Market crash opened up buying opportunity for four cryptocurrencies, report says

2 min read

After several days of decline, the market is rehearsing a slight recovery at Tuesday. However, analytics firm Santiment claimed that four cryptocurrencies have entered the buy zone.

Four cryptocurrencies have entered the buy zone

They are 1inch (1INCH), Loopring (LRC), Ren Protocol (REN) and The Sandbox (SAND).

According to Santiment, all of them are in an ideal buying period. The company actually used the expression “buy the dip” to explain the cryptocurrency moment.

“After a continuous weekend slide, several altcoins have now reached buy the dip territory,” explained Santiment.

Model points out buying opportunities

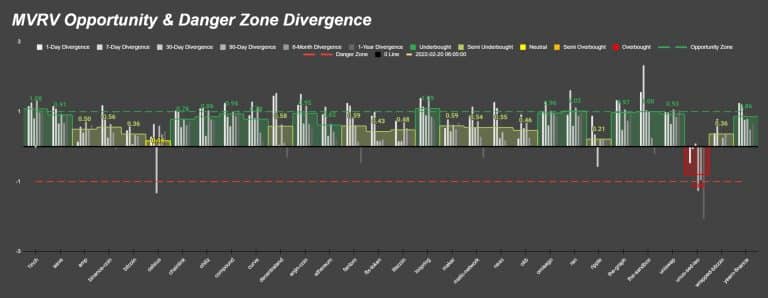

To assess the current moments of cryptocurrencies, Santiment uses a model called MVRV Opportunity & Danger Zone. According to this model, it is possible to assess what the potential levels of return are.

The model is divided into four different levels. Green cryptocurrencies are in the “opportunity zone”. Yellow levels are in the neutral zone, while the red dotted line represents risk zone.

Only Unus Sed Leo (LEO) is in an overbought region and therefore located in the danger zone. In contrast, most cryptocurrencies are in a region of opportunity (green).

Other major cryptocurrencies that are in the opportunity zone are Ethereum (ETH) and yearn.finance (YFI). BTC is in a neutral zone, which requires caution when investing.

However, the greatest opportunities are precisely those that are above 1 on this scale. In this sense, the cryptocurrencies mentioned at the beginning of the article have the following levels:

- The Sandbox (SAND): 1.00;

- Ren Protocol (REN): 1.02;

- 1inch (1INCH): 1.08;

- Loopring (LRC): 1.09.

In short, LRC and 1INCH represent the best opportunities according to the Santiment model.

Understand the MVRV

Market value and realized value (MVRV) is the ratio between the market value of a crypto asset and its realized value. It indicates the average profit-loss ratio for coins in circulation and is a useful metric for finding cryptocurrencies that are discounted.

Last month, Santiment announced updates to its MVRV model to provide more accurate and up-to-date data for merchants.

“Due to popular demand, we changed our MVRV opportunity and divergence model. Now the model is updated every hour instead of every day. This will help keep them up to date with the latest data on what their favorite assets are like for their next opportunity (or danger) zones,” the company said.