Bitcoin analysis: BTC unchanged in the downtrend

4 min readThe course of the key cryptocurrency Bitcoin (BTC) is still not moving. Since forming the annual high on April 13, the key crypto currency has ranged in a 16 percent trading range without any impetus. Although the bulls were able to fend off a price drop in the direction of the old breakout mark around 25,000 US dollars in the previous week, there was no sustained recovery despite the new annual high of the Nasdaq100 technology index. One reason for Bitcoin’s underperformance can be seen in the strength of the US Dollar Index DXY. This recovered noticeably in the last few weeks of trading and, as already mentioned in the last price analysis from May 3rd, acts as a headwind on the BTC price.

Bitcoin: Bullish price targets for the coming trading weeks

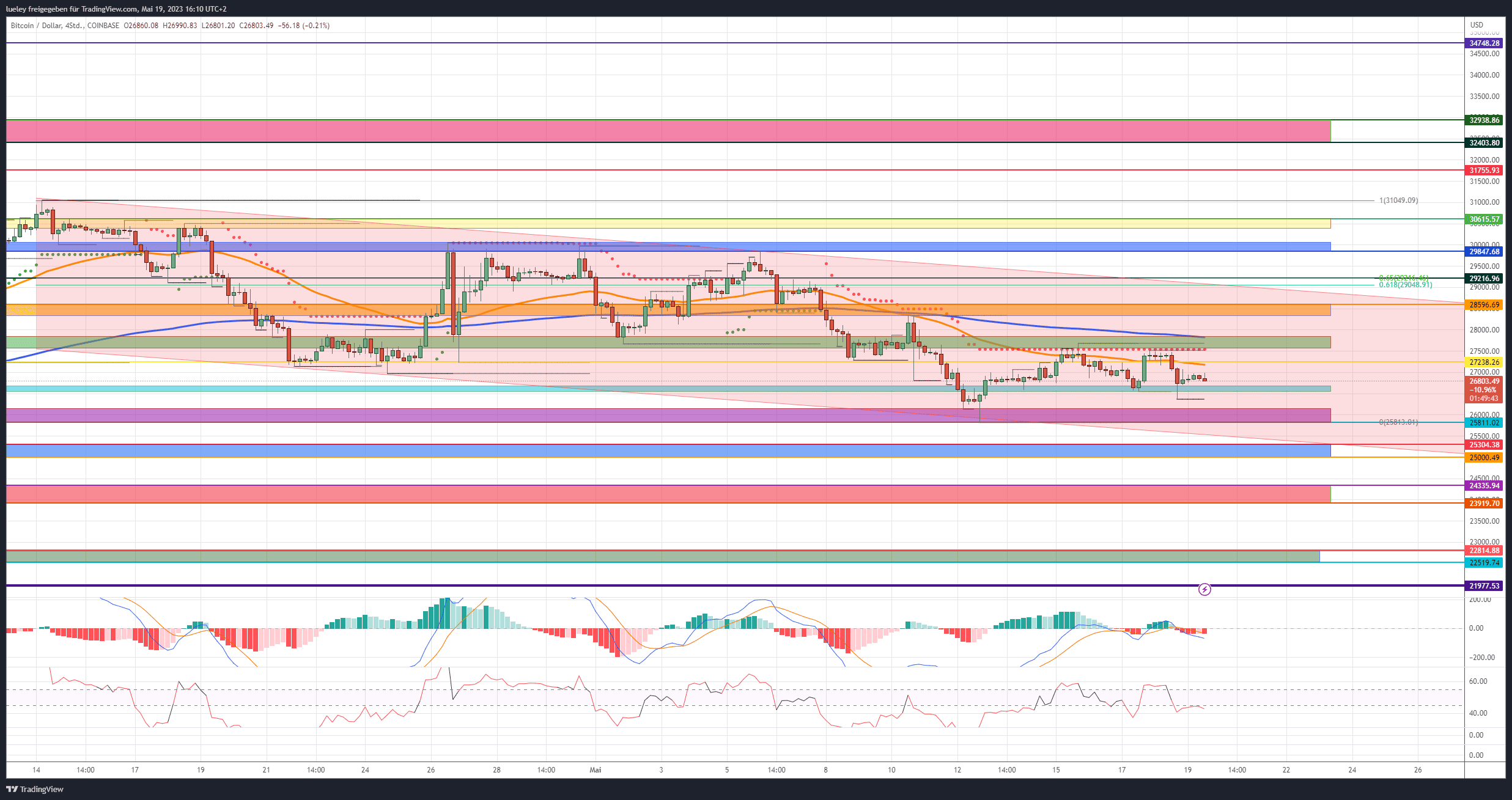

Bullish price targets: $27,238, $27,565/$27,841, $28,326/$28,596, $29,048/$29,216, $29,847/$30,060 $30,404/$30,615, $31,049, $31,755, $32.403/$32.938 USD

The BTC price is currently in a downtrend channel. Last Friday, May 12, Bitcoin reached its bottom at $25,813 before staging a first interim rally back towards the old support area around $27,600. Here the supertrend in the 4-hour chart blocked the way for a subsequent increase towards the top of the trend channel in the last few trading days. First, bitcoin needs to stabilize above $27,238 and subsequently push through the green resist area to the upside. With the Supertrend and the EMA200 in the 4-hour chart, there are several technical hurdles waiting in this zone.

Only if Bitcoin can recapture the $ 28,596, a renewed increase in the direction of the golden pocket of the current corrective movement between $ 29,048 and $ 29,216 is conceivable. This is also where the upper edge of the trend channel currently runs. A breakout of the channel would brighten the chart significantly. The buyer camp should then lift the Bitcoin price into the blue resistance zone between US$ 29,847 and US$ 30,060. If Bitcoin does not bounce dynamically to the south and overcome this neuralgic zone, the zone around the annual high at 30,615 US dollars will come into focus.

Here the BTC course failed several times in April. If the buyer side then succeeds in breaking through this area in the long term, Bitcoin could march through the year high of $31,061 towards $31,755. To break through this area, the bulls will have to show strength again. Only when Bitcoin pulverizes this area can a subsequent increase to the next relevant target area between US$ 32,403 and US$ 32,938 be planned. The old low of January 25, 2022 at 32,938 US dollars represents the short-term maximum price target for the coming trading weeks.

Bitcoin: Bearish Bitcoin price targets for the coming trading weeks

Bearish Targets: $26,686/$26,543, $26.151/$25.813, $25,304/$25,000, $24,389/$23,919 $22,814/$22,519, $21,977

The bears have remained in control for the past few weeks of trading. As long as Bitcoin remains capped below $27,800, the technical chart situation will not change. Should Bitcoin promptly correct below the turquoise zone and undercut yesterday’s daily low of 26,361 US dollars, a return to the area around the monthly low of 25,813 US dollars is to be planned.

If the BTC price does not bounce north again and does not form a double bottom, a retest of the blue support zone between US$ 25,304 and US$ 25,000 becomes increasingly likely. This zone continues to act as a key target area and strong support on a daily basis. Buyers are likely to take more action here and stabilize the price. However, a short-term spike below this key area into the red support zone between $24,389 and $23,919 cannot be ruled out.

However, should Bitcoin not find a footing here and fall out of the trend channel to the south for a long time, the chart picture would cloud over further. A daily close below the red support area would result in a sell-off into the $22,814-$22,519 zone. Even a drop back to US$ 21,977 could no longer be ruled out as a result.

Looking at the indicators

The RSI as well as the MACD in the 4-hour chart are currently showing signs of weakness. The RSI is trading at the lower edge of the neutral zone at the 45 level. The MACD indicator has a sell signal. On a daily basis, both indicators currently also have an active short signal.

Due to the bearish price development in the last few weeks of trading, both indicators have also cooled down noticeably in the weekly chart. If the price weakness persists, the MACD threatens to activate a fresh sell signal in the coming weeks. With a value of 56, the RSI indicator is also only just above the neutral zone and is threatening to neutralize the buy signal that was formed in 2023.