The 10 largest ETH wallets now own 20.58% of Ethereum’s offer

2 min readThe largest ETH whales have taken advantage of the recent drop in coin prices and bought more. As a result, the ten largest wallets now own more than 20% of the total asset offering.

The 10 largest ETH accounts own more than 20% of the coin supply

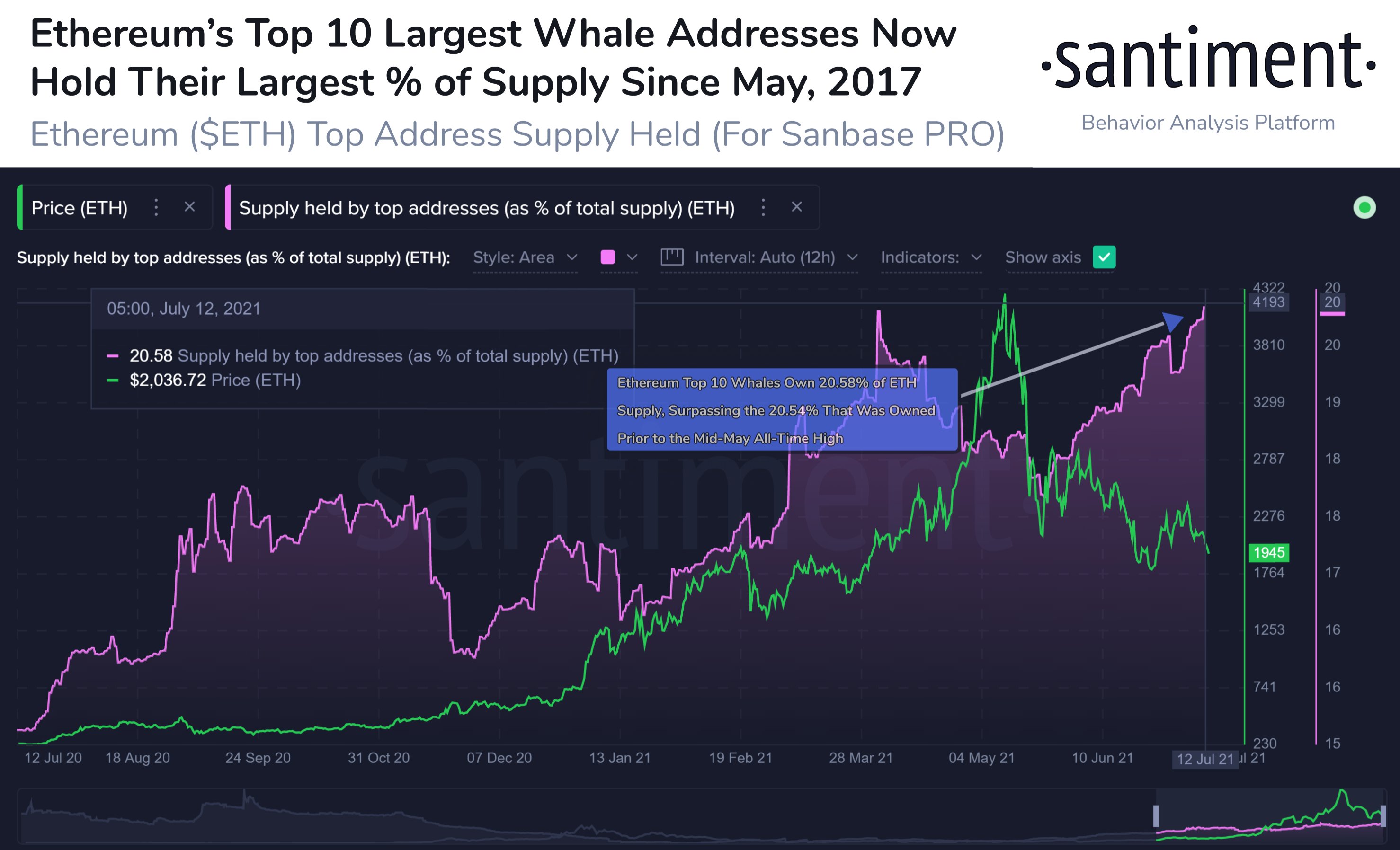

By examining the behavior of the ten largest ETH addresses, the Santiment analytical platform has outlined their sales and accumulation phases in the last few months.

In fact, they took profits in mid-May as the price of the digital asset rose to an all-time high of around $ 4,400. At that time, these addresses sold some coins and held 18.46% of all ETH in circulation. However, as soon as the asset started to turn, they started buying again.

Santiment stated that “in the last 41 days, they bought 2.12% more of the total ETH offer. As a result, the top ten addresses own 20.58% of the asset’s offer, while the second-largest cryptocurrency has lost more than 50% of its value in USD. ” The amount of Etherea stored in these wallets is the highest since May 2017.

The graph clearly shows the new accumulation phase, which began at the end of May. It is worth noting that these addresses largely belong to exchanges or DeFi protocols, but the dynamics described by Santiment remain interesting. However, it must be said that this is not necessarily a bull signal.

The number of ETHs listed on stock exchanges is still declining

In addition to large wallets, which can affect the price of an underlying asset if they decide to sell a few of their coins, another aspect that can provide an overall picture of investors’ views is the number of coins deposited on cryptocurrency exchanges.

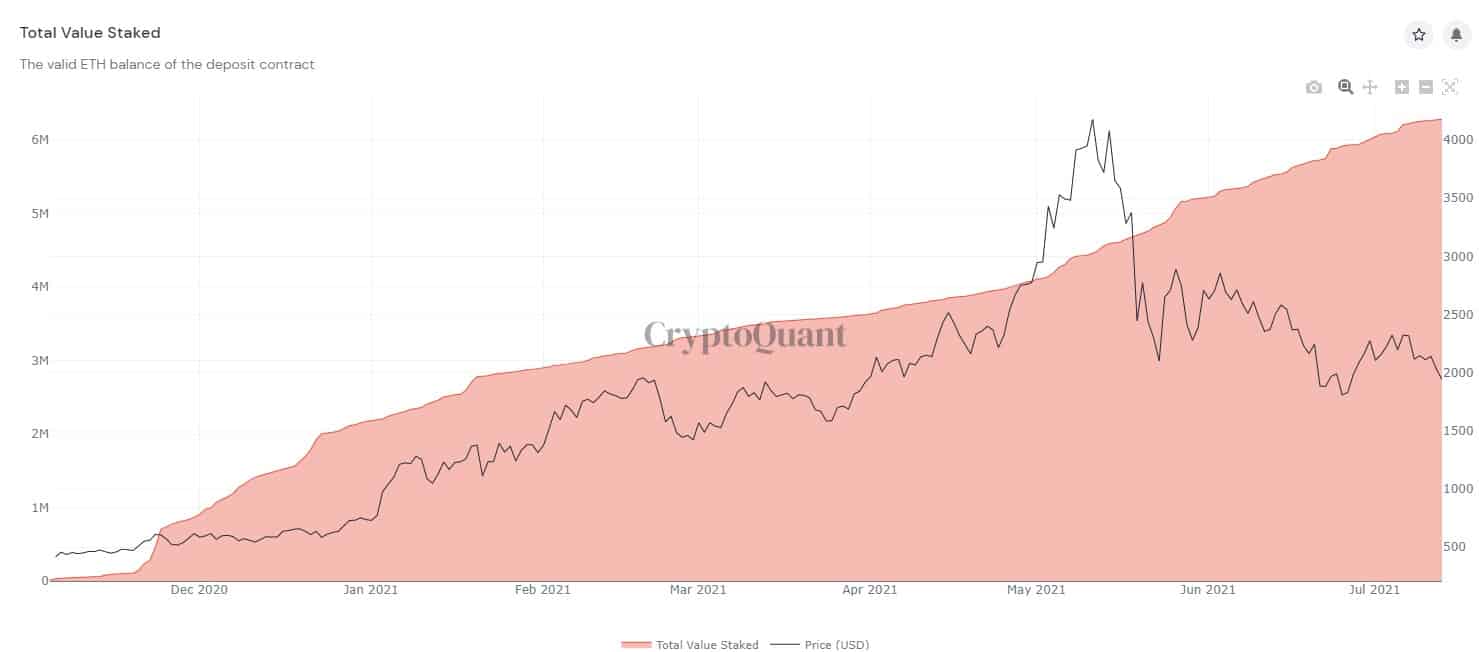

And in the case of the second largest cryptocurrency, the situation seems quite favorable. Data from data provider CryptoQuant shows that the net flows of all exchanges have been negative in the last few weeks after being positive for a while (meaning significant deposits in trading venues).

If the metric is positive, it means that the offer that can be sold on stock exchanges has increased, and vice versa. The amount of ETH held on exchanges has decreased by about 500,000 ETH since May.

One key reason for withdrawing ETH from exchanges can be attributed to the ETH 2.0 stacking platform. At the same time, the number of ETH tokens locked in the ETH 2.0 deposit agreement is still growing. More than six million tokens with 192,352 validators are now locked. In terms of the USD, that’s about $ 12 billion.