Solana is dominating institutional capital flows in 2022

2 min read

Data from CoinShares suggests that throughout 2022, institutional investors are not eyeing BTC or ETH. Instead, the research firm points out that institutional investors are interested in Solana (SOL).

Institutional investors prefer Solana this year

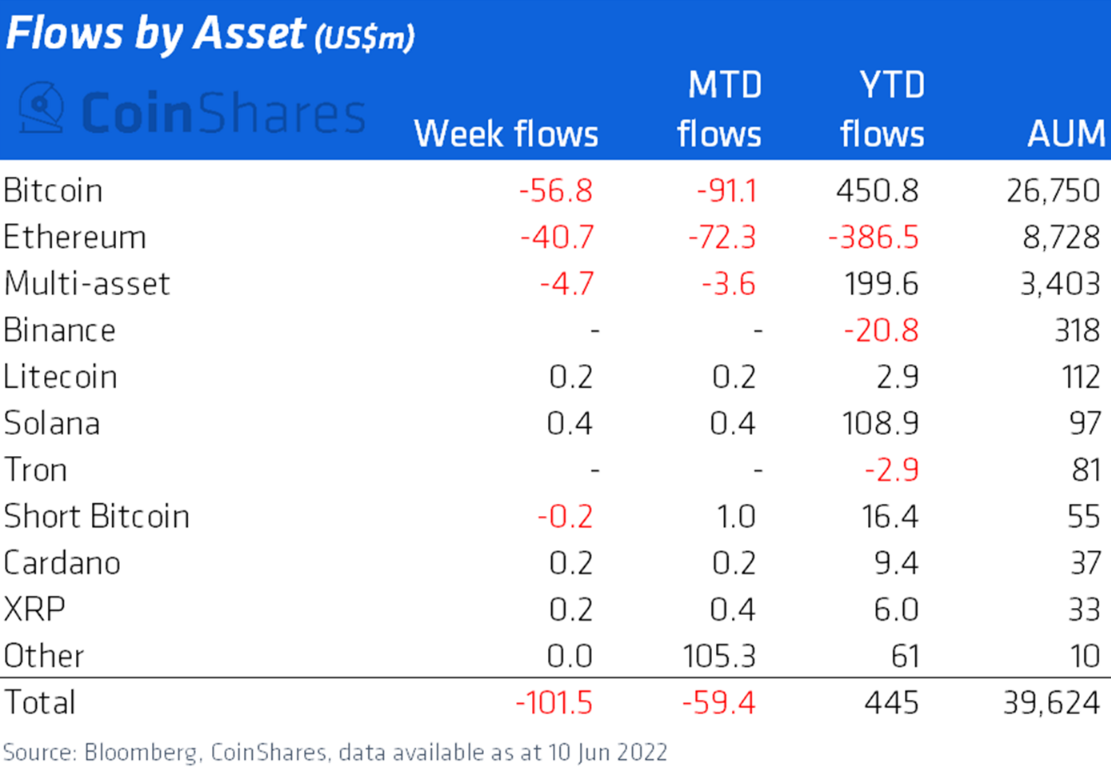

That’s the conclusion of the company’s latest report, CoinShares Digital Asset Fund Flows Weekly. According to the report, institutional investors have invested more than US$108 million in SOL-related products.

According to the company, the amount is much higher than that invested in any other altcoin, including ETH.

In addition, the report pointed out that investments in products linked to Solana are around US$ 108 million. BTC for example, leads the group with accumulated flows in the year of US$ 450.8 million.

Meanwhile, ETH is in massive decline in institutional interest and has already lost $40.7 million in the last 7 days.

Institutional investment products Litecoin (LTC), Cardano (ADA) and XRP saw inflows of $0.2 million. The amount recorded in the last 7 days brought its entries for the year to $2.9 million, $9.4 million and $6 million.

Crypto Fall and Bear Market

Multi-asset investment products saw outflows of $4.7 million last week. These are institutional investment products that invest in more than one digital asset.

With the result, according to CoinShares, the year-to-date of the category was almost US$ 200 million. As the company points out, the market’s anticipation of rising interest rates led to constant withdrawals from products.

“Digital asset investment product flows remain erratic,” he said.

The company went on to say that this was “in anticipation of aggressive monetary policy”. These withdrawals occurred daily totaling more than US$102 million.

“What pushed cryptos into a bear market is a direct result of increasingly aggressive rhetoric from the Fed,” he concluded.