85,000 crypto traders ‘liquidated’ after BTC fell to nearly $30,000

2 min readTens of thousands of crypto traders were liquidated last night as BTC briefly dropped to under $30,500, data from multiple sources shows. Altcoins saw a similar dump as a result, with millions of dollars getting shaved off on lesser-known coins like AXIE and SAND.

Over 82,000 traders were liquidated, with the largest single liquidation order taking place on Bybit—a BTC trade valued at $4.86 million.

Liquidations and how

‘Liquidations,’ for the uninitiated, occur when leveraged positions are automatically closed out by exchanges/brokerages as a “safety mechanism.” Futures and margin traders—who borrow capital from exchanges (usually in multiples) to place bigger bets—put up a small collateral amount before placing a trade.

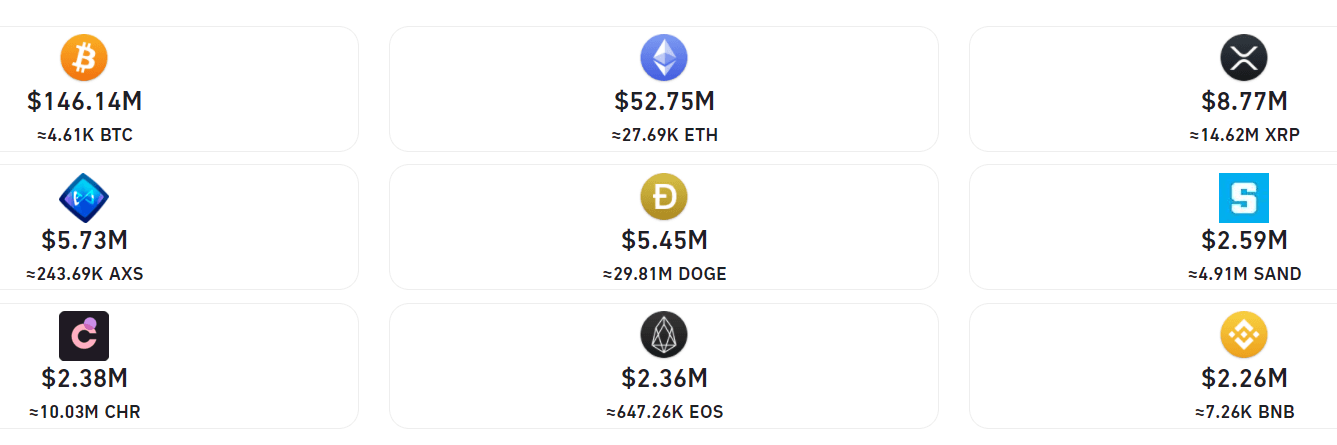

BTC traders took the majority of such liquidations yesterday. As per data from analysis tool Bybt, $146.14 million worth of BTC trades were liquidated, followed by ETH traders ($52 million), XRP traders ($8 million), and Axie Infinity traders ($5 million).

Traders punting on memecoin Dogecoin took on $5 million in liquidation damages of their own, while Sandbox NFT (SAND) and Chromia (CHR) traders saw losses of $2.59 million and $2.38 million respectively.

Where did the liquidations occur?

Futures powerhouse Bybit saw over $100 million in liquidations alone, with 83% of all traders going ‘long’—or betting on a price rise—on that exchange. $63 million in liquidations came from OKEx, while Binance saw a $23 million chunk get liquidated.

Meanwhile, despite the millions lost, the data is unlike what was seen on several occasions earlier this year. In April 2021, a staggering $1 billion in market liquidations, affecting one million trading accounts, occurred after BTC reached the top and dropped off a cliff.

Then in June, on the back of China’s renewed criticism of BTC, market volatility caused 200,000 traders to get liquidated. Several large-cap cryptos like Solana, XRP, and Polkadot saw double-digit percentage declines, with even Dogecoin racking up $30 million worth of liquidations in a single day.

Still, what looks like madness in traditional circles continues to be a normal day for those in crypto.

The post 85,000 crypto traders ‘liquidated’ after BTC fell to nearly $30,000 appeared first on CryptoSlate.