Quick take:

- Popular DeFi tokens such as YFI, COMP, SUSHI and CRV are down by over 60% since their all-time high values

- DeFi tokens continue to correct due to the current crypto market environment

- The overall market cap of DeFi related digital assets has dropped by 25% in the last 24 hours

- Trading volume in the same time period has dropped by 30%

DeFi digital assets are in the midst of a massive correction from their all-time high values experienced in Q3, 2020. A quick look at Coinmarketcap reveals that in the last 7 days, the majority of the DeFi tokens are experiencing double-digit losses.

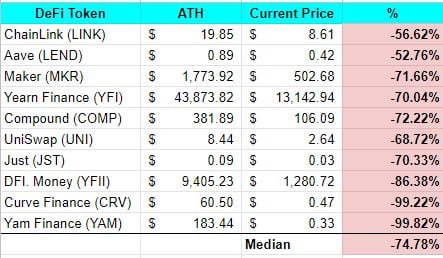

Below is a screenshot demonstrating the 7-day losses of ten popular DeFi tokens such as ChainLink (LINK), Aave (LEND), Maker (MKR), Yearn Finance (YFI), Yam Finance (YAM) and more.

DeFi Tokens Experience a Pullback of Over 60% Since All-Time High Values

On a macro level, the majority of the popular DeFi tokens that caused excitement in Q3, have continued to experience pull-backs of over 60% from their all-time high values. They include the aforementioned tokens such as Curve Finance (CRV), SushiSwap (SUSHI) and Yearn Finance (YFI).

Crypto community member @CryptoWhale had analyzed these losses being experienced by DeFi tokens and shared his analysis via the following tweet on October 4th. The tweet includes an elaborate spreadsheet that highlights the magnitude of losses by DeFi tokens since their all-time high values.

“DeFi is the future”

pic.twitter.com/5AZVMQWehI

— Mr. Whale (@CryptoWhale) October 4, 2020

Market Cap of DeFi Digital Assets Drops by 25% in 24 hours

However, @CryptoWhale’s analysis is the tip of the iceberg as it was done 4 days ago. According to the team at Santiment, the collective market cap of all DeFi-related digital assets has dropped an additional 25% in the last 24 hours. Furthermore, their corresponding daily trading volumes have shrunk by 30%.

Doing a similar analysis as the one done by @CryptoWhale of the ten DeFi tokens mentioned in the first section, it can be observed that theses popular assets have dropped an average of 74% since their all-time high values.

Has the DeFi Bubble Burst?

With such high double-digit losses, it is easy to conclude that the DeFi bubble has burst and a vast number of these tokens might just disappear into oblivion.

However, crypto analyst Andrew Kang is of the opinion that the DeFi market is in the first stages of a market cycle that is characterized by a first market sell-off and a subsequent bear trap. His analysis of the DeFi market can be observed in the following tweet and accompanying chart of the DeFi market cycle.

Where are we in the DeFi market?

We're definitely not at the 2018 stage of the market where we see a long bear market

Probably somewhere between First Sell Off and Bear Trap

Some analysis below. https://t.co/XHnvoLYS2D

— Andrew Kang (@Rewkang) September 23, 2020