Institutional demand for cryptocurrencies has revived! The money goes to BTC and altcoins

2 min read

CoinShares’ latest report, which publishes the results of the most-watched cryptocurrency funds at the beginning of the week, suggests that institutional demand for BTC-led cryptocurrencies has picked up significantly last week.

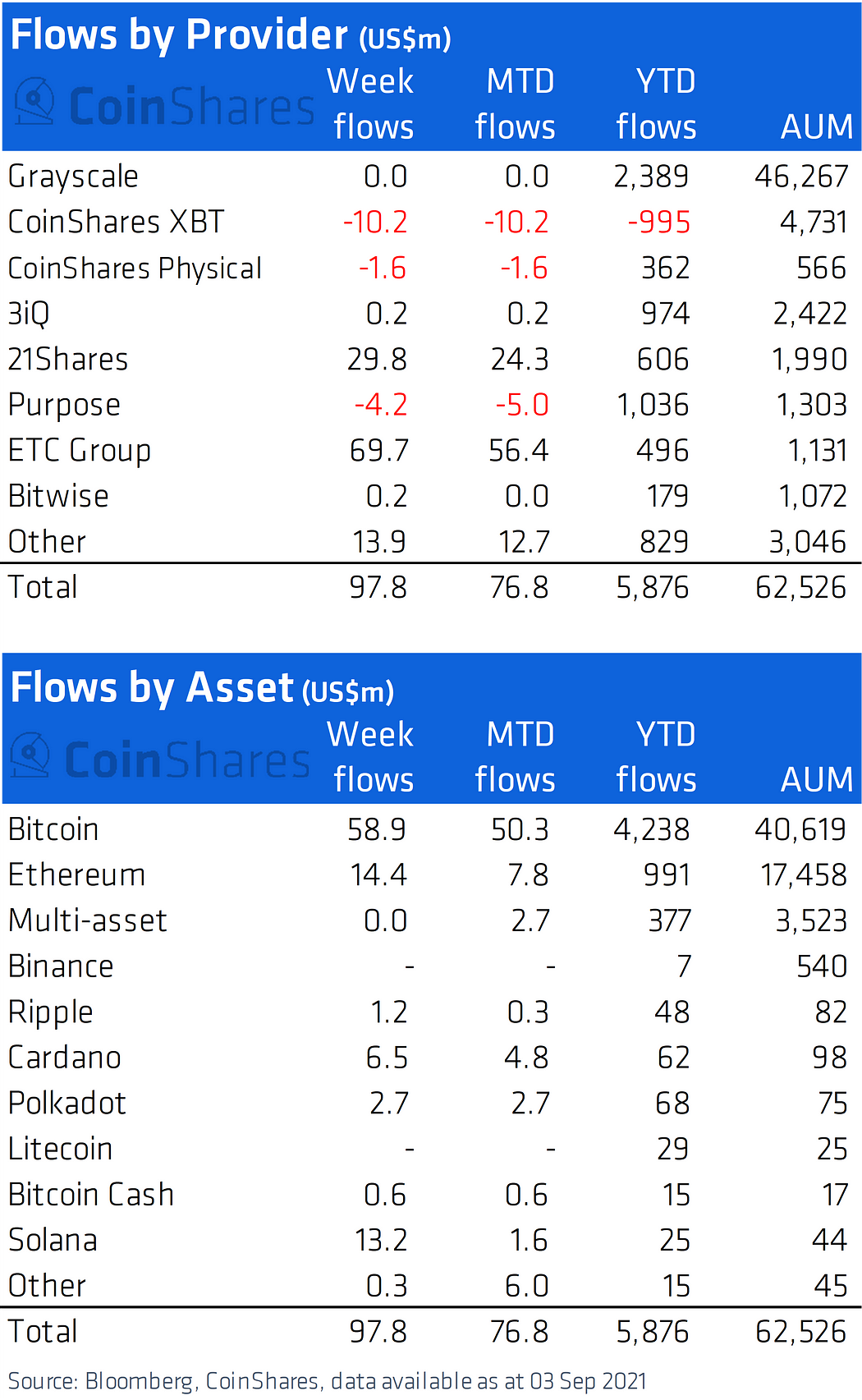

Coinshares traditionally publishes on Monday the results of the world’s most watched funds Grayscale, 3iQ, 21Shares, Purpose, ETC Group, Bitwise, as well as its two own funds CoinShares XBT and CoinShares Physical.

Especially at the beginning of 2021, hundreds of millions of dollars of capital was poured into these funds. However, the interest of institutions that make their exposures to cryptocurrencies through these funds weakened significantly during the summer, which was reflected in 11 weeks, during which the balance of these funds ended in the red (more capital decreased than was poured in that week) .

This negative trend did not reverse until the end of August, so the latest figures confirm the reversal of the trend in a positive direction. The previous week was both third in positive numbers, but also clearly the most successful. Institutions and other accredited investors have poured up to $ 97.8 million into crypto funds. After a long time, they reminded of the numbers that were common in the first months of this year.

Institutional demand, BTC was finally doing well

The recovery of investor sentiment among these funds in recent weeks was indicated mainly by the numbers of altcoins, whose balances gradually increased slightly. However, BTC still ended in the red, indicating that the institutions still have doubts about whether the bull market really continues. That changed last week, when up to $ 58.9 million was poured into BTC.

In addition to BTC, however, the altcoins also did well again. Another $ 14.4 million was poured into the second place in the ETH market. The cryptocurrency Solana (SOL) is also experiencing a big hype, setting its own record in the form of an influx of another $ 13.2 million. Well, the positive trend is further confirmed by Cardano (ADA), which added $ 6.5 million.

Conclusion

From these figures, especially in comparison with the data from previous weeks, it is clear that many institutions have become convinced that the cryptocurrency market is back on track. This is indicated in particular by the renewed focus on BTC, which sets the pace for the entire cryptocurrency market. If these numbers are confirmed in the following reports, it will be a very positive signal for the entire cryptocurrency market, indicating the positive sentiment of the big players.