On-chain data looks very promising for BTC. Is the end of 2020 repeating itself?

5 min readTable of Contents

Several on-chain data from BTC suggest that large investors, including institutions, are currently accumulating large amounts of BTC or investing in it through derivative contracts.

Reserves on derivatives exchanges are declining

According to CryptoQuant’s analytical data, current BTC reserves on derivatives exchanges are at similar values as at the end of 2020, ie before the period of the beginning of the steepest rise in the price of BTC. As of Tuesday, it was 1.256 million BTC – the lowest value since May 11.

Balances on exchange, including derivative platforms, are proof that the trend we witnessed at the end of 2020 is repeated. Even during the most intense phase of BTC price growth, derivative balances grew – a declining balance was only characteristic at the beginning of the price run.

Whales accumulate additional BTC

On-chain analyst William Clemente III pointed out that the number of Bitcoin under the control of whales holding 10,000 BTC to 100,000 BTC is growing significantly. They have accumulated another 269,450 BTC since May 19, which is about $ 12 billion. “These entities have between $ 450 million and $ 4.5 billion in BTC,Illustrated the approximate dollar value of these players’ addresses.

BTC accumulation by whales (10,000 BTC to 100,000 BTC)

However, some may say that exchanges can be classified as whales with 10,000 BTC to 100,000 BTC. William Clemente III therefore added information about BTC’s movements at addresses from 1,000 BTC to 100,000 BTC (which therefore include all whales).

Whales with 1K-100K BTC have now added +356,036 BTC ($ 16.3B) to their holdings since May 19th.

– Will Clemente (@WClementeIII) August 11, 2021

As of May 19, 356,036 BTCs have been added, or about $ 16.3 billion (at the current BTC price). It is important to note that, according to Clemente, these numbers do not include exchanges, Purpose ETFs, QBTCs, and other addresses that pertain to crypto and Bitcon ETFs in Canada.

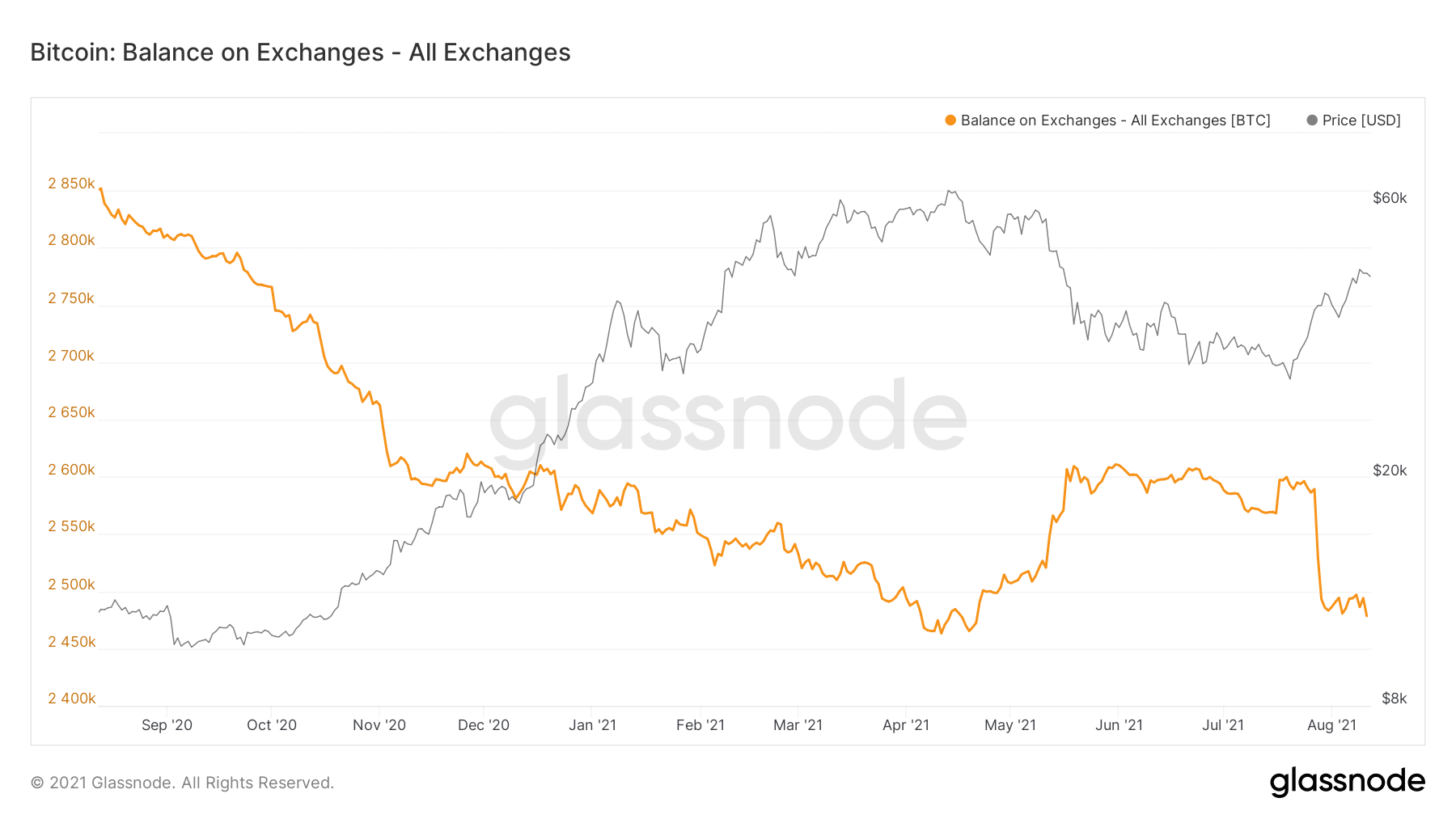

The number of BTCs on spot exchanges is also declining

The graph of the number of BTCs on spot exchanges traditionally also requires a lot of attention. This is a good illustration of the long-term mood of investors. If BTC is heading to the exchanges, investors are considering a possible sale. If, on the other hand, they leave the stock exchanges, this is a clear indication that Bitcoins are leaving for private wallets, ie their holding is planned for a longer period of time.

The balance on spot exchanges is also developing in a positive direction, as it has fallen to a three-month low. According to CryptoQuant, there are currently only around 2.44 million BTC on the stock exchanges and according to data from rival Glassnode 2.478 million BTC.

The trend of a large outflow of BTC from the spot exchanges has resumed

By the way, the trend of the outflow of BTC from the stock exchanges is also confirmed by today’s recent data, according to which there has been an outflow of BTC from the stock exchanges worth over $ 700 million in the previous 24 hours.

📊 Daily On-Chain Exchange Flow#BTC $ BTC

➡️ $ 1.2B in

⬅️ $ 1.9B out

📉 Net flow: – $ 720.9M#ETH $ ETH

➡️ $ 629.5M in

⬅️ $ 887.9M out

📉 Net flow: – $ 258.4M#Tether (ERC20) $ USDT

➡️ $ 745.0M in

⬅️ $ 823.6M out

📉 Net flow: – $ 78.7Mhttps://t.co/dk2HbGwhVw– glassnode alerts (@glassnodealerts) August 12, 2021

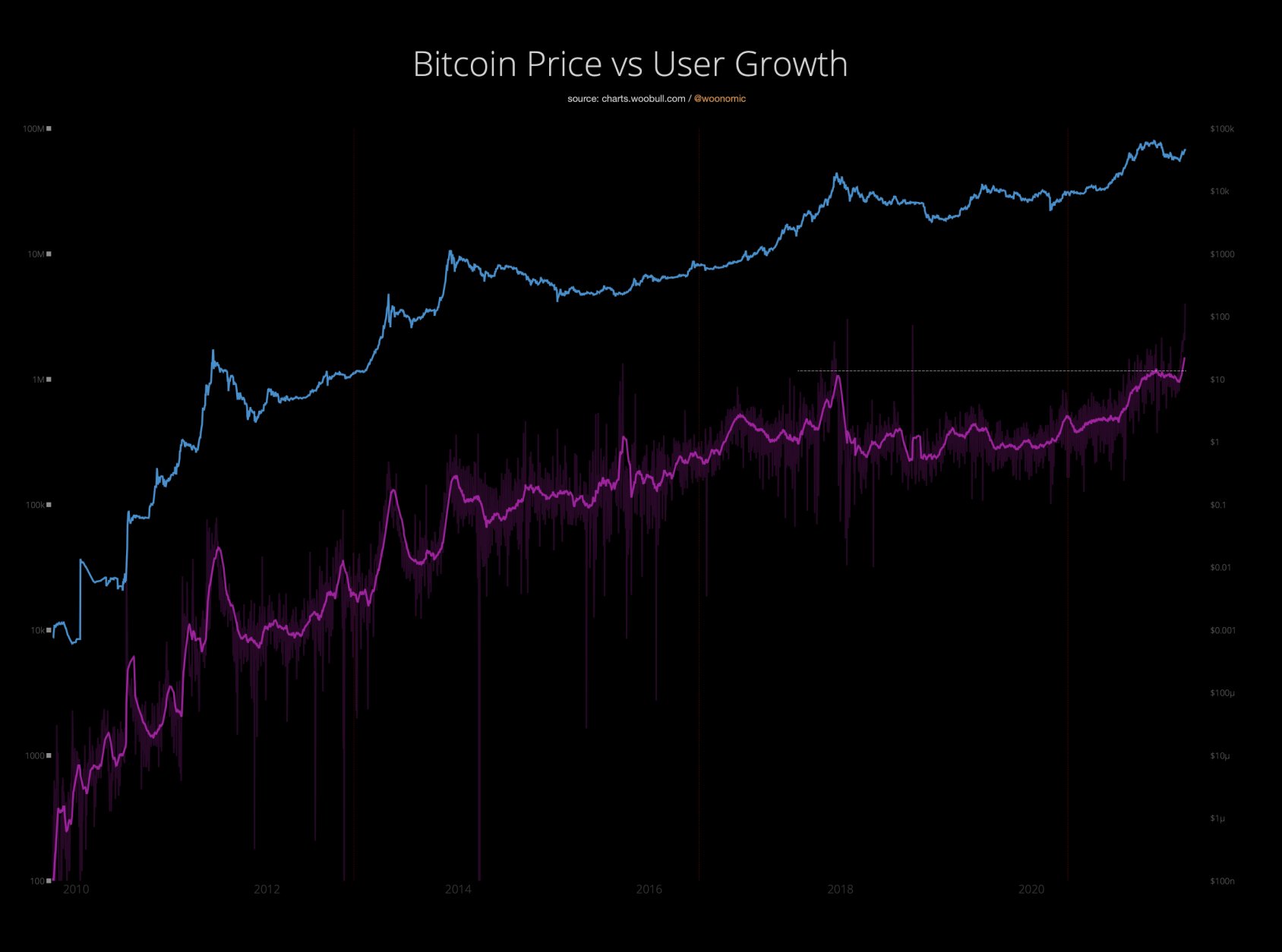

Influx of new users

Another well-known market analyst, Willy Woo, also showed a chart that casts hope that BTC’s bullrun is indeed continuing. According to onchain data, the number of new users in the BTC network is growing rapidly.

,, 1.2 million users have been added in the last 30 days (entities according to onchain data). This does not include users on exchanges, which are typically three times more. What we see is the equivalent of the arrival of the entire population of a country like El Salvador every two months, “ he pointed out.

Dead cat bounce? Maybe not

With the current rise in the price of BTC, some investors fear a repetition of the scenario from the first half of 2018, when BTC also strengthened significantly after the previous huge fall from historical highs on December 17, 2017. This phenomenon is called “dead cat bounce”. which, after the price rebound upwards, falls down again and even lower than it was before the rebound.

However, Glassnode’s onchain data from the beginning of this week suggest that BTC is currently in a significantly different situation than it was in the first half of 2018, when the “dead cat bounce” actually took place.

In that period, the long-term BTC holders used the price increase for further large sales owned by BTC. In other words, they used the price increase to get rid of BTC, which they did not manage to sell cheaply before, because they were surprised by the sharp fall in price (on the chart on the left – the period of the first half of 2018).

Unlike the 2017 dead cat bounce, long-term holders are not looking for exit liquidity to abandon ship. They’re sitting long and strong.

At present, however, long-term BTC holders behave significantly differently according to onchain data – they more or less wait and do not move their Bitcoins (on the bottom right of the chart). Thus, it appears that confidence in the growth of the BTC price by long-term BTC holders is currently at a much higher level than it was in the first half of 2018. This suggests that the “dead cat bounce” scenario may not be repeated this time.

What else raises the question marks?

Although the mentioned charts and figures give hope that BTC is out of the worst and that the continuation of the bull cycle awaits us, some data do not yet reconcile with this statement. The growing interest of institutions is not yet signaled by the Grayscale BTC Trust (it is still traded at a significant discount to the NAV price) and by weekly reports on investments in crypto funds (we wrote about it here).

The confirmation of the bullrun would also be appropriate if new BTC whales (addresses with at least 1000 BTCs) began to emerge, as was the case in 2020. The number of BTCs at addresses with 1000 BTC (and more) is growing significantly, but their total number is after the previous sharp correction more or less does not change (goes to the side).