Cryptocurrency analytics firm Crystal has published a report detailing all of the major security breaches, fraudulent activity, cyber-terrorism, and scams in the crypto space since 2011.

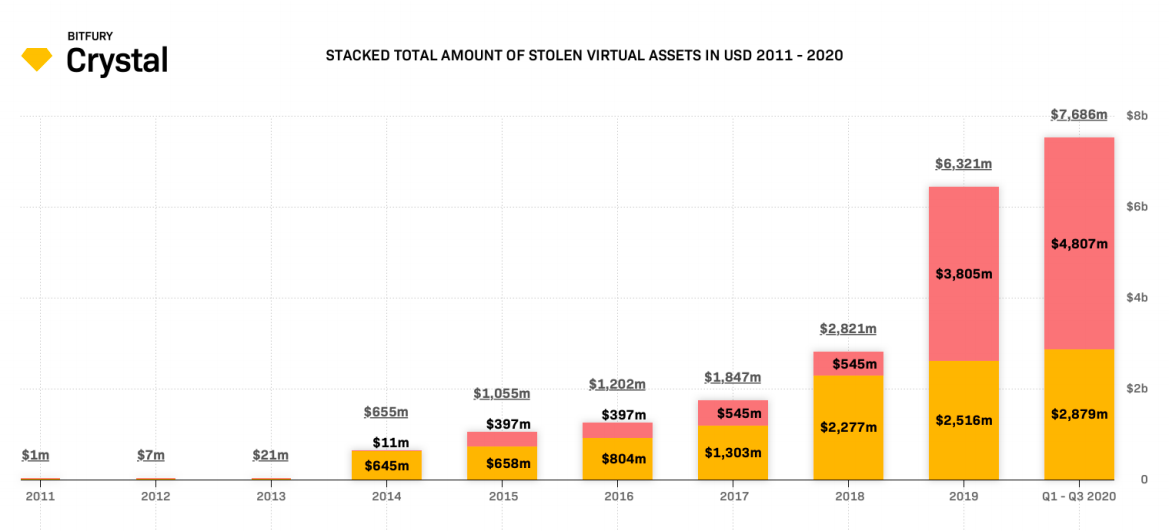

According to the report, since the emergence of cryptocurrency markets, 113 security attacks and 23 fraudulent schemes have resulted in the theft of approximately $7.6 billion worth of crypto assets. As noted by a press release announcing the report, that’s comparable to the GDP of Monaco.

The report highlighted a handful of key findings, including the most common locations for exchange security breaches.

Perhaps unsurprisingly, this was countries with the most developed crypto markets, i.e., the United States, the United Kingdom, South Korea, Japan, and China.

The United States, in particular, seems to be a major target. Since the beginning of the blockchain ecosystem’s existence, US-based crypto services have been targeted by bad actors a total of 13 times. But in terms of the value stolen, China was the runaway leader.

Japan’s Coincheck was the winner of the single biggest hack to date, involving a staggering $535 million in lost funds. Crystal also cited hackers’ favored methods, “the most popular method of crypto-robbery is the infiltration of crypto-exchange security systems.”

The report concluded with a section of predictions from security experts at Crystal. These predictions did not leave much room for optimism, “over the next couple of years, due to the fact that the number of blockchains keeps growing, and the methods and technologies utilized by illegal hackers continue to become more sophisticated and advanced, we can assume that the number of hack attacks will also continue to grow.”

Crystal did say that with the right kind of corrective action, the damage caused by scams and attacks, particularly in the case of hot wallets, could be mitigated. Overall, the report left little reason to think that its most recently reported breach of Harvest Finance will be anything other than the next item on a long list of cautionary tales.

The post Security Incidents Cost Cryptocurrency Investors $7.6 Billion Since 2011: Crystal Report appeared first on BeInCrypto.