Ripple News: After BTC and ETH ETFs – are XRP spot ETFs inevitable?

3 min readThe year 2024 is a very special one for the crypto market, as the first Bitcoin spot ETFs were approved for the US market on January 10th. This was followed by billions in inflows, which at times even pushed the Bitcoin price above the 73,000 US dollar mark and most recently brought a new all-time high in March. The US Securities and Exchange Commission (SEC) has already approved the New York Stock Exchange (NYSE) for eight Ethereum spot ETFs to be listed there in the near future.

Could an XRP spot ETF be next? At least that’s what one of the crypto world’s best-known voices claims.

Approval for XRP spot ETFs is ‘inevitable’

Brad Garlinghouse is not only one of the most well-known public figures in the crypto world, but as CEO of Ripple Labs – the company behind the cryptocurrency XRP – he is one of the biggest advocates of his own product. This is not surprising. But what is unusual is how convinced Garlinghouse is that the first applications for XRP spot ETFs will be submitted in the near future.

For example, he recently stated at the “Consensus” crypto trade fair in Austin, Texas, USA, that approval for corresponding investment opportunities in the USA was “inevitable”.

However, in order for such an introduction to be possible, the regulatory authorities would first have to change. In the past, Garlinghouse has repeatedly criticized the consistently “crypto-hostile” stance taken by the SEC, which makes faster development impossible. In addition, it should not be forgotten that Ripple Labs is currently in a legal dispute with the SEC, which accuses the company of unlicensed securities trading.

It is extremely unlikely that the SEC, as the stock exchange regulator, will approve applications for XRP spot ETFs as long as a legal dispute with the company behind the XRP currency is ongoing. A final verdict on the legal proceedings that have been ongoing for years could come this year. If it goes in favor of the crypto company – and even a small fine could be interpreted as positive – then this should not only boost the XRP price, but also ensure that the first financial companies are interested in XRP ETFs. Then the XRP forecast should look extremely rosy.

Ripple Labs invests millions in lobbying

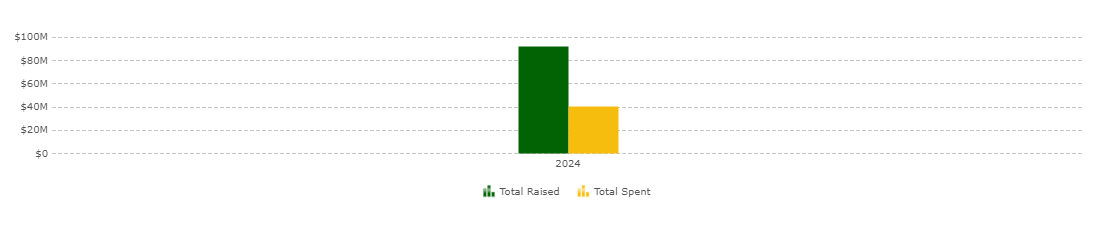

The USA will elect a new president next November. At the moment, it seems that it will be another duel between the incumbent President Joe Biden and the previous ex-President Donald Trump, with the latter being more liberal towards cryptocurrencies. Garlinghouse himself is definitely hoping for a new attitude from the US government after the election. His company has already donated another 25 million US dollars to Fairshake – a group known for lobbying in the crypto world. According to unofficial sources, this Fairshake PAC has already raised over 92 million US dollars for lobbying work.

The Ripple CEO has always given the same reason for this and other donations in the past. He explained that in his opinion the US is simply not competitive at the moment to be at the forefront of the crypto space. His donations to Fairshake are intended to ensure that candidates who are positive towards the crypto world receive support. At the same time, this is also intended to ensure protection for investors, who often have a rather weak position in the crypto world.

A common problem in the crypto world is that many investors do not have comprehensive knowledge of the various options and products. Many do not even know what risks and opportunities there are, as there are only a few central points of contact for this information. Investors are therefore increasingly relying on so-called learning platforms that explain the various options in the crypto world and reveal exactly what to look out for when investing in crypto tokens.