fraction: less than 3% of the total.

In this sense of investment, cryptocurrencies are used by the richest part of Americans, those who earn more than US$ 100 thousand annually.

“People who held cryptocurrency purely for investment purposes were disproportionately high-income,” the Fed concluded.

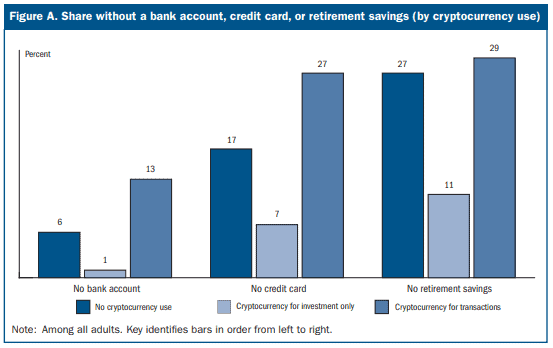

Finally, the research concluded that cryptocurrencies are more used as a form of investment in relation to the use for transactions or purchases. However, the situation is reversed when taking into account Americans who do not have a bank account. Of this group, 13% use cryptocurrencies as a payment or means of transfer.

What are cryptocurrencies used for in the US?

According to the survey, Americans who have access to the banking system see cryptocurrencies as an investment. About 12% of adults surveyed said they had purchased cryptocurrencies just for this purpose.

In comparison, 2% said they used them to buy products or send money to family or friends. Another 1% of respondents said they used their cryptocurrencies to send money to family or friends abroad.

This shows a fairly clear usage cleavage. Those who have access to banking services have less difficulty making transactions. Therefore, the value of BTC (BTC) and other cryptocurrencies as a means of payment is not recognized by this group.

At the same time, banked citizens still prefer traditional remittance services. Platforms such as Western Union and bank accounts, for example, are the most used by this group.

Success among the unbanked

The theme shown in the previous topic is reinforced by other research data. According to the Fed, 99% of people who invest in cryptocurrencies as an investment have a bank account. On the other hand, those who do not have access to banks use 13 times more cryptocurrencies.

Analyzing the situation of the unbanked, the survey reveals that 13% of them are more likely to use cryptocurrencies as a means of payment. For this group, BTC is not an investment, but a cheap alternative to banks.

“About 99% of those who invest in cryptocurrency but do not use it for transactions had a bank account. By contrast, 89% of non-withdrawal cryptocurrency investors had at least some retirement savings.”

Naturally, unbanked citizens also use BTC as an investment. This group has a long-term vision, focused mainly on retirement. In fact, most unbanked investors are among those who do not have retirement plans.

- Proportion of unbanked people using cryptocurrencies. Source: Federal Reserve.

In addition, 27% of the unbanked who do not have credit cards use cryptocurrencies for transactions. As for investment, 7% of this same group use them as a form of financial reserve.

Overall, the report showed that cryptocurrency adoption in the US is growing and that more people want to invest in cryptocurrencies before actually using them as a means of payment.

What happens when the next stablecoin bomb bursts?