What is NFT lending?

3 min readIn recent months, the integration of non-fungible tokens in the DeFi area has progressed rapidly. The combination of NFTs and decentralized financial applications opens up new possibilities in the crypto space: Fractions of NFTs can be traded on decentralized exchanges or NFTs can be used for staking. One of the DeFi sectors where NFTs have become particularly popular: lending.

What is NFT lending?

NFT lending describes someone lending an NFT to earn interest or using an NFT as a reserve to borrow. The process is thus similar to lending money, with the difference that digital assets are involved in the form of NFTs.

To better understand the concept, a simple example: Anna owns a non-fungible token. To have enough cash to buy a new laptop, she wants to leverage the value of her NFT without having to sell it. To do this, she turns to a platform where she can lend NFTs. She then deposits it there as security and in return receives a loan in the form of cryptocurrencies, such as Ethereum or stablecoins.

During the term of the loan, Anna pays interest to the lender. If she can repay the loan in full, her NFT artwork will be returned to her. Should Anna be unable to repay the loan, the lender has the right to confiscate and sell the NFT to make up any losses.

Another use of non-fungible token lending is in crypto gaming. A player could lend their in-game items to another player and receive interest in return. For example, gamers could use this to rent skins for a short time or lend rare weapons to other players.

Among other things, NFT lending opens up new opportunities to use the value of digital assets and thus increase flexibility for NFT owners.

NFT lending is booming

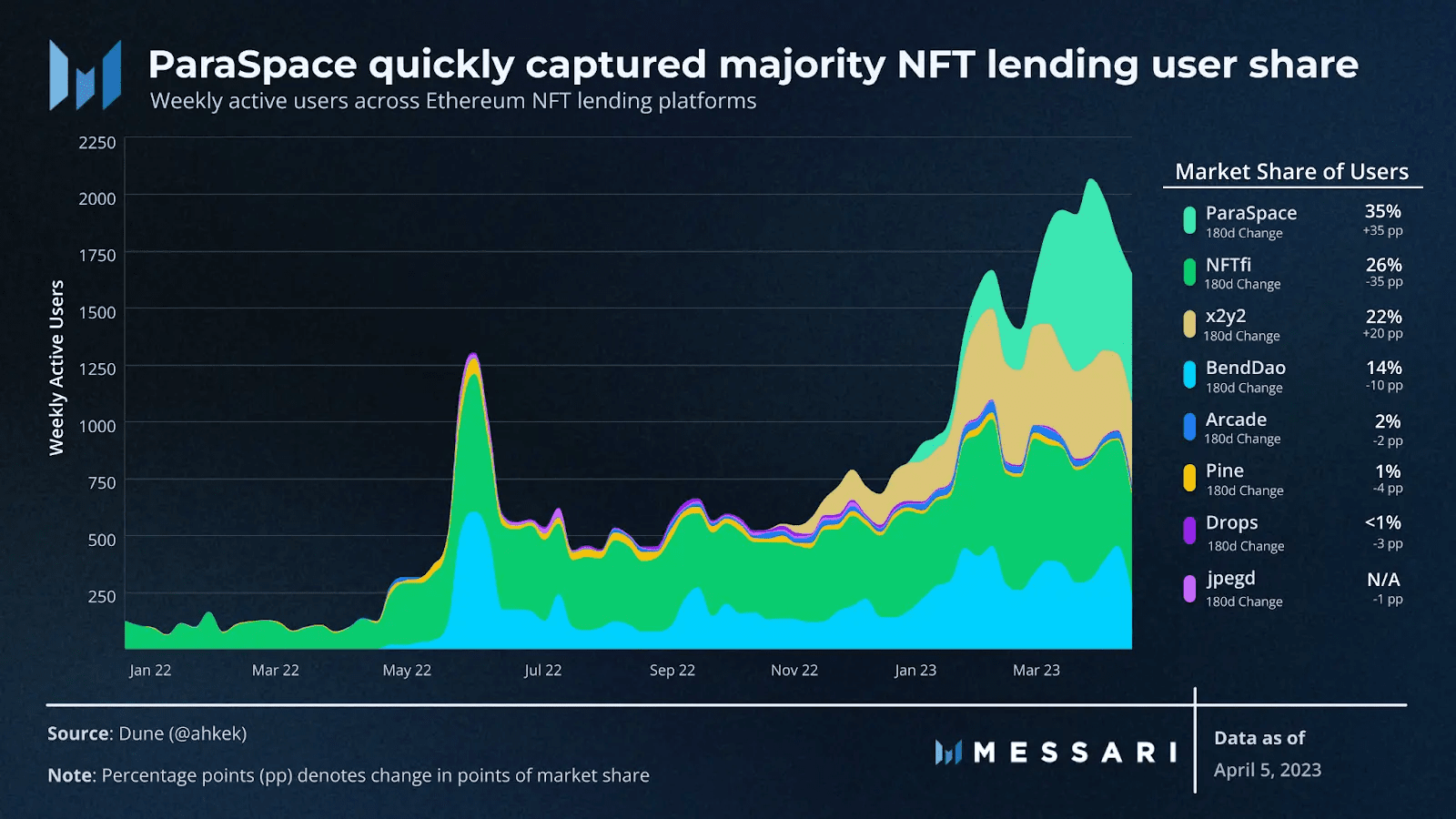

Recently there has been a surge in interest from many users of non-fungible token lending, with ParaSpace and NFTfi currently dominate the scene. ParaSpace was able to increase its number of users the most and is currently number one in the NFT lending sector.

Overall, user count across the NFT lending sector is still low at just over 2,000 users per week. However, compared to the beginning of the year, it was able to increase almost tenfold. In addition, lending has almost tripled from the lows of mid-2022, amounting to over the past six months over $200 million. Responsible for the lion’s share of the volume were the Board Ape Yacht Club, Mutant Ape Yacht Club and Cryptopunks NFTs.

Additionally, the recent surge in trading activity across the NFT sector is likely to have had a positive impact on the lending market. As more NFTs are traded with corresponding increases in value, NFT owners are looking for ways to free up liquidity by using them as collateral for loans. However, lending with non-fungible tokens also involves some risks. Eventually, lenders can seize and sell the collateral in the event of loan defaults. Many NFT lending platforms therefore only support the lending of very well-known and valuable collections.

Crypto exchanges with the lowest fees 2023