The index of fear and greed for Dogecoin is here

2 min readDogecoin has its own index of fear and greed.

The parameter usually associated with BTC, which, however, is also an indicator for the entire cryptocurrency sector, now also has its own version dedicated to the king of meme coins.

Dogecoin Fear and Greed Index has been launched on Twitter in recent days. It was created by the same people who run the BTC Fear and Greed Index Twitter channel.

In June, they launched a similar index for ETH, ETH Fear and Greed. On August 8, the BTC channel launched a challenge: “In 10,000 retweets we will launch the Dogecoin Fear and Poor Index.”

In fact, only about 3,200 retweets were received. However, as was later specified, they did not resist and ran the Dogecoin index anyway.

The Dogecoin Fear and Greed Index indicates greed

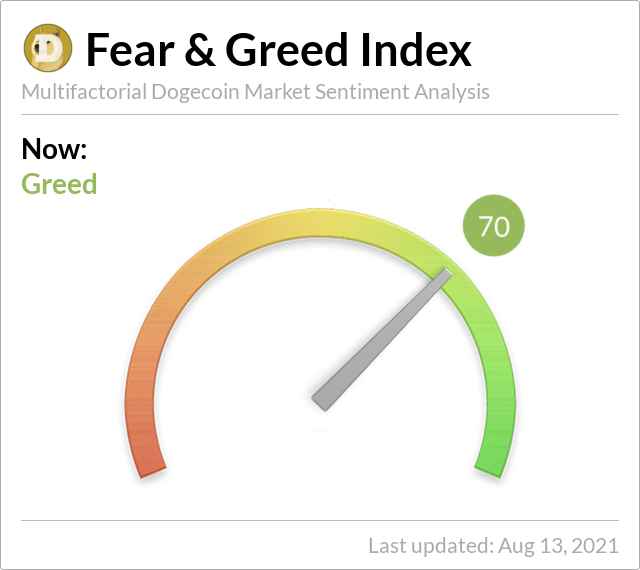

Looking at the data, the latest update shows that the Dogecoin Fear and Greed Index is 70, indicating greed.

The way it works is similar to BTC. It is a scale from 0 to 100, where 0 means extreme fear and 100 means maximum greed. Usually, when the market is in fear or extreme fear, sales and panic predominate. Conversely, purchases predominate in the zone of greed or maximum greed. Then there is an intermediate value, defined as neutrality.

These days, the meme coin has returned to approximately 27 cents. DOGE is still far from its peak of 73 cents on May 8, but still enjoys an extraordinary year in 2021, in which it has multiplied, climbed the capitalization scale and is becoming more and more famous.

DOGE is now accepted and traded by stock exchanges such as Coinbase, there are those who even consider it a method of payment. In fact, the days when they considered it just a meme coin are over. Behind Dogecoin is now a team of developers, supported by Tesla CEO Elon Musk, who are working to make it increasingly competitive. There is still a long way to go.