Several Crypto Indices Complete Significant Bounces

3 min readThe Altcoin Index (ALTPERP) has bounced at the long-term support area of $2,815.

The DeFi Index (DEFIPERP) has created a double bottom pattern and broken out from a descending resistance line afterwards.

The Crypto Total Market Cap (CRYPTOCAP) has broken out from a descending resistance line and is attempting to move above the $1.74 Trillion horizontal resistance area.

Altcoin Index

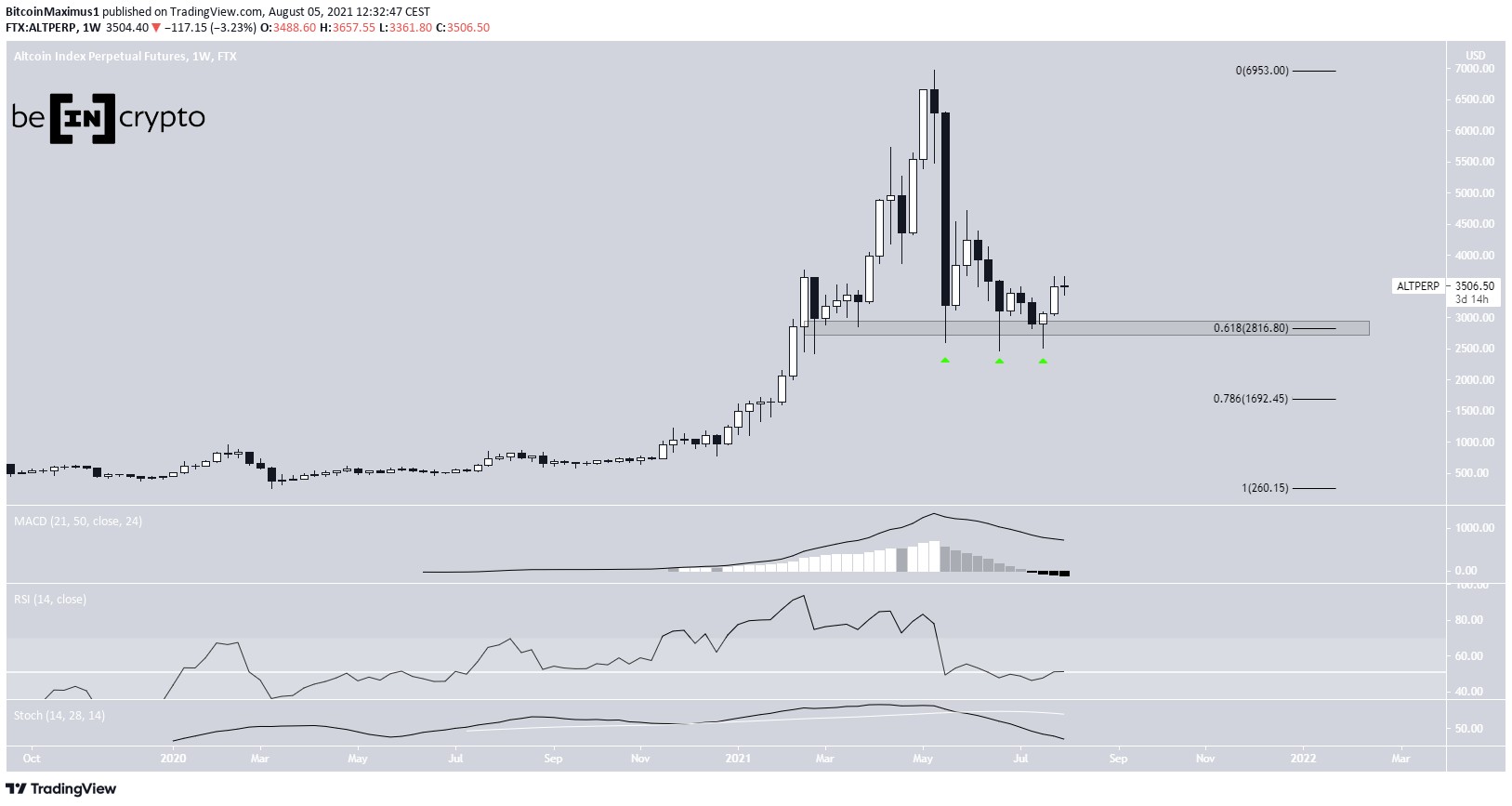

ALTPERP has been decreasing since reaching an all-time high of $6,965 on May 12. So far, it has reached a low of $2,462, doing so on June 22.

The low was made inside the 0.618 Fib retracement support level at $2,815, which is also a horizontal support area.

ALTPERP bounced thrice above this level, creating long lower wicks each time (green icons).

Despite the bounces, technical indicators are bearish. The RSI has fallen below 50 and the Stochastic oscillator has made a bearish cross. Furthermore, the MACD is decreasing and is nearly negative.

The next support area is at $1,690.

The shorter-term six-hour chart shows that ALTPERP has broken down from an ascending support line, and validated it as resistance afterwards (red icon).

It also created a double top pattern near $3,600, which was combined with bearish divergences in both the RSI and the MACD.

Therefore, a decrease towards the $3,090 support area seems to be the most likely scenario. It would also coincide with the 0.5 Fib retracement support level.

Highlights

- ALTPERP has created a short-term double top pattern.

- There is support at $2,815 and $1,960.

DeFi Index

On June 22 and July 20, the DeFi index created a double bottom pattern. The pattern was combined with bullish divergences in the MACD, RSI and Stochastic oscillators.

It began an upward movement shortly afterwards and then broke out from a descending resistance line.

It has been increasing since, and has reached a high of $1,948 so far, doing so on Aug. 4.

Technical indicators in the daily time-frame are still bullish. The MACD is nearly positive, the RSI has moved above 70 and the Stochastic oscillator has made a bullish cross.

The main confluence of resistance levels is between $2,134 and $2,242. The resistance is found by using the 1.61 length of the first portion of the upward movement (A). In addition to this, it is a horizontal resistance area.

Furthermore, this would also be close to the 0.382 Fib retracement resistance level (white) when measuring the entire downward movement from the all-time high.

Highlights

- DEFIPERP has completed a double bottom pattern.

- It has broken out from a descending resistance line.

Total Market Cap

The cryptocurrency total market cap reached a low of $1.127 Trillion on June 22. After a bounce, it returned close to the same level on July 20, successfully creating a double bottom pattern. The pattern was combined with bullish divergence in the MACD and RSI.

TOTALCAP has been increasing since and broke out from a descending resistance line on July 23. So far, it has reached a high of $1.69 Trillion, doing so on Aug. 1.

Technical indicators in the daily time-frame are bullish. The MACD has crossed into positive territory, the Stochastic oscillator has made a bullish cross and the RSI has moved above 50.

However, there is strong resistance at $1.74 trillion. Until TOTALCAP breaks out above this level, the trend cannot be considered bullish.

Conversely, the closest support area is at $1.43 Trillion.

Highlights

- CRYPTOCAP has broken out from a descending resistance line.

- It is facing resistance at $1.74 Trillion

For BeInCrypto’s latest BTC (BTC) analysis, click here.

The post Several Crypto Indices Complete Significant Bounces appeared first on BeInCrypto.