2020 is probably the last year that Bitcoin will be under 10 000 USD

2 min readOn the last day of July, Bitcoin ignored alarming news about the US economy, which declined by 32.9% in the second quarter of 2020. The lack of growth in the US economy was associated with job losses and low consumer spending, which caused the economic effects of COVID19.

Following positive news from Amazon, Apple and Facebook, BTC is firmly holding 11 000 USD

When the news of the US economy was published, the reaction was cautious, because such information has the ability to immediately reduce the value of Bitcoins. However, major technology companies Amazon, Apple and Facebook have published their quarterly earnings reports, which have been supported stock markets. The positive news from large technology companies also had a direct impact on Bitcoins, which have since regained a price level of $ 11,000. At the time of writing, the value of BTC is $ 11,260.

It should also be noted that the Bitcoin price follows a prediction published by the team in Bloomberg in early July. According to the research team, the number of active bitcoin addresses indicates that BTC will reach $ 12,000.

The number of active bitcoin addresses, a key signal of the fall in prices in 2018 and the recovery in 2019, shows a value closer to $ 12,000 based on historical formulas.

2020 may be the last with Bitcoin under 10 000 USD

In addition to all the positive news about crypto markets, 2020 could be the last year that Bitcoin is valued under 10 000 USD.

According to an analysis by Timothy Peterson of Cane Island Alternative Advisors, BTC can be modeled using Metcalfe’s law. Metcalfe’s law is used primarily in the telecommunications industry, and Mr. Peterson used it for his analysis of Bitcoins. Metcalfe’s law states that the effect of a network is proportional to the number of connected users in the system.

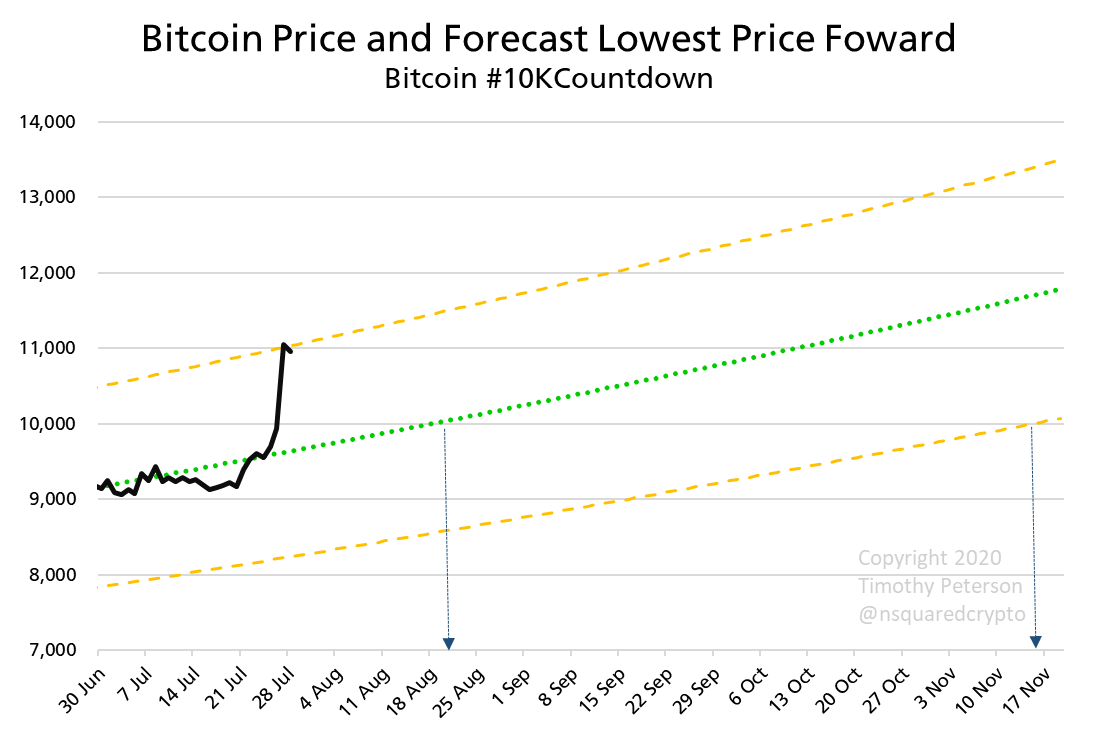

In addition, Mr. Peterson has a very sophisticated and simple chart that shows mid-November 2020 as the last period when Bitcoins are likely to be valued under 10 000 USD. He published it in one of his latest tweets.

The yellow lines show the expected range of variations from the lowest price. Over time, Bitcoin followed the green line.

As the Fed and the European Central Bank continue to print fiat, more investors are interested in safe resources such as gold, silver and Bitcoin. This fact, combined with recent bullish reports about Visa, Mastercard and Paypal finally including the crypto, concludes that the general trajectory of the Bitcoins is higher from now on.

Do you agree with Timothy Peterson’s analysis?

You might also like: What Is Yield Farming? The Rocket Fuel of DeFi, Explained