The traditional Monday report CoinShares indicates the sentiment among institutional investors. It reports inflows and outflows of capital to the most famous cryptocurrency funds.

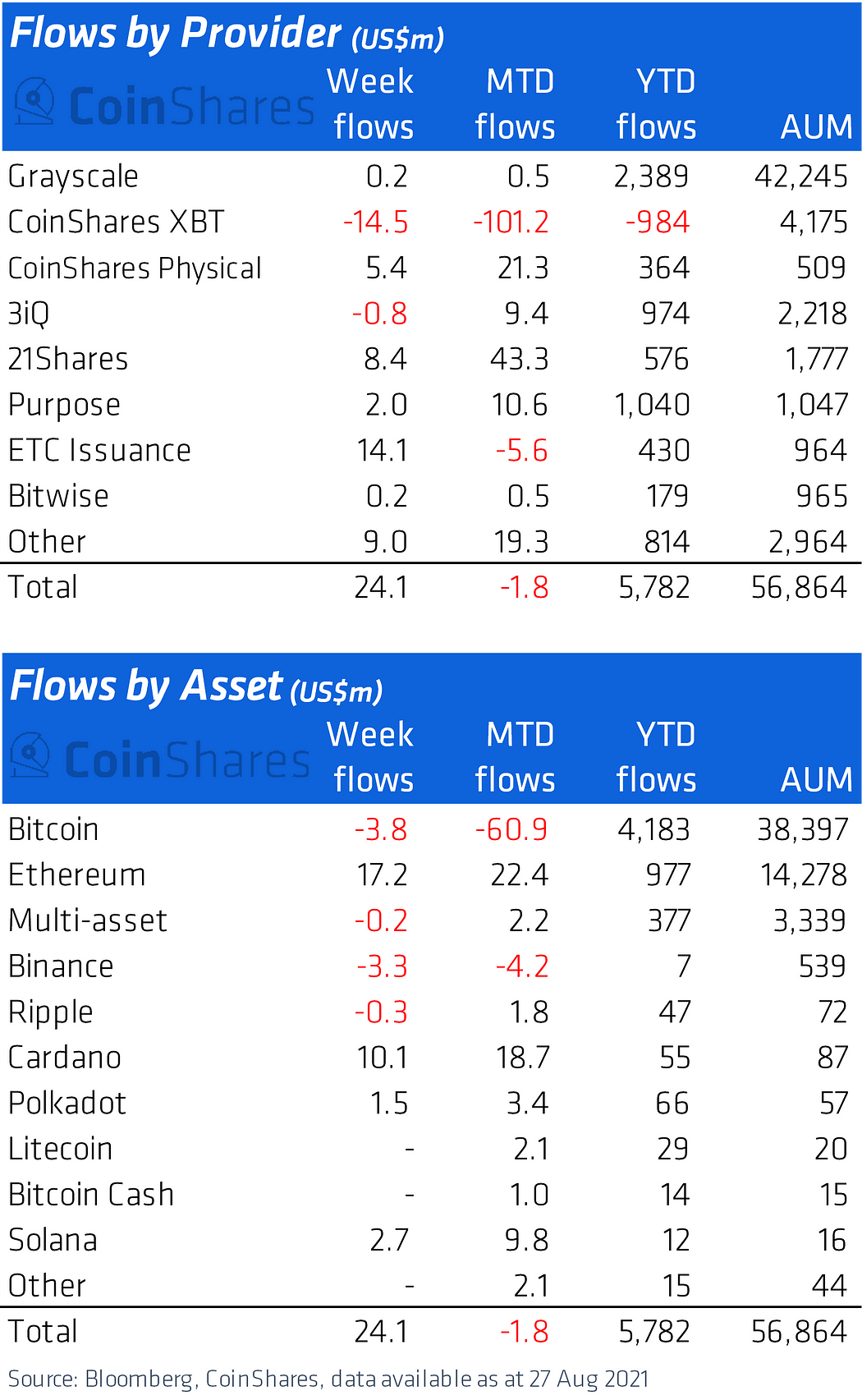

CoinShares regularly publishes current balances of unknown cryptocurrency funds from Grayscale, Coinshares, 3iQ, 21 Shares, Purpose, ETC Issuance a Bitwise.

From the latest one, it can be read that the total managed value of funds has increased over the past week by $ 24.1 million. It should be added that this is the second week in a row when these funds ended in the black. In the previous 6 weeks, more capital was lost from them than went to them.

A view of specific cryptocurrencies – BTC in red

Through the mentioned funds, it is possible to invest in BTC, ETH, Binance Coin, XRP, Cardano, Polkadot, Litecoin, Bitcoin Cash, Solana and also in a basket of several cryptocurrencies.

Over the past week, the greatest interest has been in investing in ETH (+ $ 17.2 million) and Cardano (+ $ 10.1 million). Solana (+ $ 2.7 million) and Polkadot (+ $ 1.5 million) also finished in the black. By contrast, BTC ended up in the red again, with investors withdrawing $ 3.8 million from funds tied to it. These numbers suggest that institutional accredited investors currently see more potential in altcoins than in BTC.

Of course, it should be noted that these funds are just one of several ways in which institutions can make exposure to cryptocurrencies, led by BTC. Other forms include direct purchase of BTC, investment in the Grayscale Bitcoin Trust (GBTC) or the Canadian BTC ETF. Some institutional investors even choose to invest in companies that have exposure to BTC – for example, Microstrategy, which owns over 108,000 BTC, or companies that mine BTC and are publicly traded on stock exchanges.

The waiting period continues

The cryptofunds currently manage more than $ 56.8 billion. Most of the capital flowed into them at the beginning of 2021, especially in January and February, when the current weeks were with inflows amounting to over $ 100-200 million. Figures from recent weeks, on the other hand, are significantly lower, regardless of whether they end up in black or red, suggesting that institutional investors are still waiting for a stronger signal to buy or sell their shares.

Top alternative exchanges for Binance without KYC verification