Over $11B in BTC Held by 32 Companies: Crypto Treasuries Report

2 min readData from CryptoTreasuries shows that 32 companies hold nearly $12 billion in BTC, while 11 companies hold roughly $470 million in ETH.

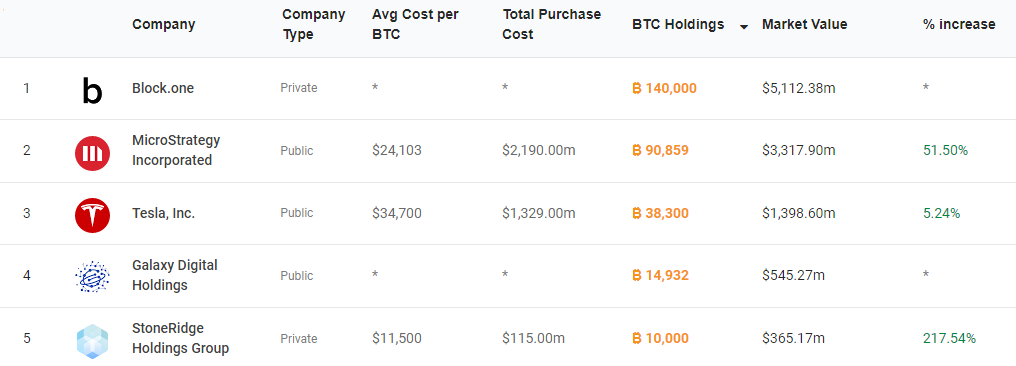

According to data from CryptoTreasuries, 32 companies together hold about 325,013 BTC. That value amounts to roughly $11.7 billion. As for ETH, 11 companies hold 169,279 ETH, at a value of roughly $470 million. These figures are not exhaustive but do give an indication of how much weight is being thrown behind the assets.

The BTC big-boys

Block.One has the largest holdings of BTC at 140,000. It’s followed by MicroStrategy and Tesla. The former especially is long on BTC and that shows in its holding of 90,859 BTC. MicroStrategy is up approximately 50% on its investment in BTC.

MicroStrategy CEO Michael Saylor has been a huge proponent of BTC in the past few months, with the company periodically adding to its holdings. Tesla, meanwhile, has made a much smaller gain at 5% — something not helped by Elon Musk’s inflammatory tweets.

Galaxy Digital Holdings and StoneRidge Holdings Group round out the top 5. Square, which is also a significant supporter of BTC, holds 8,027 BTC. The company’s Cash App is a major entry point for would-be investors, and its BTC revenue became its dominant stream last year.

Galaxy Digital seems to be much more focused on ETH, being the company with the largest holdings at 98,892 ETH. The figure is worth roughly $275 million. Coinbase Global and Meitu follow with 31,787 and 15,00 ETH respectively.

All-in-all, there are likely many other companies holding these assets and other cryptocurrencies. The website also notes that this does not include ETFs and other assets under management — which, if were included, would boost the numbers up significantly.

Proof that crypto is seen as legitimate

What this information does tell us is that several major companies are getting in on the crypto game. There is certainly much more belief now in crypto than a few years ago. There was a time when companies would not even consider investing in this asset class.

This is most clearly evident in how MicroStrategy changed its tack on BTC. The company and its CEO once dismissed BTC, but now they stand as some of its most ardent supporters.

The financial decisions taken by some governments in the wake of the pandemic have spurred these companies to protect themselves by diversifying. This is one major reason as to why big firms are entering the space, besides seeing potential value in the form of decentralized apps (dApps) and decentralized finance (DeFi) courtesy of ETH.

The post Over $11B in BTC Held by 32 Companies: Crypto Treasuries Report appeared first on BeInCrypto.