A look at on-chain indicators for BTC (BTC) and ETH (ETH), more specifically the balance of tokens on addresses that belong to exchanges.

The BTC balance on exchange addresses has been decreasing since July 28. Previously, this has led to upward movements in price.

BTC on exchange addresses

The amount of BTC held in exchange addresses has been decreasing since the March 2020 bottom. On April 11, exchange addresses held only 2.463 million tokens, which was the lowest amount since Nov. 2018.

Afterwards, BTC began flowing into such addresses, most likely as a result of investors attempting to sell the bounce (black square).

However, another withdrawal followed on July 28, and the number of tokens held in exchange addresses is now back at 2.479 Million.

Historically, the balance on exchanges has fallen sharply prior to significant price increases (black arrows). This has been the case so far, since the price has been moving upwards since July 28.

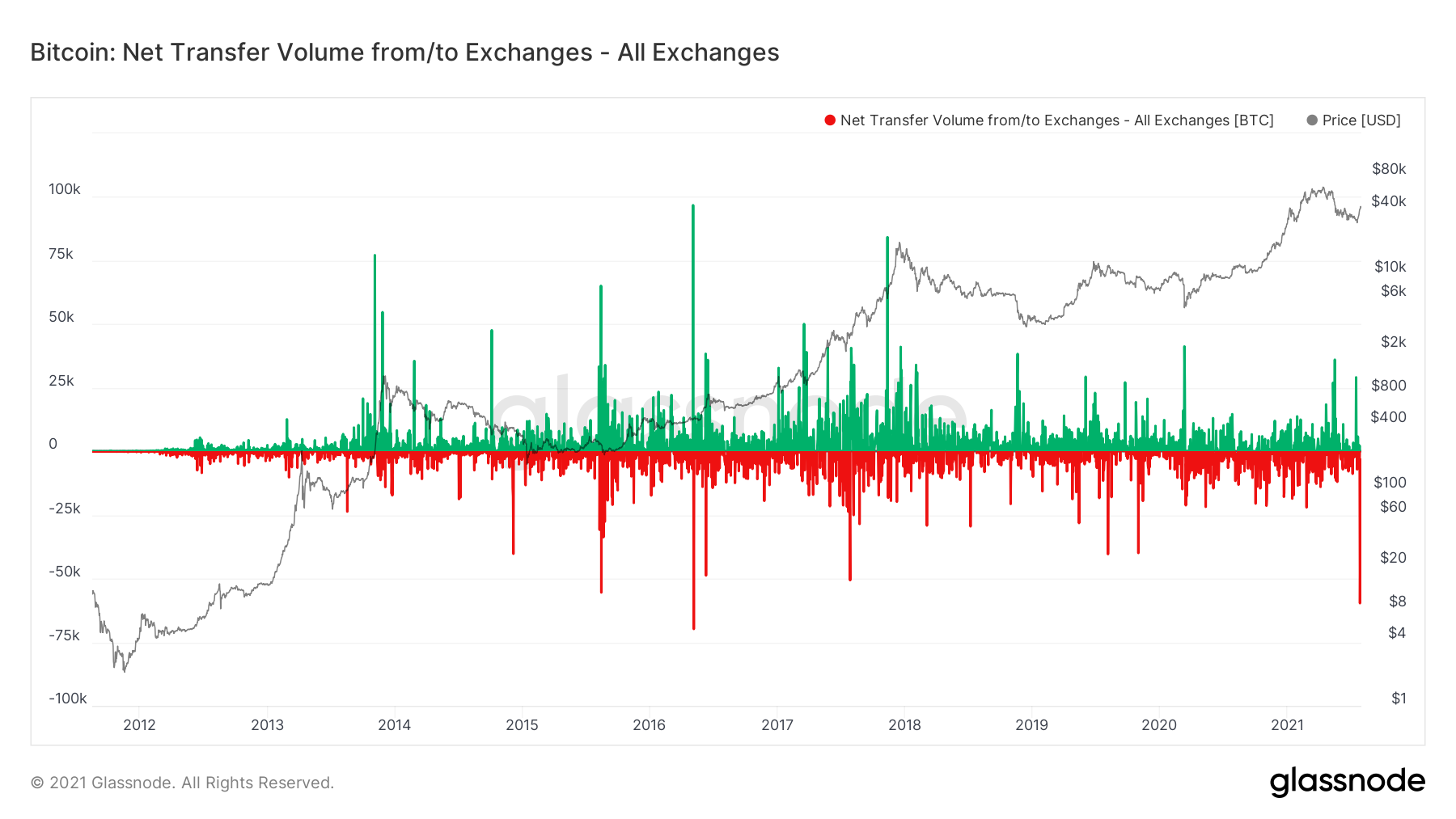

Net volume

A closer look at the exchange net flow volume shows just how significant the withdrawal was. The July 28 decrease of roughly 59,000 BTC lags behind only that of May 5, 2016.

The exchange net flow volume can be used to predict price movements.

Taking a look at the indicators since the beginning of March, we can see that significant negative volume (tokens flowing out of exchanges) have often preceded price increases, while the opposite is true for positive volume.

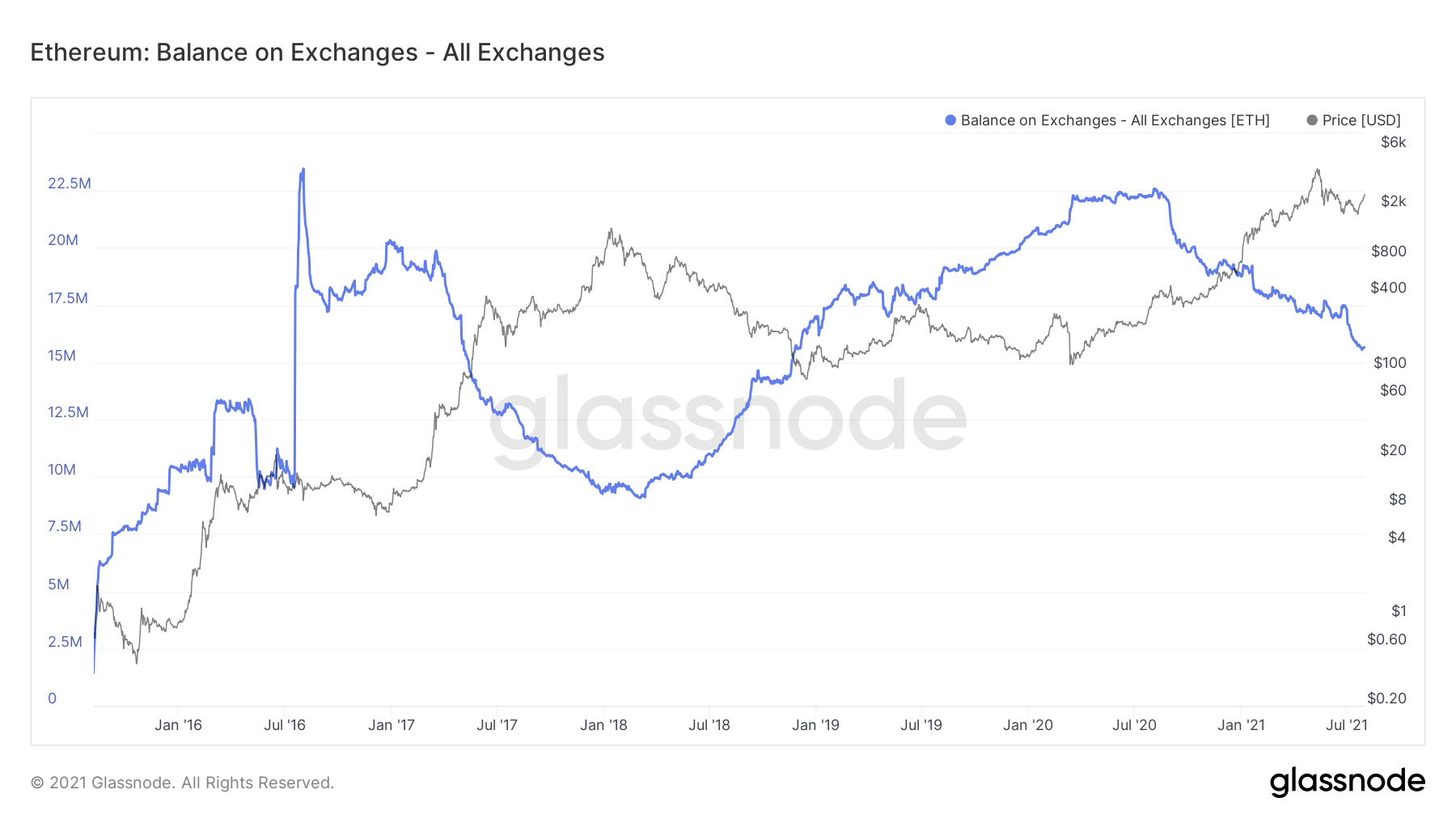

ETH exchange balance

The balance of ETH on exchange addresses has been decreasing since Aug. 2020. Similarly to BTC, the trend seemingly reversed in the beginning of March.

However, the significant withdrawals have begun to occur starting from June 27. Unlike BTC, there has not been a single day sharp fall, rather the decrease has occurred more gradually, even though the rate of decrease is accelerating.

For BeInCrypto’s latest BTC (BTC) analysis, click here.

The post Significant Number of BTC Leaves Exchange Addresses appeared first on BeInCrypto.