Magnificent Seven: AXS, FLOW, XRM, RVN, OKB, STX, HBAR – Biggest Gainers July 9 -16

3 min readTable of Contents

BeInCrypto takes a look at the seven altcoins that increased the most over the past seven days, from July 9 to July 16.

These altcoins are:

- Axie Infinity (AXS) : 81.17%

- Flow (FLOW) : 34.43%

- NEM (XEM) : 18.86%

- Ravencoin (RVN) : 13.42%

- OKB (OKB) : 11.03%

- Stacks (STX) : 9.01%

- Hedera Hashgraph (HBAR) : 8.97%

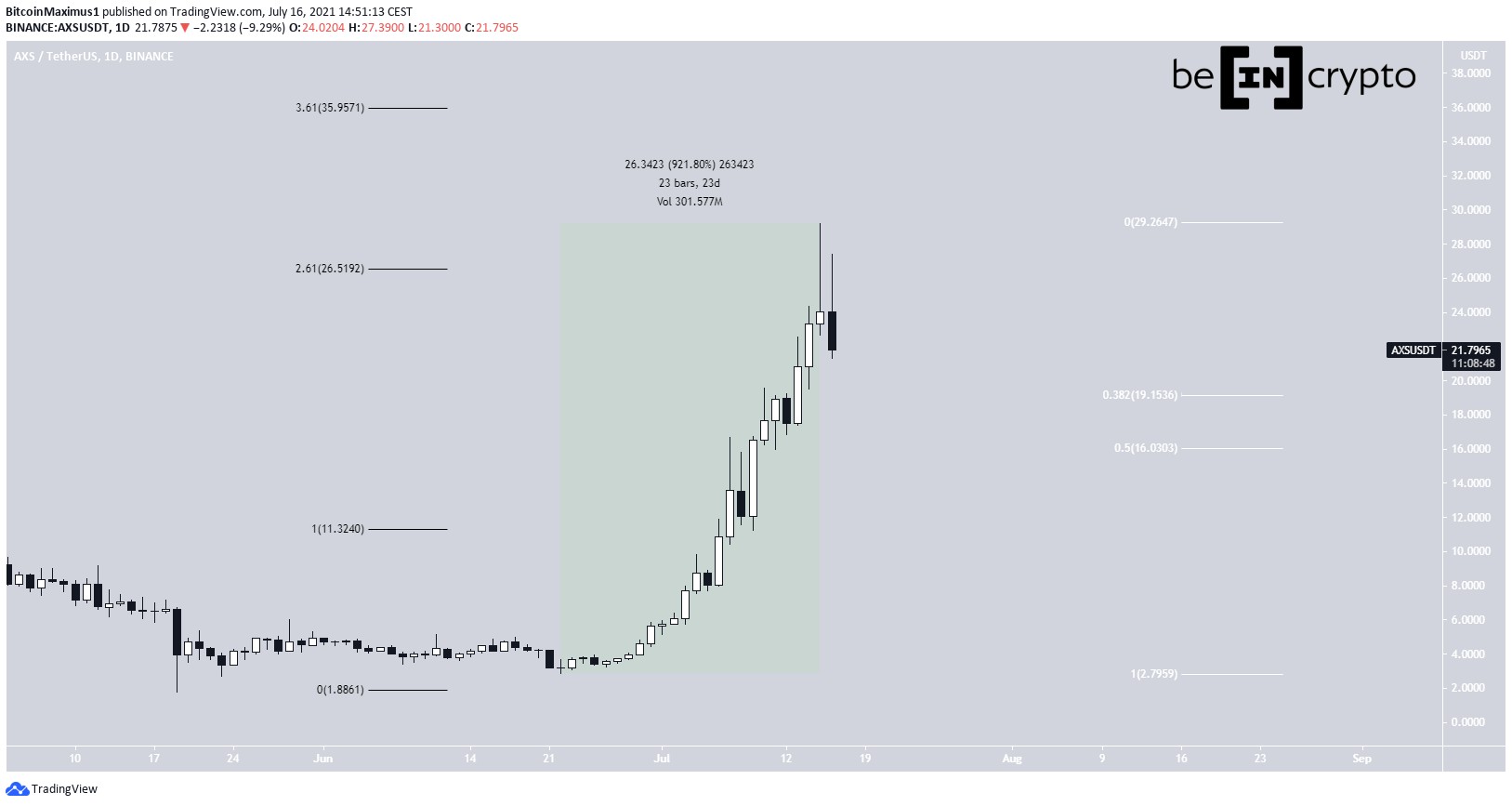

AXS

AXS has been rapidly moving upwards since June 22. It managed to increase by 921% in only 23 days, leading to a new all-time high price of $29.20 on July 15.

The high was made very close to the 2.61 external Fib retracement at $26.5 (black). AXS proceeded to close below this area, creating a shooting star candlestick.

The next resistance is at $39.95, the 3.61 external Fib retracement level, while the closest support is between $16-$19.1, the 0.382-0.5 Fib retracement support level (white).

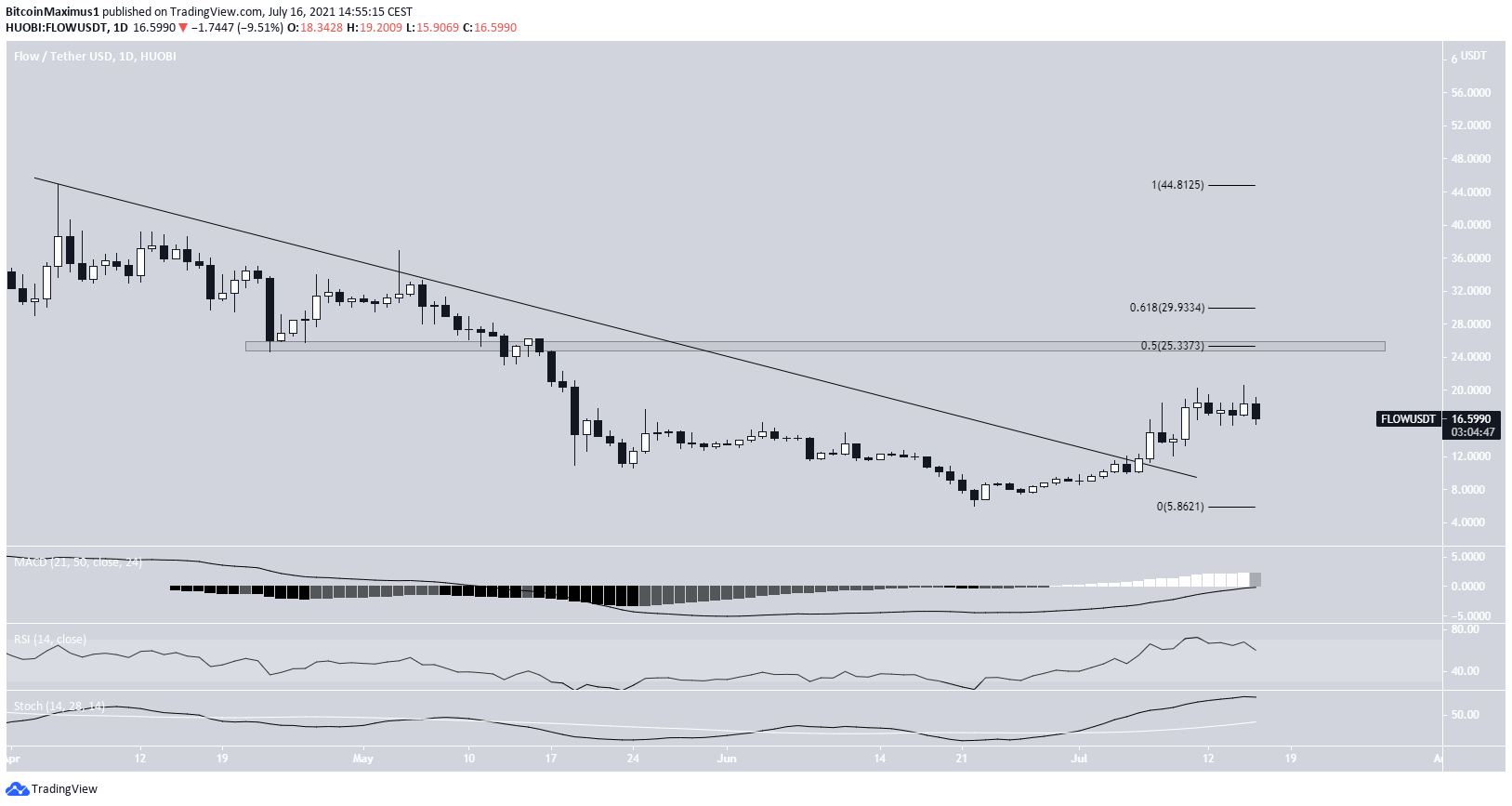

FLOW

FLOW has been moving downwards while following a descending resistance line beginning on April 5. It finally managed to move above the line on July 6.

It has been moving upwards since, culminating with a high of $20.61 on July 15.

The closest resistance area is at $25.33. This is the 0.5 Fib retracement resistance level and a horizontal resistance area.

The MACD and Stochastic oscillator are moving upwards, and while the RSI might have begun to move downwards, it is not bearish yet.

NEM

NEM had been following a descending resistance line since March 3. It broke out on June 13 but fell to a lower low on June 22.

The token has been moving upwards since and has reached a high of $0.146 so far.

The closest resistance area is at $0.24.

Technical indicators are bullish. The RSI is moving upwards and is above 50. The MACD has nearly crossed into positive territory, while the Stochastic oscillator has made a bullish cross.

Therefore, the token is expected to increase towards the $0.24 horizontal resistance area.

RVN

RVN has been decreasing alongside a descending resistance line beginning on May 7. It reached a low of $0.04 on June 22 and bounced. On July 4, it managed to break out from this line.

The ongoing upward movement is supported by both the MACD & RSI.

The closest resistance area is at $0.102.

OKB

OKB has been increasing since June 22, when it had reached a low of $8.50. The upward movement has been gradual and choppy, indicating that it could be corrective. It is possible that the movement can be contained inside an ascending parallel channel.

The closest resistance area is at $12.55, the 0.382 Fib retracement resistance level.

Until OKB manages to break out from the channel, the trend cannot be considered bullish.

STX

STX has been moving upwards since June 22, when it reached a low of $0.50. The upward movement led to a high of $1.47 on July 11. It looks like a completed five wave bullish impulse.

STX has been moving downwards since July 11, in what seems like an A-B-C corrective structure. It has reached the 0.382 Fib retracement support level and bounced. The next closest support is at $0.98, the 0.5 Fib retracement support level.

HBAR

HBAR has been trading inside a descending parallel channel since March 15. On June 22, it reached the support line of the channel and bounced. This also coincided with a validation of the $0.15 area as support.

Technical indicators are bullish, supporting the continuation of the upward movement. This is especially evident by the multiple bullish divergences in place.

However, HBAR has to reclaim the middle of the channel in order for the trend reversal to be confirmed.

For BeInCrypto’s latest BTC (BTC) analysis, click here.

The post Magnificent Seven: AXS, FLOW, XRM, RVN, OKB, STX, HBAR – Biggest Gainers July 9 -16 appeared first on BeInCrypto.