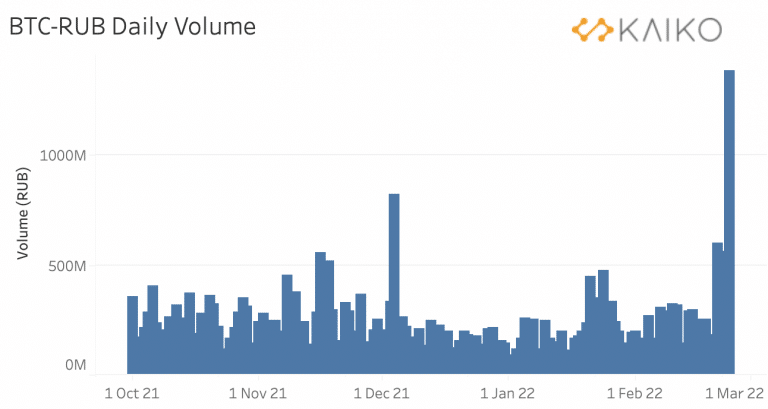

With new sanctions, BTC trading volume in Russia skyrockets 150%

3 min readTrading volumes between the Russian ruble and BTC hit the highest level in nearly 9 months, according to data from analytics firm Kaiko. In fact, the total volume has already exceeded 1.5 billion rubles and practically tripled from the previous record.

The same situation occurred in Ukraine, with an increase in volumes between BTC and hryvnia. However, demand in Ukraine has not reached the same levels as in Russia.

“Activity was concentrated in the billions,” said Clara Medalie, an analyst at Kaiko. “Trading volume between hryvnia and BTC also increased, but not as much as the previous record.”

The new record comes amid a series of new sanctions applied by the West against Russia. The country had part of its banks cut off from Swift, an international transfer system. As a result, both the ruble price and the interest rate experienced strong volatility.

Ruble sinks and interest rates soar

With the Swift block, Russian banks are banned from making or receiving international transfers. In practice, accounts and services such as credit cards are isolated from the rest of the world.

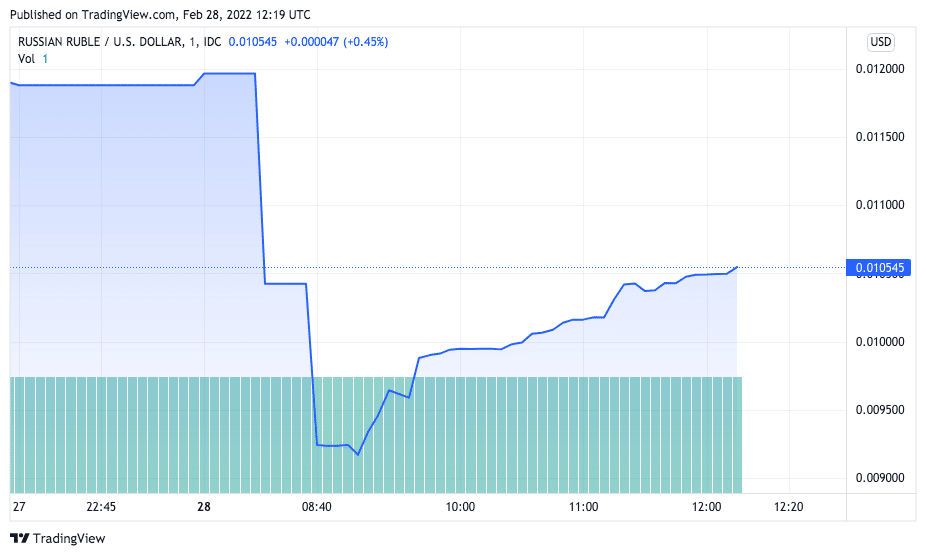

This was the toughest measure among sanctions applied against Russia since the beginning of the conflict, and it caused strong volatility. The ruble opened with a sharp drop of 30% on the Monday morning, with one dollar reaching 118 rubles. But some banks selling dollars at a rate of 180 rubles.

To try to contain the soaring dollar, the Central Bank of Russia doubled the interest rate, which went from 9.5% to 20%. The measure seems to have softened the fall of the local currency, which now operates at a low of “only” 11%.

Russian debt securities were also penalized, particularly by the rating agencies. S&P downgraded the country’s credit rating below investment grade on Friday, while Moody’s will review the rating.

If there is a decline, Russia’s note could reach the status of junk bond that is, the worst degree of risk.

On the other hand, the Russian stock market will not operate on Monday, as the central bank ordered the closing of the Moscow stock exchange.

Queues to withdraw money

With so many problems, Russians have become fearful that the banks might not have the money. Thus, they still face huge queues to withdraw their money at ATMs.

Analyst Ben Schaak posted a video of a huge queue to withdraw cash at a mall. This video was recorded before the opening of the markets and the fall of the ruble, which indicates that the Russians wanted to prevent an eventual devaluation.

ATM Lines in Russia – people trying to get cash and exchange in goods before the currency market opens – hyperinflation possible pic.twitter.com/g8z9RRrMJs

— Ben Schaack (@BuyingStrength) February 27, 2022

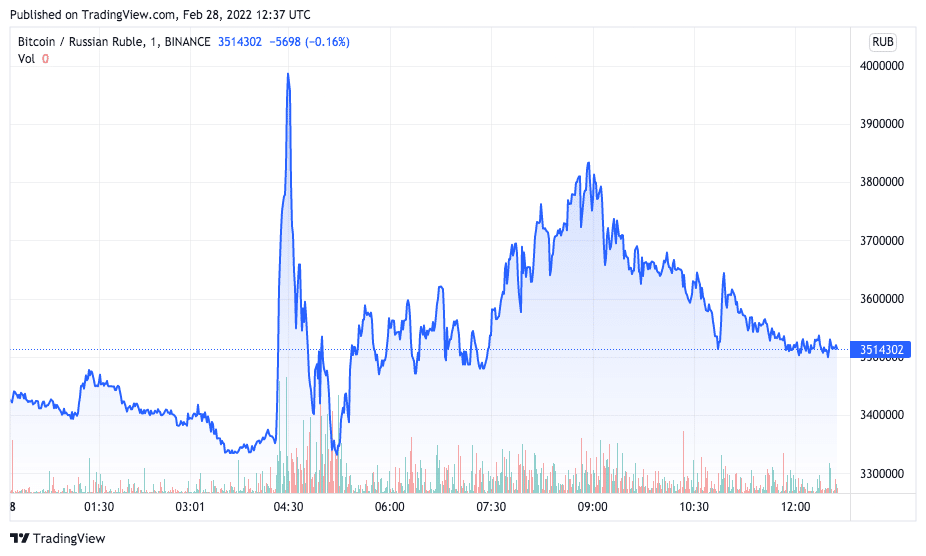

However, most of these people were unable to withdraw their money in time, which made many of them turn to cryptocurrencies as a safe haven. Thus, part of the large increase in BTC volumes in Russia is explained by this behavior.

According to the charts, the price of BTC in rubles rose sharply shortly after the sanctions were announced, reaching close to 4 million. Currently, one BTC is worth about 3.5 million rubles, and the market operates with great volatility.