Bitcoin tests the $32k support

3 min read

Today sees Bitcoin extend the declines that began in recent days with Bitcoin once again testing support at $32,000.

The declines again accompany prices to test delicate support levels. This is starting to deflate weekly performances as well.

Today more than 80% of the major cryptocurrencies are in negative territory. Among the top 20, only two are above par.

VeChain (VET) continues to rise, climbing 4% to an all-time high of over 35 cents of a dollar.

Polkadot (DOT) also rose during the day, jumping more than 8%. Polkadot in the last few hours is close to the absolute records of the last weekend with a price that for the first time has risen above $19.

Among the best risers of the day there is Curve Dao (CRV), the token linked to the third most used decentralized exchange by users, with a weekly volume of about 700 million dollars traded on the DEX. Curve is now up 18%, as is Hedera Hashgraph (HBAR). Polkadot is the third best of the day.

The sluggish market of the last few days has sent the fear and greed index, a measure of investor sentiment, down to 75 points, its lowest level in two months.

Volumes have also continued to fall, an indication that has been highlighted on these pages in recent days. This confirms the lack of validity of the rises of recent days, rises not supported by purchases.

These first hours of the day show an increase of the daily trading volumes that highlight how the current declines are increasing the coverages. There seems to be an increasing number of traders who prefer to start cashing in on the large gains of recent weeks.

The declines in recent hours bring the market cap back below $950 billion, with Bitcoin’s market share dropping below 64.5%, its lowest point in 30 days.

Ethereum’s dominance remains above 14%, while XRP has fallen a few fractions of a decimal since yesterday, back to its lowest point in three years, at 1.2%.

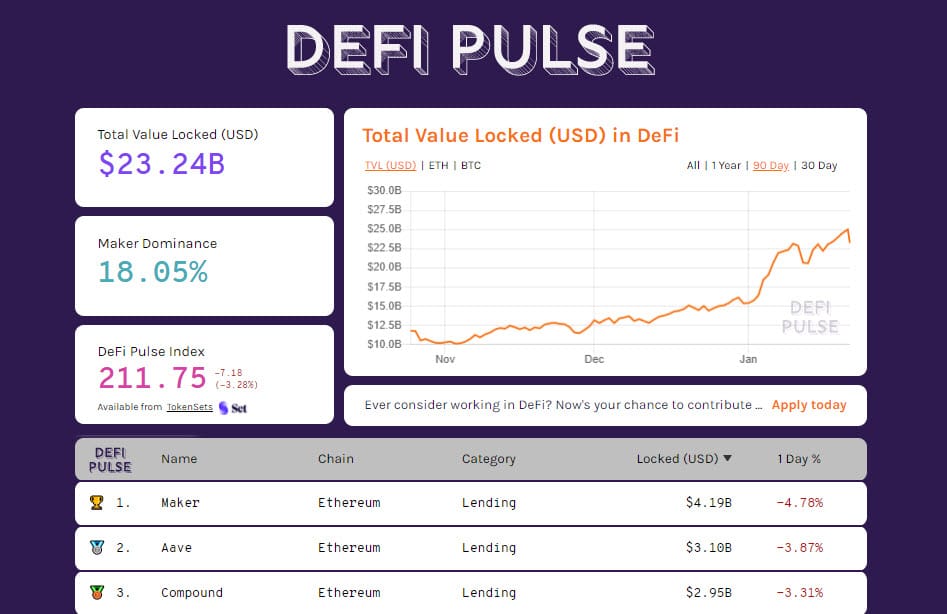

DeFi, after a strong upward movement in the total value locked, which in the last few hours has exceeded $25 billion probably due to major shifts within projects, in just a few hours lost over $1.5 billion returning to $23.2 billion. Maker maintains its lead with over $4.2 billion, followed by Aave and Compound. All three are lending projects.

Bitcoin (BTC): watch out for support holding

After exactly 10 days, Bitcoin prices are back to test the support of $32,000, which coincides with the 25% Fibonacci retracement that takes as reference the lows and highs of the last year. The movement also pushes the quotations under the bullish trendline that joined the rising lows since mid-December. This is the first sign of weakness for the price of Bitcoin.

In a context that has seen a weakening of the trendline for more than 10 days now, it is necessary to continue to follow the trend in the coming days, to understand where the price of Bitcoin will target the support from which to restart.

Attention must be paid to the holding of $32,000, or the next level is in the $29,000 area.

Ethereum (ETH)

Less than 48 hours after its all-time high, Ethereum is in line with the main trend, falling more than 9% since the opening of the day. After January 11th (-13% in 24 hours), today is the most negative day in the last 4 months.

It is a decline that unlike that of Bitcoin still does not jeopardize the uptrend even in the short term, confirming the goodness of the structure built over the past 10 months.

For Ethereum, a failure to confirm the holding of today’s lows in the $1,250 area opens up the possibility of stretching to revisit the $1,100 area, leaving ample room for manoeuvre for downward speculation.

The post Bitcoin tests the $32k support appeared first on The Cryptonomist.