Magnificent Seven: AXS, TEL, SUSHI, OKB, DASH, FTT, LUNA — Biggest Gainers July 16-23

3 min readTable of Contents

BeInCrypto takes a look at the seven altcoins that increased the most over the past seven days, from July 16 to July 23.

These altcoins are:

- Axie Infinity (AXS) – 28.49%

- Telcoin (TEL) – 26.59%

- SushiSwap (SUSHI) – 26.18%

- OKB (OKB) – 19.30%

- Dash (DASH) – 18.40%

- FTX Token (FTT) – 16.51%

- Terra (LUNA) – 12.34%

AXS

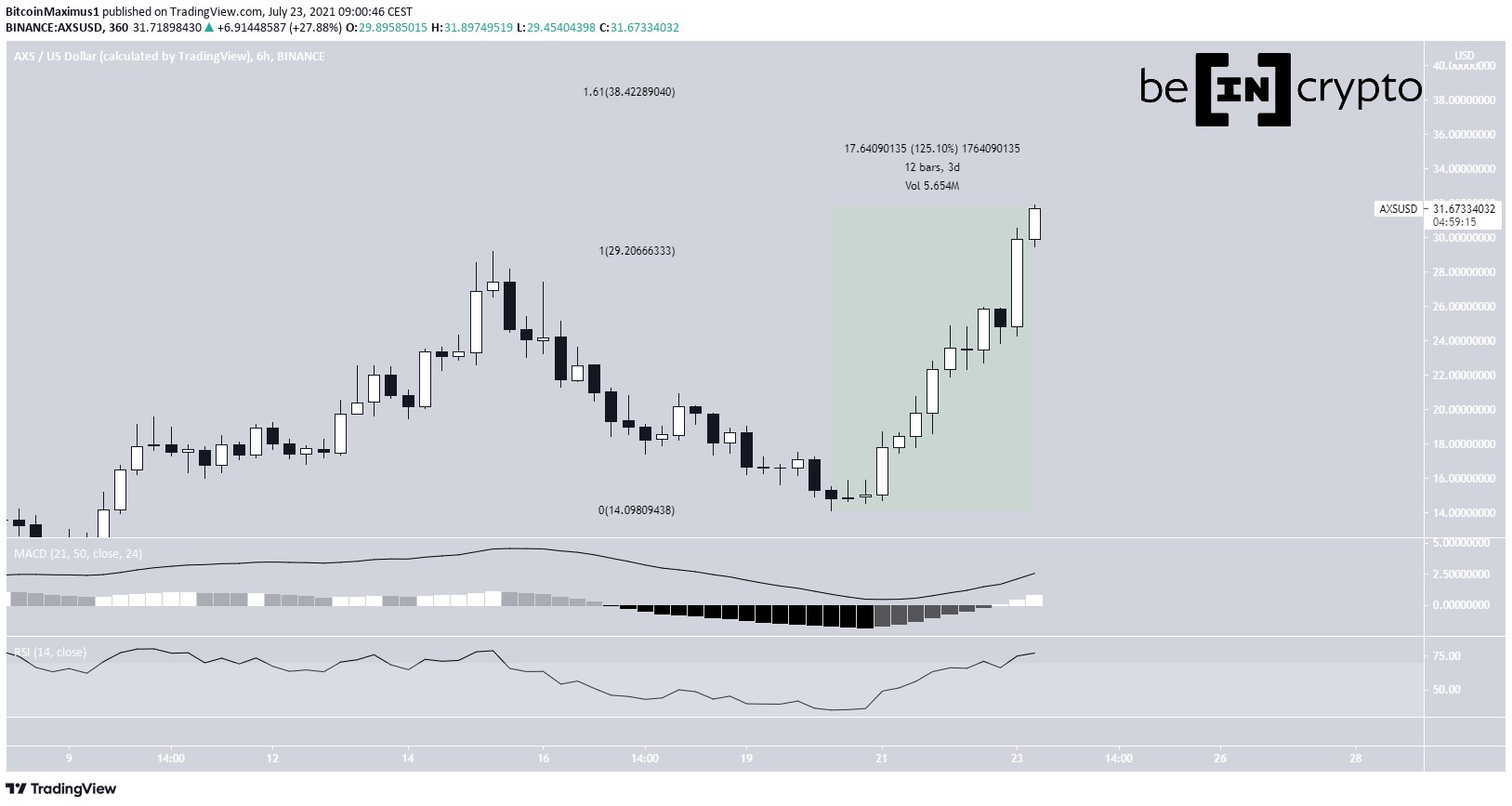

AXS has been moving upwards since July 20, after reaching a low of $14.10. In the span of three days, it has increased by 125%, leading to a new all-time high price of $31.94 on July 23.

AXS is still moving upwards and has so far shown no signs of weakness. The MACD and RSI are both increasing.

The next resistance area is found at $38.42. This is the 1.61 external Fib retracement level.

TEL

On May 19, TEL fell to a low of $0.0095. After a bounce and correction, it returned to the same level on July 20.

This effectively created a double bottom pattern and TEL has been moving upwards since. Technical indicators are providing some bullish signs, such as the potential bullish cross in the Stochastic oscillator.

TEL is also following a descending resistance line. If a breakout occurs, the closest resistance level would be found at $0.03.

SUSHI

SUSHI had been following a descending resistance line beginning on May 20.

It broke out on June 27, and proceeded to reach a high of $9.72 on July 7. However, it was rejected by the $9.50 area and began a downward move.

This caused a drop to the $6.20 area which has been validated four times since May 19.

Currently, SUSHI is trading inside a range between $6.20 and $9.50. A breakout above the latter could cause a sharp increase.

OKB

OKB has been increasing since June 22. On July 20, it created its first higher low and resumes its upward move at an accelerated rate.

It’s following an ascending resistance line and has touched it for the third time (red icon). In addition to this, the line coincides with the 0.5 Fib retracement resistance level at $13.75.

A breakout above the line could trigger a sharp upward move toward the range highs at $19. The MACD and RSI are both bullish, supporting the continuation of the upward movement.

DASH

DASH had been following a descending resistance line since May 20. On July 19, it broke out above the line and validated it as support the next day.

It has been moving upwards since.

The main resistance area is found at $190. This is the 0.618 Fib retracement resistance level.

FTT

FTT has been following a descending resistance line since May 27. While under the resistance, it has reached a low of $21.83 on June 26.

FTT has been moving upwards since, making another attempt at breaking out from the descending resistance line.

If successful, FTT would likely move toward the $37 resistance area.

The MACD and RSI are both bullish.

LUNA

LUNA has been increasing alongside an ascending support line since May 23. It created its second higher low on July 20.

The MACD and RSI are both increasing, supporting the continuation of the upward movement.

The closest resistances are found at $10 and $11.83. These are the respective 0.382 and 0.5 Fib retracement resistance levels. The latter is also a horizontal resistance area.

For BeInCrypto’s latest BTC (BTC) analysis, click here.

The post Magnificent Seven: AXS, TEL, SUSHI, OKB, DASH, FTT, LUNA — Biggest Gainers July 16-23 appeared first on BeInCrypto.