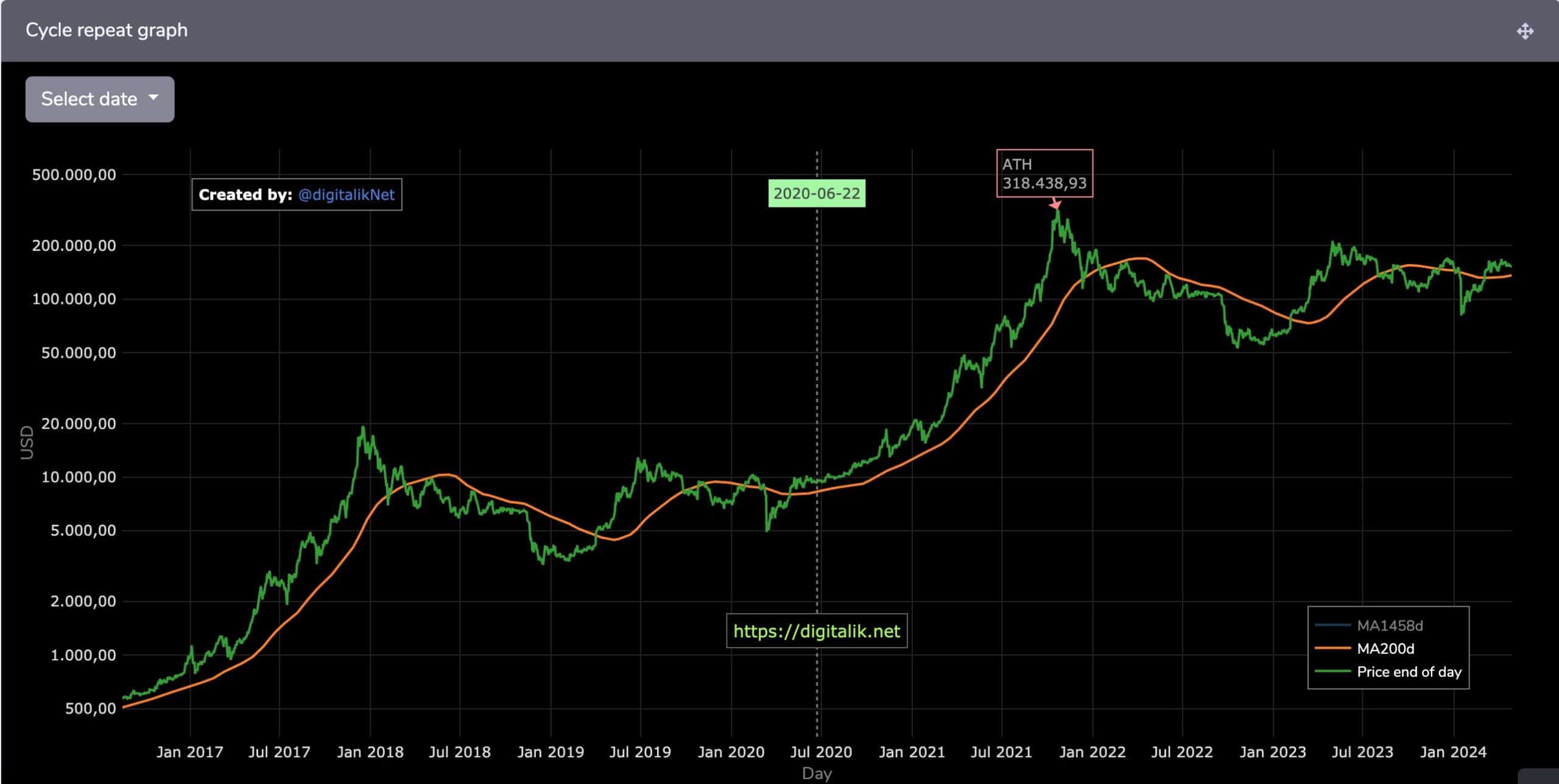

Bitcoin Price To $318,500 By October 2021

2 min readPopular cryptocurrency YouTuber recently posted a chart illustrating that if Bitcoin repeats its previous significant bull run from 2017, its price could exceed $300,000 by October of 2021. Interestingly, this highly optimistic prediction corresponds with the well-known BTC stock-to-flow model.

BTC To Over $300,000 by October 2021?

Bitcoin price predictions are among the most commonly discussed threads in and out of the cryptocurrency community. Such forecasts range from overly adverse ones such as Jim Rogers, who sees the asset heading towards zero to some sounding a bit far-fetched in which BTC reaches a global reserve status and its total market cap goes into the “10s of trillions of dollars.”

Another optimistic forecast posted by Carl Eric Martin, the person behind the popular The Moon YouTube channel, takes Bitcoin into six-digit price territory. It’s based on history by examining the 2017 bull run, which started in Q4 2016.

At the time, BTC was trading just below $600. Fast-forward to the parabolic price increase of late 2017, and the asset can be found at its all-time high of nearly $20,000. This represents a massive increase of over 3,300% in slightly over a year.

Now, Bitcoin is hovering around $9,200. If this impressive increase of 3,300% is to occur again in the same timeframe, BTC will be on a wild ride to almost $318,500 by October 2021.

“‘Price doesn’t repeat, but it does rhyme.’ – This famous saying is very relevant to this chart. I don’t think that Bitcoin will top at exactly $318,000, but I do believe that it’s a good estimate of what’s possible for the next couple of years.

Bitcoin is looking very bullish for the end of the year, and I think we have a great chance of breaking $20,000 by December this year.”

S2FX In Play?

Although reaching $300k in a year sounds like a tough challenge for Bitcoin, such a similarly high number has previously appeared in a popular model. By upgrading the original stock-to-flow ratio, which examines BTC’s existing reserves (stocks) and the asset’s annual supply (flow), a popular analyst created the stock-to-flow cross-asset (S2FX) model.

The new model contains several narratives that have altered for Bitcoin since its introduction in 2009. Those range from the initial “proof-of-concept” phase written in the white paper, then a “payments” stage, “e-gold” – following comparison with the precious metal, and “financial asset” after BTC received legal clarity in certain countries and surpassed $1B transactions per day.

The S2FX formula takes Bitcoin’s market capitalization to $5,5 trillion, or roughly $288,000 per coin. According to this projection, this massive price should occur by 2024 – the year of the next halving.

You might also like: Coin Metrics Finds the ‘Coinbase Effect’ Is Actually Pretty Lame