On-Chain Analysis: Interest in ETH Remains High Despite Correction

2 min readA look at on-chain indicators for ETH (ETH) in order to determine if the recent drop has waned the interest of participants in the market.

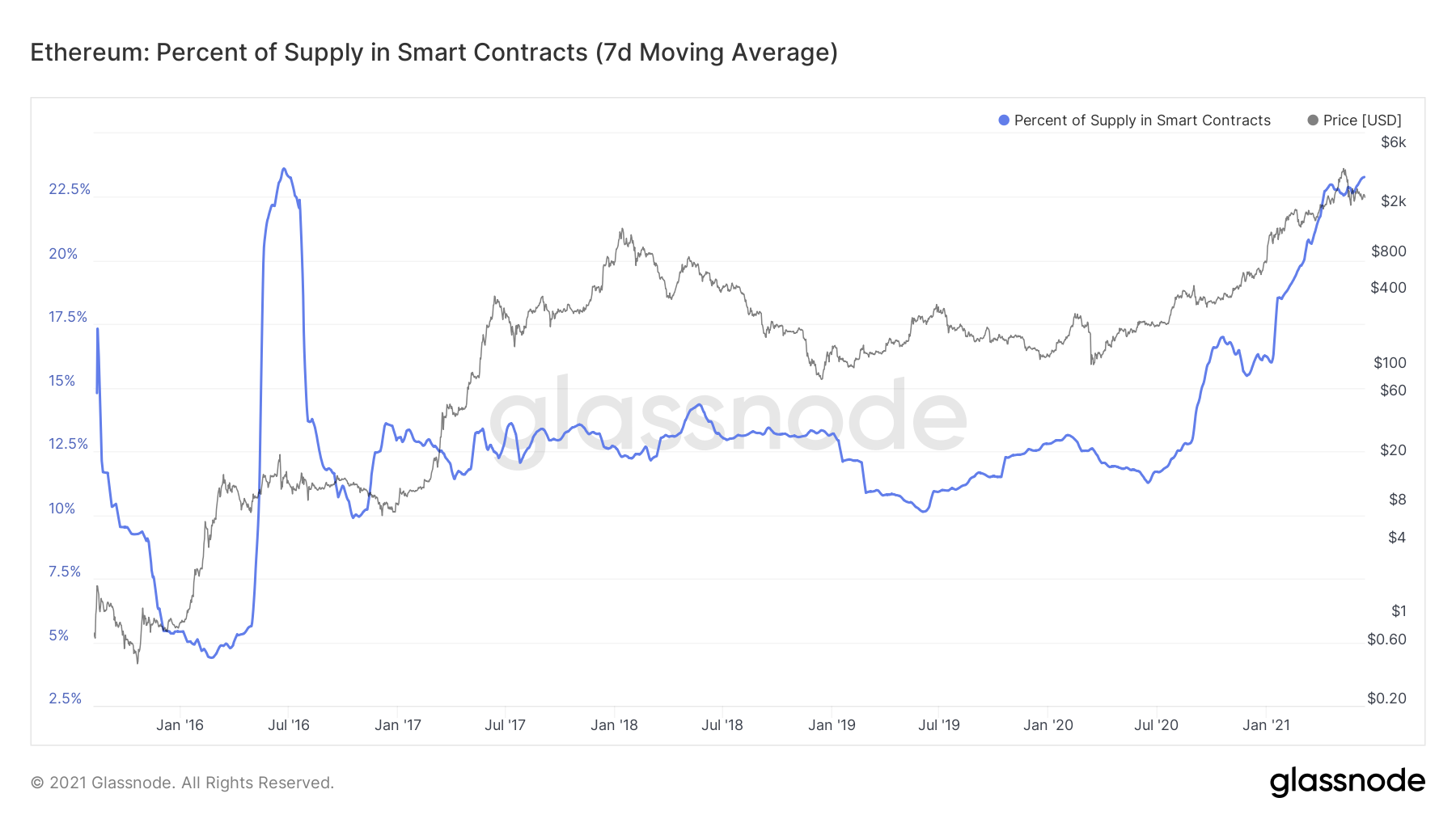

Interest in ETH remains high both in the form of increased staking and higher percentage of the supply that is locked in smart contracts.

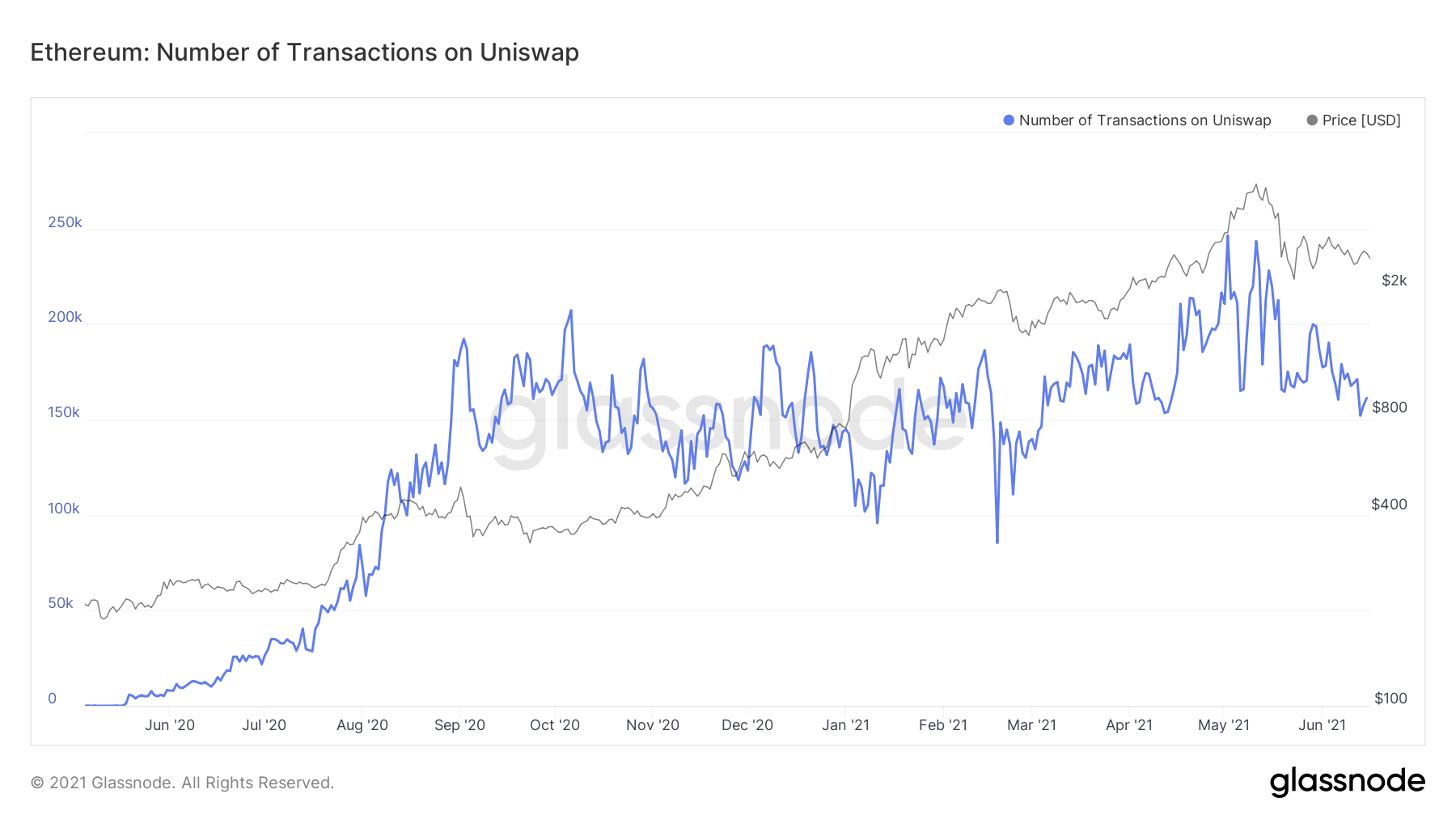

ETH use on Uniswap

The first thing we will take a look at will be the number of transactions on Uniswap, which is the largest decentralized exchange (DEX).

Despite the drop, the number of transactions on is still high. There were 161,317 transactions on June 15, a level similar to that of April.

Therefore, participants are still using their ETH in order to make transactions on Uniswap, being relatively unfazed by the sharp drop.

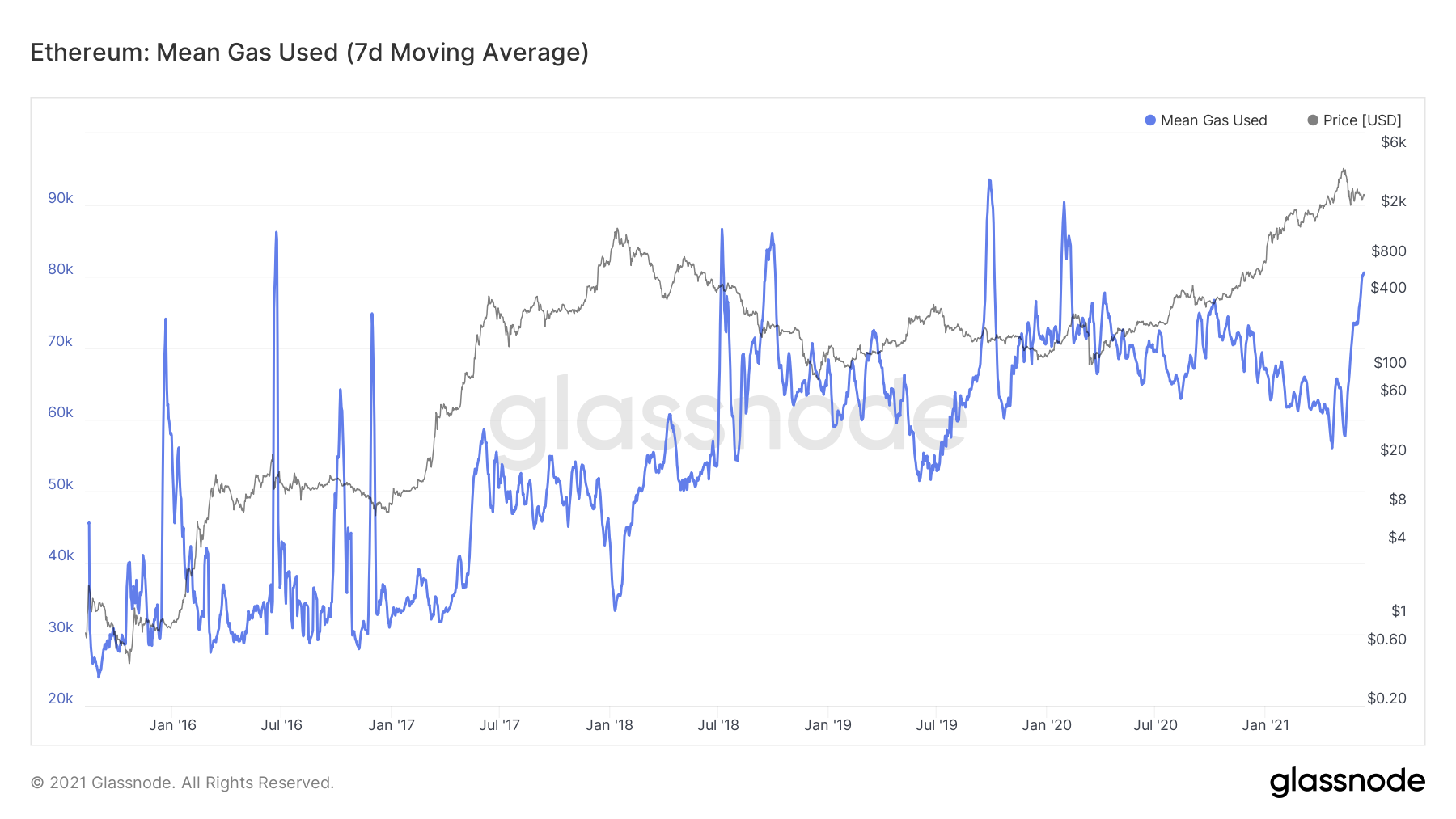

Furthermore, the mean amount of gas used per transaction is also relatively high, likely as a result of the high number of transactions. It is currently 80,515, which is a yearly high, and not that far off from the all-time high of 90,314.

This is not the same as the mean gas price paid per transaction, which has fallen considerably as a result of the decrease in the ETH price.

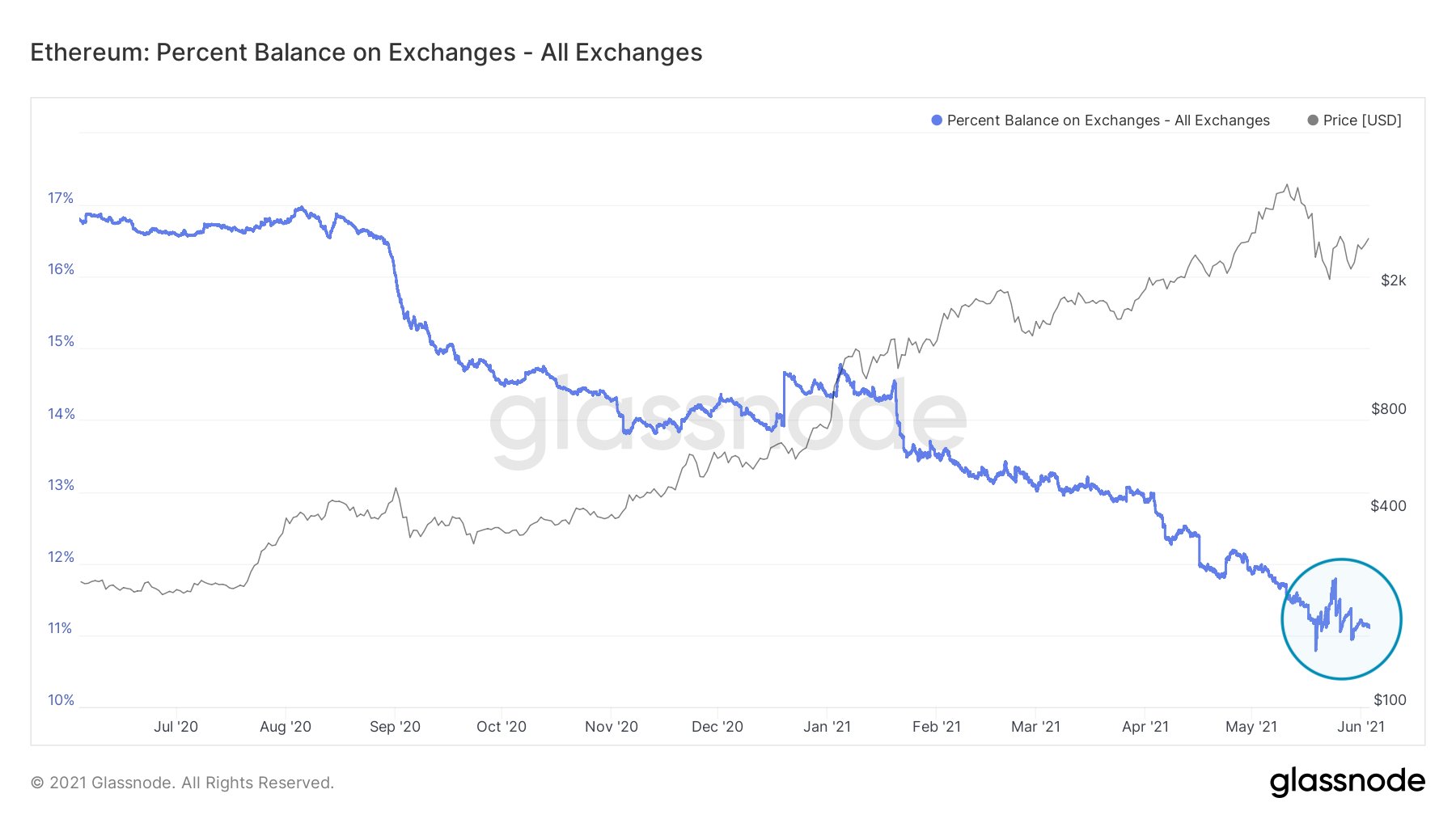

Exchange movement

An interesting development is that ETH is still continuously leaving exchanges, something that has been going on since the end of January. Therefore, investors are either moving it to cold storage or staking it in anticipation of ETH 2.0.

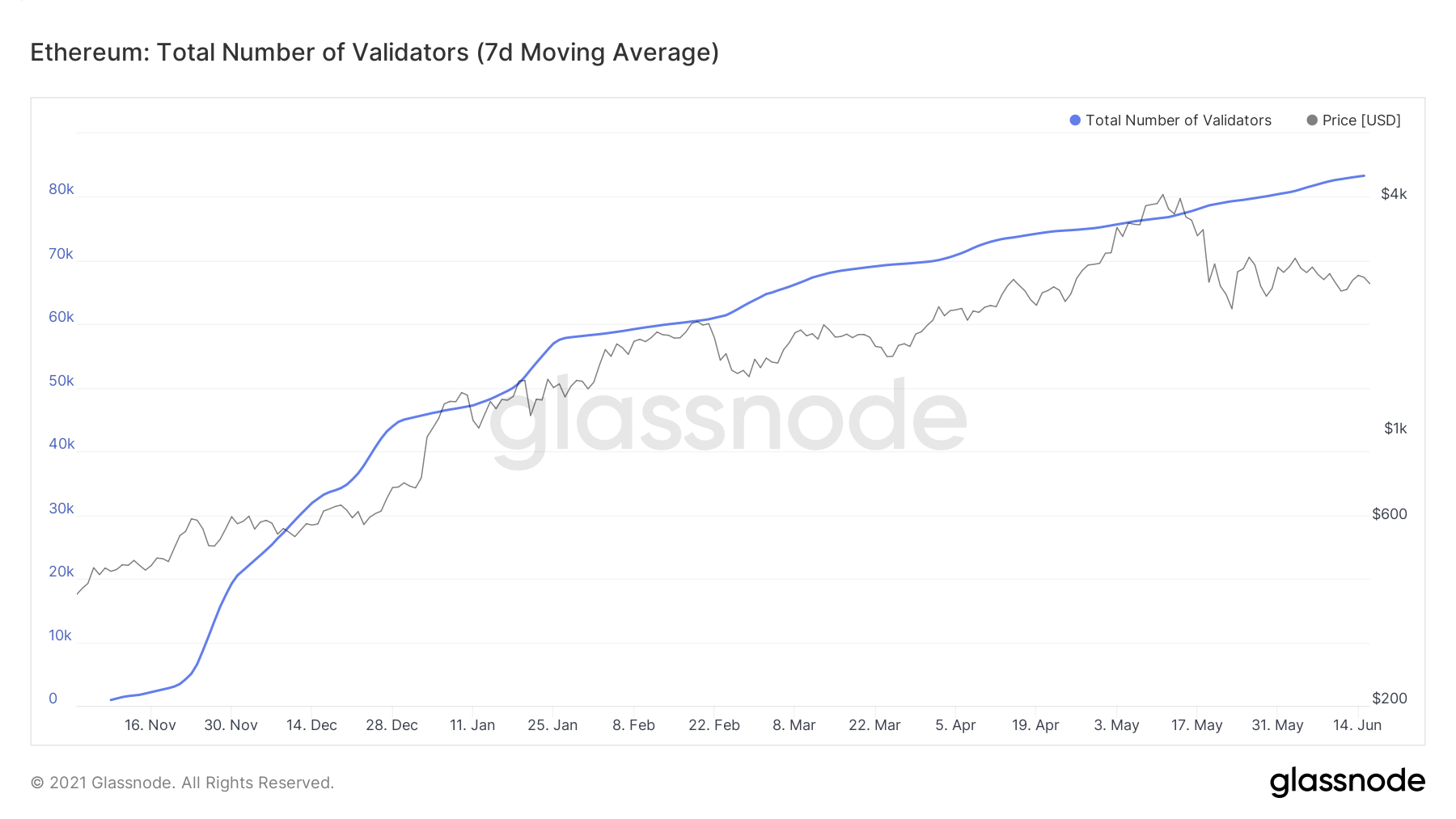

The number of validators, meaning accounts that are depositing tokens to the ETH2 deposit address, are increasing.

On June 15, there were 83,592 validator accounts, which is a new all-time high.

This indicates that investors are staking tokens in anticipation of ETH 2.0.

Finally, a look at the percentage of ETH supply in smart contracts is also currently at an all-time high of 23.29%.

For BeInCrypto’s latest BTC (BTC) analysis, click here.b

The post On-Chain Analysis: Interest in ETH Remains High Despite Correction appeared first on BeInCrypto.