ETH (ETH) has been moving downwards since May 12, when it reached an all-time high price.

Despite the ongoing bounce, there are not enough signs to predict a bullish reversal.

Ongoing decrease

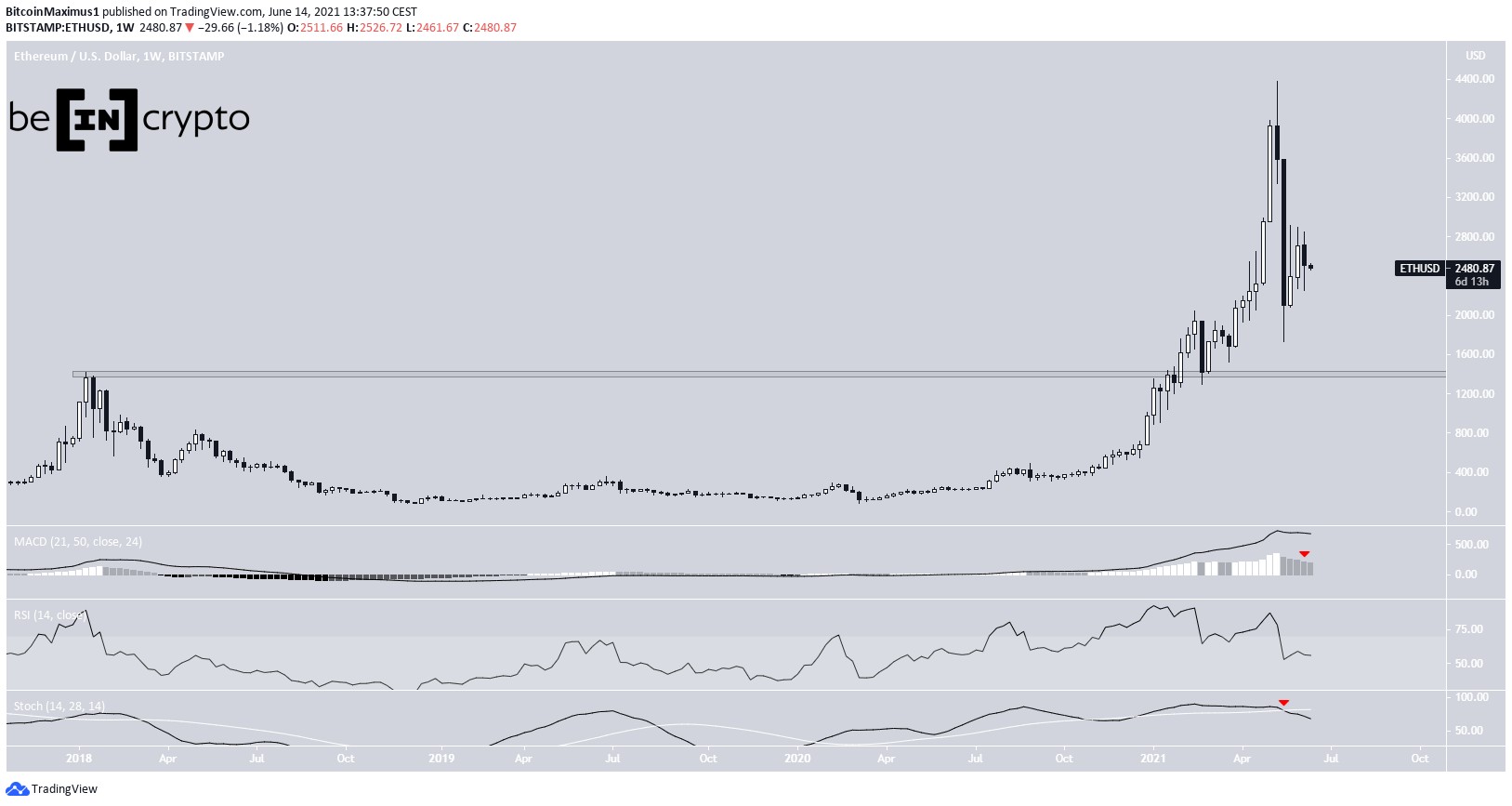

ETH has been moving downwards since reaching an all-time high price on May 12. The decrease has been sharp, culminating with a low of $1730 on May 23. This amounted to a 60.50% decrease in only 11 days.

Long-term indicators are bearish. While the RSI has generated hidden bullish divergence, both the MACD & Stochastic oscillator are moving downwards, the latter having made a bearish cross (red icon).

In the weekly time-frame, the main support level is found at $1400, which is the previous all-time high resistance area.

The daily chart shows the ongoing bounce since May 19.

However, ETH has been thrice rejected by the $2850 resistance area, which coincides with the 0.382 Fib retracement resistance level.

Despite showing some bullish signs, technical indicators are still bearish.

The RSI is below 50 and the Stochastic oscillator is decreasing, despite having made a bullish cross. The MACD is also negative.

Wave count

The wave count indicates that ETH is in a long-term wave four (red), of a bullish impulse that began in Dec. 2020.

While it has bounced at the 0.618 Fib retracement support level at $1,775, it is not yet clear if wave four has reached its bottom.

The next support area is at $1,030, the 0.786 Fib retracement support level.

The shorter-term chart shows that the decrease from the all-time highs is a five wave structure. Therefore, it means that it is likely only the first part of a larger corrective structure, which would complete the previously outlined wave four.

As a result, an increase towards $3370-$3814 could transpire before another low is reached.

ETH/BTC

Cryptocurrency trader @Pentosh1 outlined an ETH/BTC chart, which shows the token decreasing towards ₿0.0645.

The ETH/BTC chart does look bearish in the short-term.

It has been decreasing since May 15 and created a lower high on June 8. The high was made right at the 0.786 Fib retracement resistance at ₿0.076

Technical indicators are bearish. The MACD is decreasing, the RSI is below 50 and the Stochastic oscillator has made a bearish cross.

The ongoing decrease looks like a potential fourth wave pullback.

The most likely target for the low would be near ₿0.05. This is the 0.618 Fib retracement support level and the middle of a parallel channel created by waves one & two (orange). Furthermore, it would give sub-waves A:C (black) a 1:1 ratio.

For BeInCrypto’s latest BTC (BTC) analysis, click here.

The post When Will ETH Reach a New All-Time High? appeared first on BeInCrypto.