Nearly $ 50 million in ethers have been burned

2 min readAfter Ethereum hard fork, called London on August 5, 2021, had already managed to burn Ethers (ETH) worth almost $ 50 million – at the time of writing, more than 16,320 coins were the second largest and most famous cryptocurrencies.

The burning of ETH coins brought with it an update marked EIP 1559, which was part of the aforementioned Thursday hard fork. This update changed ETH’s “inflation policy” in the sense that transaction fees paid are now destroyed instead of being rewarded to miners.

According to the portal ultrasound.money, which tries to show statistics how significantly the EIP 1559 has affected ETH, making it even more attractive to investors, has already burned 16,324 ETH worth about $ 48 million (at the current price of ETH $ 2,930) since Thursday.

At the same time, most Ethers were burned in transactions related to the NFT marketplace OpenSea – until 1923 ETH. In second place is the decentralized sexchange Uniswap V2 (1264 ETH). They follow Axie Infinity (1009 ETH), stablecoin transactions Tether (772 ETH) a Space Poggers (570 ETH).

The model estimates ETH inflation

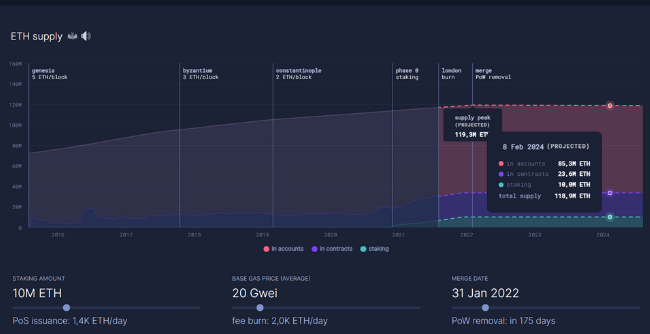

The untrasound.money portal also predicts future inflation of the cryptocurrency ETH through its calculator.

With settings based on current data on the amount of ETH stacked, transaction fees and the date of transition to ETH 2.0, it assumes that inflation of new ethers into circulation will slow significantly due to the update of EIP 1559 – especially compared to previous eras genesiswhen 5 ETH per block were mined, byzantium (3ETH / block), coinstantinopole (2ETH / block) a phase 0 staking (starting a beacoin chain).

Following the merger of ETH with ETH 2.0, which will bring with it a complete cessation of ETH mining, even current figures on transaction fees and the number of locked coins in staking can even be expected to keep ETH inflation virtually stable.

To put it simply, this model assumes that if transaction fees fall in the long run and the number of stacked ETH coins increases, ETH inflation will continue to rise (although the pace of growth will not be as rapid as in the past). Conversely, with lower ETH coins stacked and higher transaction fees, the number of ETHs in circulation may even decline in the future. However, it will really show up real data.