SEC Chairman Gary Gensler: Launch of spot Ethereum ETF trading planned this summer

2 min readUnited States Securities and Exchange Commission (SEC) Chairman Gary Gensler expects spot ETH ETFs to be approved sometime this summer, the federal regulator said in testimony before the Senate Budget Committee on Thursday morning. When asked by Senator Bill Hagerty (R-TN) when spot ETH ETFs would be approved, Gensler stated he “would envision it happening sometime this summer.”

SEC Chairman Gary Gensler promises approval of spot ETFs this summer

While the SEC chairman noted that “individual issuers are still going through the registration process,” he claimed that overall the approval process for spot ETH ETFs is “smooth.” “If you’re suggesting to me that these applications will be approved by the end of the summer, then I appreciate that,” Hagerty said.

However, Gensler expressed concern about setting an exact date for the approval of the long-awaited ETF, saying that each applicant’s registration statement “must contain the correct disclosures” before it can go into effect. “We have a disclosure-based system at the SEC, and I would say that the crypto industry has largely ignored that system and not complied with it,” he continued.

Gensler criticizes “non-compliance” with regulations in the crypto sector

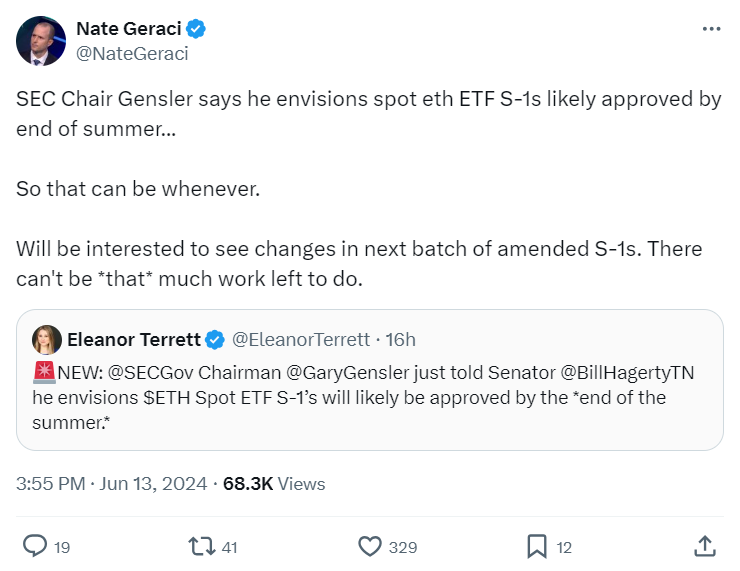

The applicants are currently awaiting a decision on their S-1 forms. The basic registration form is the last one required before approval from federal regulators, following the approval of the spot ETF hopefuls’ 19b-4 forms on May 23. “We are excited to see the changes in the next batch of amended S-1 forms,” ETF specialist Nate Geraci wrote on X. “There can’t be that much work left.”

SEC Chair Gensler says he envisions spot eth ETF S-1s likely approved by end of summer…

So that can be whenever.

Will be interested to see changes in next batch of amended S-1s. There can’t be that much work left to do.

Gensler, long known for his approach to regulating digital assets, did nothing to counteract his tough reputation when he testified before the Senate committee on his agency’s federal budget.

“This is an area that is not serving the public well right now,” he said of the crypto industry.

In particular, the SEC chairman criticized the widespread mixing of financial activities on exchanges across the digital asset sector, which runs counter to the interests of customers.

“What happened at FTX is very common, but not unique,” Gensler continued. “It’s happened in many places. There’s this confluence with the intermediaries presenting themselves as exchanges but doing a whole host of other things to put their interests ahead of those of their customers.

Regardless, the regulator’s scrutiny of the blockchain industry has not yet prevented cryptocurrency-based exchange-traded products from going through the federal agency’s approval process.