The price of BTC has slipped, but sentiment remains positive

2 min readBTC slipped below $ 46,000, with the price in 24 hours recording a slight loss of 3.3%. Those who waited for BTC to overcome the $ 48,000 resistance and then reach 50,000 will have to wait a little longer.

Despite the price of BTC, sentiment remains positive

According to an analysis published on Tradingview, BTC is testing a resistance of $ 47,500. If this level is exceeded, it will rise toward $ 51,600. So BTC would return above the psychological threshold of $ 50,000. And according to the analytical platform Santiment traders are quite optimistic.

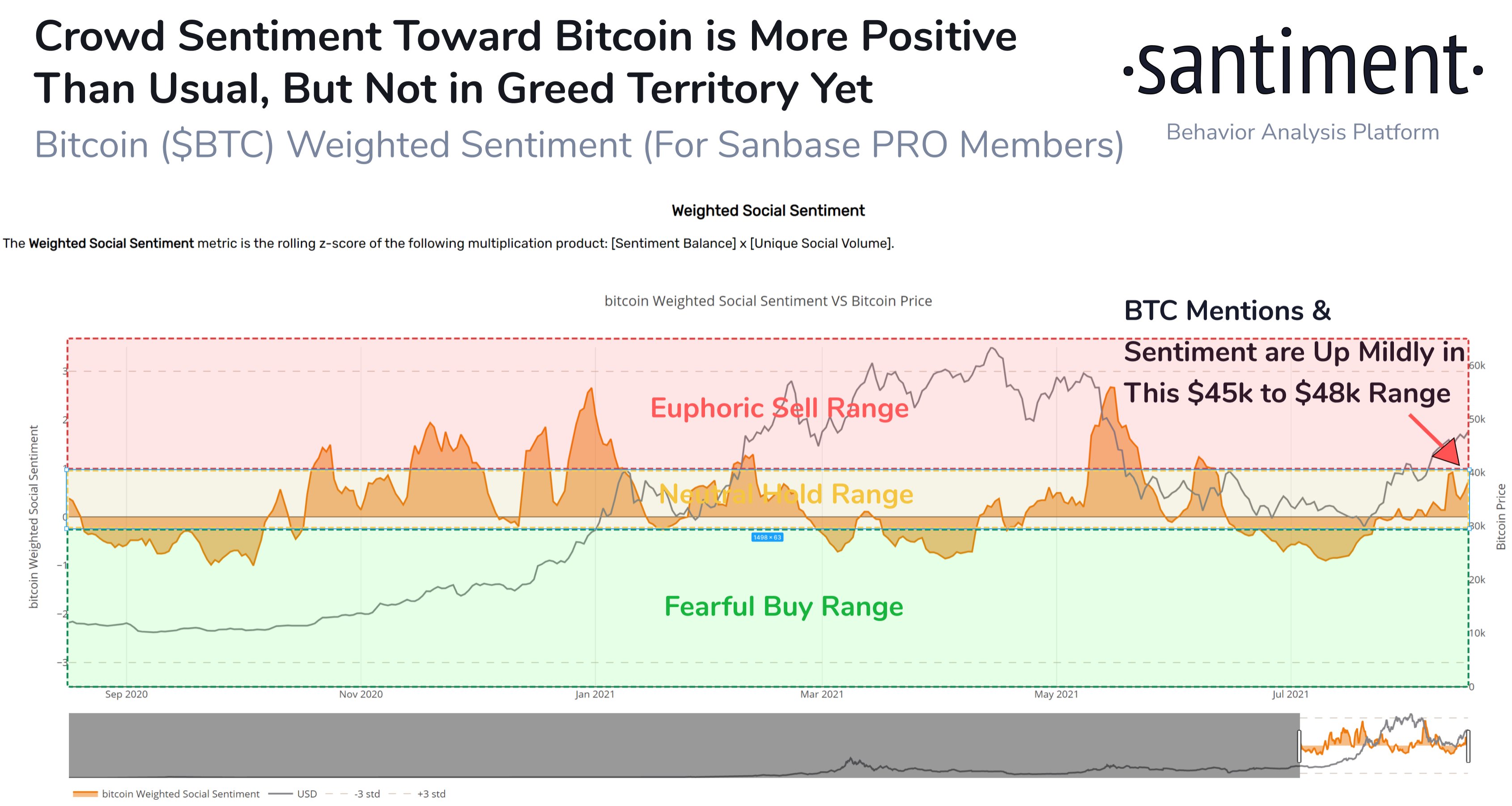

BTC settled in the range of $ 45,000 to $ 48,000, which encouraged traders to join FOMO in anticipation of further growth towards April’s AllTimeHigh. Our data suggest that optimism is on the rise, but not euphoric in a way that leads to immediate BTC corrections.

According to this chart, it is generally felt that BTC is heading for a new ATH, which is more than $ 65,000. However, according to the Santiment platform, traders are not euphoric, which could lead to a correction. That’s a bit of what happens when the price rose to $ 48,000 and then came back and settled between $ 46,000 and $ 47,000.

The index of fear and greed is also stable at 73, which is a sign of greed: investors at this time want to buy.

According to Paolo Ardoin, CTO of Bitfinex, the market is in a bull phase and institutional investors are buying BTC in bulk:

“Bullish sentiment seems to be driving cryptocurrency markets with Solana and Matic chalking up impressive gains. We may be seeing a reawakening of animal spirits among speculative investors with decentralized finance (DeFi) and the market for NFTs both resurgent. While volumes remain relatively subdued, a lot of the profits that have been made are filtering back into the ecosystem, causing a continued boom in retail markets for altcoins. It is also important to note a backdrop of sustained institutional investment in the space, a trend that will only further consolidate if bitcoin returns to the highs that it reached earlier this year.”