Terraform Labs sold LUNA tokens just before the UST collapse

3 min readAnders Helseth, senior analyst at Arcane Research, released a report on Terraform Labs’ moves. According to the document, the organization sold large amounts of LUNA during the UST collapse.

That is, the founders of the network managed to sell their LUNAs before the collapse that turned the cryptocurrency to dust. Meanwhile, other investors had to suffer losses of up to 100%, with many losing the capital of a lifetime.

Helseth likened Terraform Labs’ attitude to a sinking cruise ship. In this regard, “the captain and distinguished guests fled on super yachts, leaving most passengers behind without lifeboats.”

Design flaws in favor of Terraform Labs

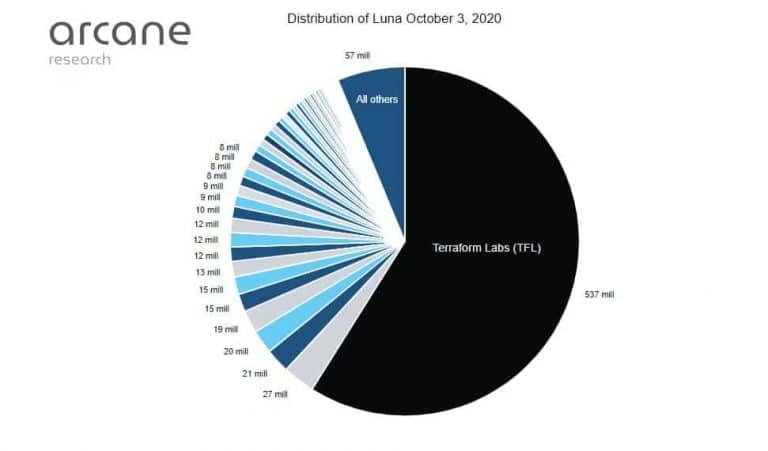

At first, Helseth traces the flaws of the Terra Classic protocol back to its origins. The report points to the large concentration of LUNA in the hands of Terraform Labs. According to the data, the institution concentrated more than 50% of the LUNAs in its hands.

Another problem is that Terra doesn’t have any block rewards, that is, it doesn’t have mining. And as there was a pre-distribution, the first holders of the currency gained a lot of power.

LUNA distribution in 2020. Source: Arcane Research.

The analyst claims to have analyzed value streams in the Terra ecosystem and was responsible for transactions until May 5 (shortly before the accident) to avoid obscurity.

The analysis reveals that sets of unknown wallets (dubbed John Doe) interact closely in groups. This group of wallets has carried out massive withdrawals from the Terra ecosystem.

Most transactions were directed to bridges and centralized exchanges (DEX). That is, it is likely that the owners of the wallets were already intending to sell.

He states that there is a common denominator among these clusters – “one or more wallets in the cluster received significant transfers from the Terraform Labs wallets”.

From October 2020 to May 5, 2022, wallets moved over $6 billion through bridges and DEX. Most addresses were associated with major network investors

On the other hand, “all other hundreds of thousands of wallets have a net inflow of $6.5 billion.” That is, very small investors bought as addresses associated with Terraform Labs sold.

Taking advantage of the UST

Finally, Helseth also argues that groups deposited large amounts of LUNA in exchanges when its price was still relatively low, making outputs “undervalued relative to LUNA inputs”.

The report also details that the algorithm behind the UST allowed for other types of earnings. For example, these addresses were able to create large amounts of UST.

Next, investors put their UST on the Anchor protocol, which paid yields of up to 20%. The high yield served as a bait to attract more demand.

In the report, Helseth points out that this yield created a huge demand for UST. As small investors entered the protocol, they provided the required outflow liquidity for large addresses.

“In a standard ‘buy and sell’ scheme, the short side builds demand before aggressively selling its coins. During dumping, often called traction, the usual market dynamics apply. Eventually, the supply offered by sellers looking to squeeze every penny overwhelms demand, and then the price collapses,” the analyst explained.

General manager of the US division of Ontology: “In the future everyone can monetize their data”