ETH holdings of the 10 richest ETH addresses at a record level

2 min readNever before have the 10 largest ETH whales held as much ETH as they do today – this is shown by data from the crypto analysis company Santiment.

According Santiment The ten richest ETH addresses (excluding crypto exchanges) now hold over 21.3 million ethers. The value has reached a new high for the first time since 2016.

On the other hand, the top 10 exchange addresses hold just 4.66 million ethers. That is the lowest level since 2015, according to Santiment.

The top 10 ETH whales (excluding crypto exchanges) continue to increase their stocks: With 21.3 million ETH they reached a new 5-year high this week. Meanwhile, the holdings of the 10 largest crypto exchanges are at a low of 4.66 million ETH, the lowest level since ETH was launched in 2015.

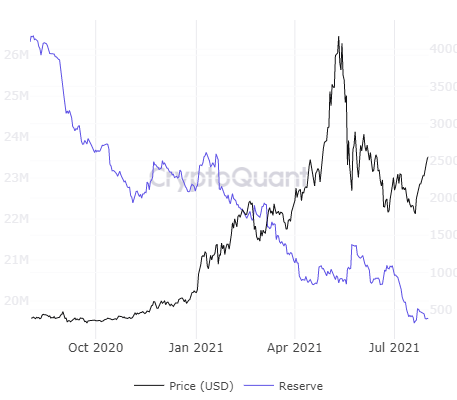

In addition, data from CryptoQuant show that this trend has been emerging for some time and that more and more investors are still withdrawing their ETH from crypto exchanges.

In the past week in particular, ETH whales have massively increased their ETH holdings and more than 1.65 million ethers bought.

ETH whales, which hold between 10,000 and 1,000,000 ETH in their respective wallets, now own a total of 60.52 million coins. This is the highest amount this category has held in 5 weeks and represents an accumulation of 1.65 million

In addition, the ETH 2.0 deposit contract also reached a new all-time high in the first week of July 2021. According to the data from Etherscan, there are now over 6.4 million ethers in the deposit contract. According to the current ETH rate, this corresponds to almost 15 billion US dollars and comprises around 5.4 percent of the total ether supply.

Is ETH currently more popular than BTC?

If you look at the fund flows of the European crypto asset manager Coinshares, it currently looks like ETH is more popular than BTC. A recently released report of the asset manager suggests that ETH investment products are currently more popular in Europe than BTC investment products. In the third week of July 2021 alone, investments totaling 11.7 million US dollars flowed into ETH. In comparison, over $ 10 million has flowed out of Coinshare’s BTC fund over the same period. At Goldman Sachs, too, analysts highlight the growing popularity of ETH and believe that ETH has the potential to overtake BTC in the future. Until then, however, it will be a long time. If you compare the market capitalizations of both cryptocurrencies, BTC is still worth almost three times as much as Ether. It is therefore unlikely that so-called flippening could occur in the near future.