What is Solana (SOL)?

9 min readTable of Contents

Solana (SOL) experienced a real surge. Investors recognized the potential of the smart contract platform and gave the SOL Coin an immense increase in value. But Solana is not only so exciting because of its success on the stock exchanges. The underlying technology is also worth a closer look.

But how did Solana manage to become a serious competitor to Ethereum (ETH) and how does the blockchain actually work?

What is the Solana Blockchain?

Solana has the ambitious goal of solving the so-called “blockchain trilemma”. The trilemma describes the scenario in which blockchain projects usually cannot be equally decentralized, secure and scalable.

As a rule, the developers behind the projects focus on two of the three core features and optimize them as best as possible. One property is often less optimized than the other two. This explains why large blockchains, such as Ethereum or Bitcoin (BTC), are decentralized and secure, but scalability is a problem.

Solana’s network can process tens of thousands of transactions per second (TPS) (up to 60,000 TPS in test environments) and an average transaction costs just $0.00025. This makes Solana one of the most efficient and cheapest blockchains ever. This is achieved through the consensus mechanism used.

The developers implemented a Proof of History (PoH), which we will go into in more detail later. In addition, a classic Proof of Stake (PoS) was also used.

The blockchain is intended – similar to Ethereum – to offer developers an infrastructural basis. So Solana is ideal as a platform for operating decentralized applications (dApps), such as exchanges or blockchain games.

Who is behind Solana?

Behind the open source project is a top-class team made up of a large number of developers. At the end of 2017, the founder Anatoly Yakovenko published the first white paper. In the paper he described the basics of a new consensus mechanism: the Proof of History. He saw this as the solution to the existing scaling problems of the established blockchains. As a result, Yakovenko worked with former Qualcomm employee Greg Fitzgerald to develop a new blockchain project around his algorithm.

After the first test attempts were successful, he was able to convince other employees from Qualcomm and Apple of his project, who ultimately formed the founding team. Together they founded the company Solana Labs, which, however, would only receive this name much later. The project initially started under the name “Loom”. However, since they wanted to avoid confusion with Ethereum’s Layer 2 scaling solution Loom Network, Loom was renamed Solana.

At the beginning of 2018, the team was able to raise money from investors for the first time. About a year later, $20 million in venture capital went into the development of Solana. As part of the launch of the mainnet beta, SOL tokens worth $1.76 million were auctioned for the first time.

Today, Solana Labs continues to take care of the ongoing developments of the Solana Blockchain. A second company, the Solana Foundation, was founded to manage finances and channel funds into developments.

How does Solana work?

As mentioned before, Solana’s functionality can be compared to that of Ethereum or Cardano. But as is often the case, the consensus mechanism used differs significantly from the algorithms of other networks.

For example, while Ethereum is moving to Proof of Stake with Ethereum 2.0, Solana uses Proof of History. At its core, every consensus mechanism has the task of recording the transaction history in a correct time sequence. However, the way this happens in practice is often very different. Reason enough to take a closer look at the Proof of History.

How does a proof of history work?

The PoH is the reason Solana is celebrated within the community for its short validation time and fast transaction processing.How the algorithm works is quickly explained, but is still unique and innovative in its form. Every transaction on Solana’s network is assigned a cryptographic hash. This hash is a checksum which, among other things, results from the hash of a previous transaction.

A built-in algorithm called “Gulf Stream” broadcasts the transactions to all validators. These finally verify the transactions and add them to the blockchain. Because Solana creates tons of new blocks in a very short amount of time, it uses digital timestamps to uniquely identify each data packet.

In each verification round there is a selected validator, who is the so-called “leader”. Its job is to collect all already confirmed transactions and sort them in the correct order. This process should be kept as short as possible, which is why a separate protocol called “turbine” is used.

Turbine uses the UDP network protocol and streams the individual data packets through the network. The leader divides each block into countless smaller 64KB data packets and streams them along a random path through the network. The respective network nodes record the data and distribute it to the peers in the infrastructural neighborhood.

It is also important to know that Solana processes data blocks and transactions separately. The blocks contain the signatures and references of the transactions. The references are to the transactions published via Gulf Stream. This explains Solana’s enormous data throughput. On average, a new block can be created every 400 milliseconds. This time can be compared to the second hand of a clock, except that a “second” in Solana time calculation is significantly shorter.

The Proof of History is strongly reminiscent of the “Tangle”, i.e. the acyclic graph from IOTA. However, while IOTA works completely without a classic blockchain, Solana validates every transaction on its own blockchain.

The role of the leader

An important point to understand how Solana works is the role of the leader. As mentioned before, the leader is one of the most important people in the network. As part of the so-called leader rotation, the leader is democratically elected by the network participants. The role is passed on regularly, clearly intended for the most active and wealthy users.

Anyone who stakes a particularly large number of SOLs in the network has a good chance of becoming a leader. He will be rewarded for his work in the form of further SOL, but at the same time he must carry out his role responsibly. If an elected leader behaves manipulatively or fails completely, he or she can be voted out immediately.

The leader changes every four blocks (reminder: 400 ms per block, i.e. 1.6 seconds). During this time, he or she organizes as much data as he can (depending on individual computing power) into the four blocks created.

What is SOL Coin and how to stake this coin

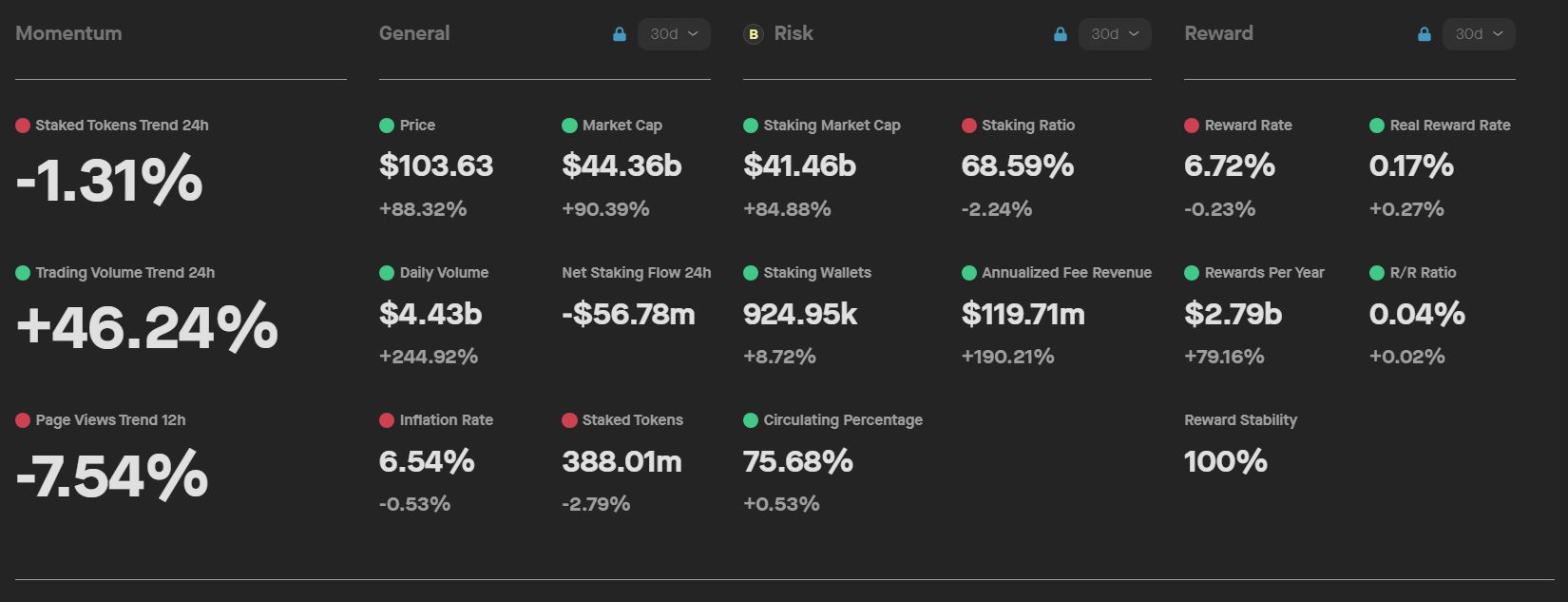

SOL is worth a closer look not only because of its immense increase in value. It is deeply integrated into Solana’s ecosystem and can be used to pay the fees incurred. In general, transactions are very cheap, with average costs of just $0.00001 and $0.00025.

Around 489 million SOL of the native coin were initially put into circulation. However, the inflationary approach ensures that supply will continue to increase in the future. SOL used when paying transaction fees are then completely burned. In the future, however, only 50% will be destroyed and the rest will go to the validators as an additional reward.

In addition, the coin can also be used for voting in the future. However, what is certainly more exciting for many investors is the possibility of staking the SOL Coin. Users can either set themselves up as validators or stake indirectly by delegating their staking right. In particular, network participants with smaller assets can still generate passive income and use their SOL coins.

When staking, users assign a certain amount of SOL to a validator. The more SOL allocated to a validator, the more transactions it can process. In return he receives a correspondingly large reward. He in turn distributes these as a percentage to the delegates who elected him.

SOL staking is generally possible on many exchanges or directly in the wallets that support SOL staking. However, if you want to stake your SOL, you first have to wait a certain amount of time. Rewards are only available after a few “epochs”, with an epoch being between 2 and 4 days.

The time depends on the epochs that have already begun and takes into account a warm-up and cool-down time.

Risks and things to know about SOL staking

Staking your SOL is incredibly easy. Users can delegate their coins from just 0.01 SOL. But as always, there are risks with SOL staking that you should be aware of. The most likely risk is so-called “slashing”. Slashing describes a situation in which a validator’s behavior harms the network. For example, if he knowingly signs false transactions.

The remaining validators can then vote him out immediately and some of the delegated coins will be burned. Due to the warm-up and cool-down phase, users can only theoretically access their coins. It is therefore advisable to only transfer your coins to validators who have a good reputation and are trustworthy.

You can easily find lists of the best validators on the Internet. Important to know: many wallets and exchanges do not allow a free choice of validators.

Why Solana and what alternatives are there?

In addition to Solana, there are a number of other blockchain platforms that offer similar functionality. The big competitors Ethereum, Cardano, Algorand and Polkadot are well known. The core is always identical. All platforms enable developers and users to create and use decentralized applications. Part of the ecosystems are native tokens that can be used to pay for smart contracts, dApps and decentralized financial services.

Solana does not have a unique selling point, at least from the perspective of the range of functions available. However, the technology is what makes Solana so special. Many of the alternatives mentioned do not come close to Solana in terms of execution speed, scalability and security.

As a so-called “first mover”, Ethereum certainly has the best starting position and is currently unassailable in terms of adoption. Cardano recently attracted attention due to its rapid development. Algorand is considered a sleeping giant and Polkadot could attract many developers in the future thanks to its innovative side chains.

In short: the competition never sleeps and could challenge Solana’s market share in the future.

Solana is currently in an exciting market phase. More and more developers are becoming aware of blockchain technology. New exchanges and DeFi applications are entering the market and the need for powerful blockchain platforms is growing. The hype surrounding Solana comes at exactly the right time. Due to the consistently high fees on the Ethereum network, Solana is likely to be one of the first alternatives.

If the blockchain platform can keep up the current hype, Solana should continue to challenge Ethereum’s supremacy in the future.

Conclusion

Solana has now become one of the leading smart contract platforms. Many developers see Solana as the first alternative to the clear number one Ethereum. Above all, the consensus mechanism used – called Proof of History – reflects the excellent technical basis.

Solana is considered one of the most performant and cheapest blockchain platforms ever. As we already explained in the section on the competitive situation, Solana is not alone in the field. A large number of other crypto projects are trying to gain market share in the areas in which Solana is also active.

So far, however, things are going very well for Anatoly Yakovenko and his project. However, it remains to be seen whether Solana has earned its current laurels in the long term. The goal should be to develop Solana into a serious competitor to Ethereum. If this plan works, further price gains are likely to await SOL.