Although the skyrocketing Bitcoin bull run has started slowing down, it hasn’t seemed to deter the biggest whales from continuing to stack their satoshis.

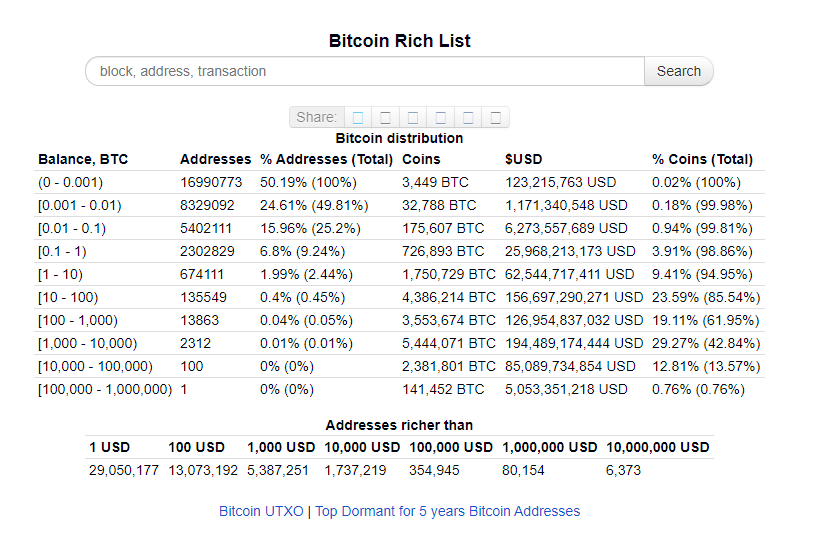

According to BitInfo Charts, which tracks the top 100 richest bitcoin addresses, the top 100 users have added almost 350,000 bitcoin to their holdings. The amount is worth about $11 billion at current prices.

These top 100 addresses currently own $82 billion worth of bitcoin, representing almost 13% of the entire circulating supply.

Several crypto influencers and observers have noted the recent movement of capital from weak hands to strong ones. Anthony Pompliano was one of them:

“Bitcoin moved from weak hands to strong hands today.”

Following the Money

It’s impossible to say who owns each address, but the wealth needed for these hefty sums likely means they are corporations, the extremely wealthy, or long-term bitcoin hodlers.

At these record-high bitcoin prices, big investors are still dedicating more capital to crypto accumulation.

Institutional Investment Takeover

To afford this many bitcoin, investors would need to be defined as institutional. Retail investors cannot usually afford these amounts.

With newcomers like Microstrategy CEO Michael Saylor and Ruffer Investments investing close to over $1 billion of their company’s treasury reserve in bitcoin, a new shade of legitimacy may have been cast over the entire space.

With the social, economic, and financial turmoil faced globally in 2020, many large investors are likely looking to safe-haven assets that will protect their wealth.

Many governments have drastically increased their inflation rates to accommodate collapsing businesses, a big reason these investors are looking for alternative assets.

Many institutional investors, including Saylor, see bitcoin as a more efficient and digital form of gold, allowing them to hedge against future inflation by holding BTC against the US dollar or even gold.

The post Top 100 Bitcoin Addresses Add $11 Billion in BTC in the Last Month appeared first on BeInCrypto.