Prediction of BTC value using quantitative models – part 2

3 min readTable of Contents

Predicting the development of the value and price of BTC is a thorny but at the same time very popular topic. So there are several methods that help us with predictions. What do you need to know about them?

The market is moving in bubbles

In recent months or even years, there has been a lot of talk about bubbles emerging in bond markets. Newspapers, financial and non-financial, specialized television stations, and prestigious “macroeconomists” from around the world talked about the fact that today’s global debt has negative interest rates.

It is financially unintuitive to have to pay or lend money to someone, even if that person is the state. We are experiencing an absurd situation that has never happened in the environment of financial markets. The main reason is related to the huge liquidity that central banks supply to the markets, which they use as funds to avoid their own bankruptcy, only to turn it cautiously back to the states (which have found themselves in trouble). In fact, this absurdity made it possible to avoid the bankruptcy of the financial system.

One of the phenomena, which is not really fed by central bank money and which everyone in 2017 called a meaningless megabublin, is BTC.

Inflation

All the world’s currencies have become less and less valuable over time due to inflation. Inflation is triggered by a rule that combines the total value of goods in the world with the total value of currency in circulation. If the number of currencies in circulation doubles, the same goods will tend to cost twice as much. It will “tend” because the currency is not a linear phenomenon and may take some time.

Deflation

BTC was created with a deflationary logic that more closely resembles commodities such as gold and silver. That’s why many consider it a new digital gold because it has value-preserving properties.

Nakamoto decided that the maximum number of Bitcoins created and available should be 21 million (this number will appear more often, it is the Greek letter fi). He might have chosen to enter a fixed number of Bitcoins for each block extracted, but this would not create the exponential growth effect that characterizes BTC, or at least not as significant as it is today.

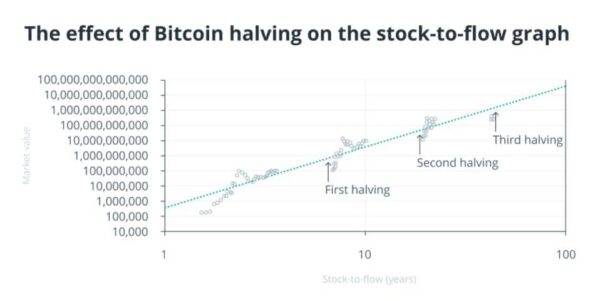

As a result, halving takes place every 4 years, halving the number of newly released Bitcoins and creating a very significant and interesting stock-flow ratio effect that will push the price higher and higher.

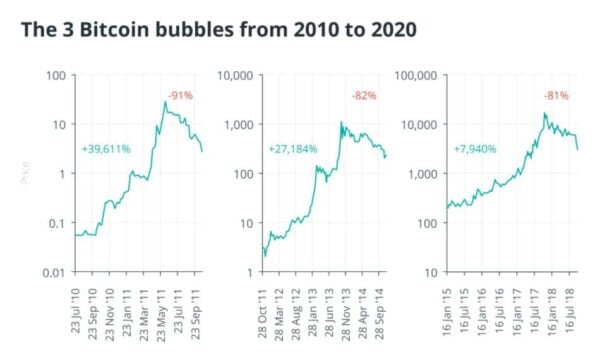

BTC bubbles

BTC had three death bubbles in his lifetime:

The price has always multiplied by at least tenfold after halving. Of course, this is not a guarantee that this will be the case in the future, but there are many factors that lead us to believe that what we experienced in 2017 will not be the last bubble and many more will follow in the future.

How to use the information?

Can this information be used to predict the price of BTC? In fact, it is possible to look at this graph, where the halvings are highlighted on the X-axis. In accordance with the change in the state of the halving, we can estimate the fair value – the right price to which BTC could go.

If the price of BTC tends to return around the line described in the figure above, it is clear that based on the various halvings that await us, we can estimate what the future target price of BTC will be.

Conclusion

BTC is becoming more and more popular, so it is definitely worth knowing the possibilities of predicting its price in the future.