The Vechain (VET) price has failed to sustain a potential upward move that was initiated with a breakout above a descending resistance line and is in the process of breaking down from a long-term support level.

The failure to sustain the upward move suggests the price is in a bearish trend.

Failed Breakout

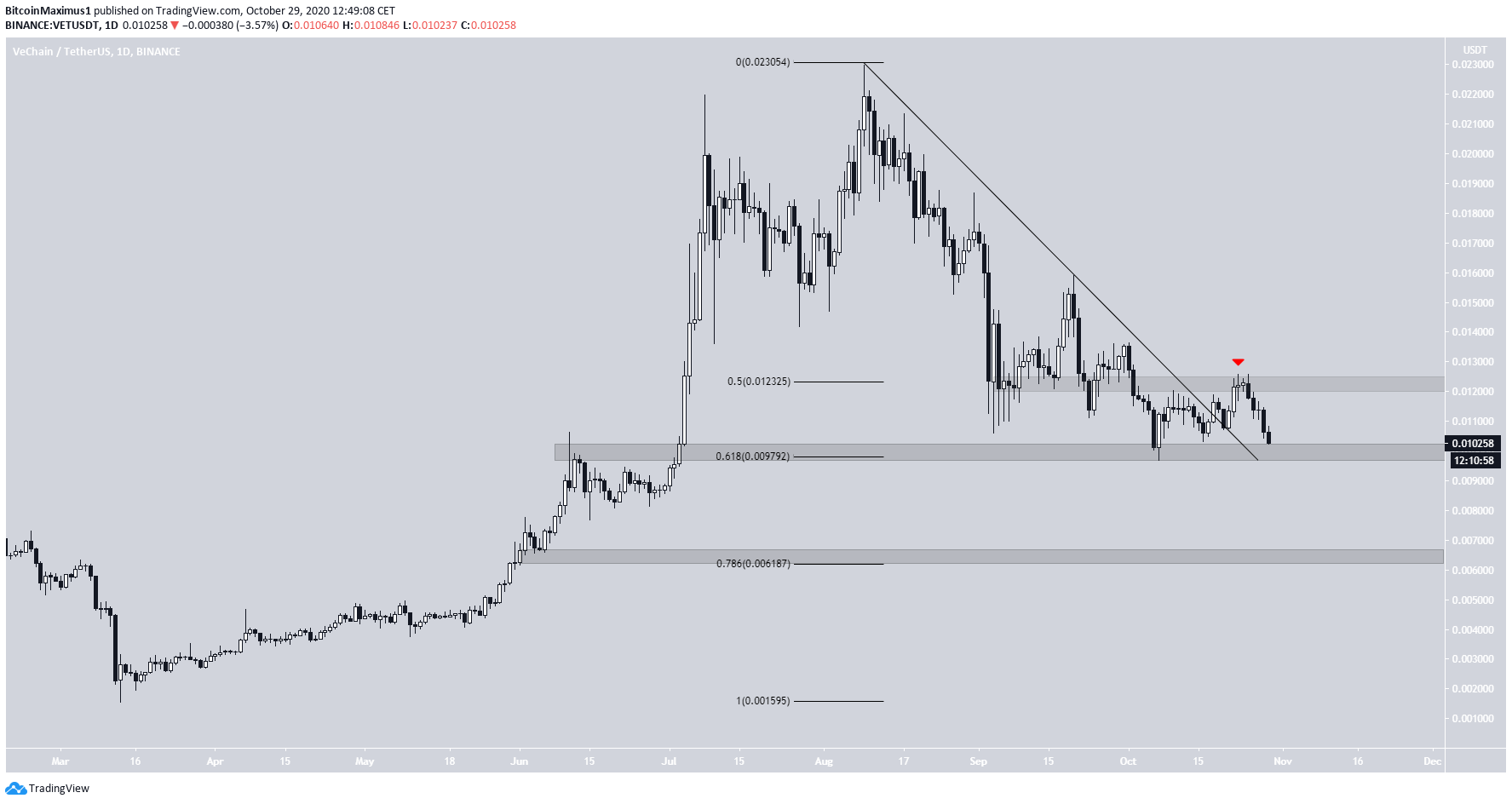

The VET price has been declining since it reached a high of $0.0230 on Aug 9, following a descending resistance line. While the price touched a low of $0.0096 on Oct 7, it proceeded to break out from the descending resistance line shortly afterward.

VET was then rejected by the $0.123 area, validating it as resistance, and has been falling since. At the time of writing, it was trading very close to the $0.0098 support area, which is also the 0.618 Fib level of the entire upward move.

If the price were to break down, the closest support area would be found at $0.0062.

Bearish Technicals

Cryptocurrency trader @TheEuroSniper tweeted a VET chart, stating that the price is likely to drop once more towards $0.0085 before eventually moving upwards.

On the daily time-frame, technical indicators have begun to turn bearish but have not confirmed the bearish trend yet.

The MACD is falling but has not turned negative, and while the 50 line rejected the RSI before dropping, the Stochastic Oscillator has not yet made a bearish cross. The latter occurrence would confirm a bearish trend.

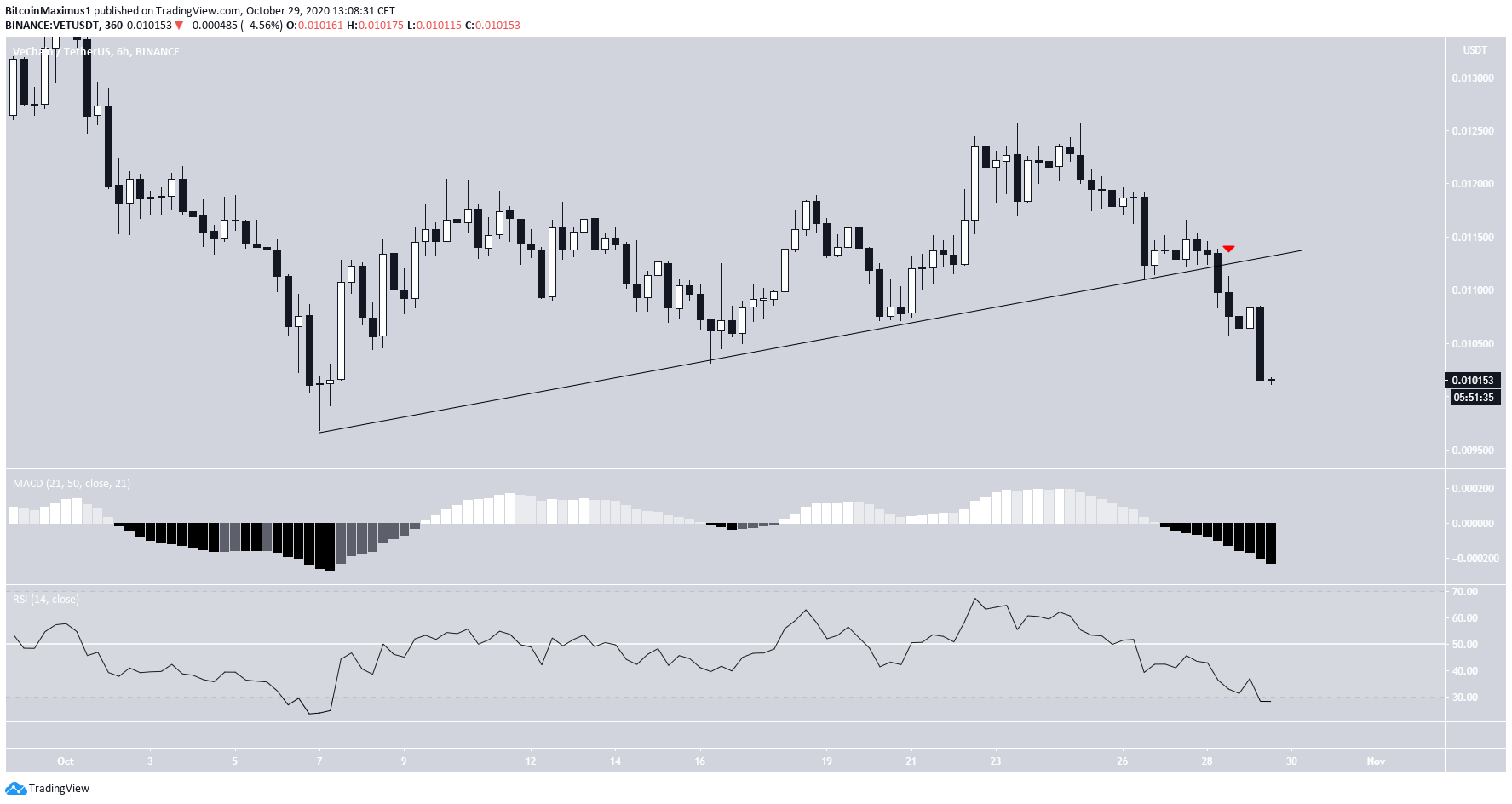

However, the shorter-term six-hour chart shows a breakdown from an ascending support line, signaling the end of the upward move that began with the previous Aug 7 low.

The MACD has crossed into negative territory, and while the RSI is oversold, there is no bullish divergence to signal a reversal.

Therefore, an eventual breakdown from the $0.009 support area seems the most likely option.

VET/BTC

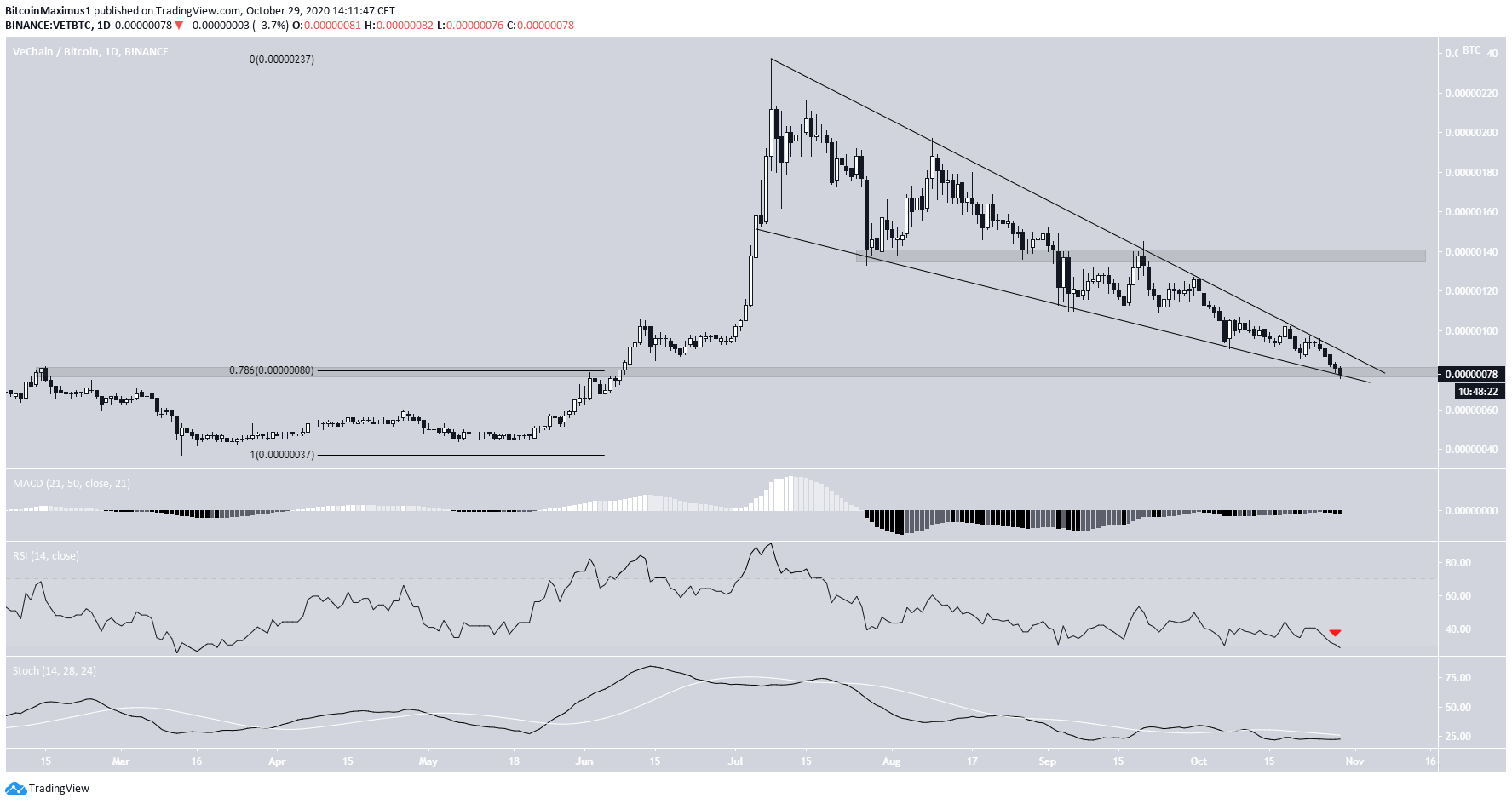

The VET/BTC chart shows a long-term descending wedge that has been in place since July. At the time of writing, the price was rapidly approaching the point of convergence between resistance and support, at which point a decisive move should occur.

Furthermore, the price is also trading inside the 80 satoshi support area, which is the 0.786 Fib level of the entire upward move. Since the wedge is a bullish pattern, a breakout is likely, which could take the price all the way to 140 satoshis.

Technical indicators are neutral, but they show that the move is extremely oversold.

The VET/USD chart’s relative bearishness casts some doubt about the possibility of a VET/BTC breakout, so the VET/BTC pair may undergo a similar failed breakout followed by a sharp drop.

A decline below the 80 satoshi support area could cause the price to drop all the way to 40 satoshis, the March lows.

For BeInCrypto’s previous Bitcoin analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.

The post VET Retests Support After Failed Upward Move appeared first on BeInCrypto.