Quantitative easing – how does this central bank tool work?

6 min readTable of Contents

In today’s regular educational article, we will focus on quantitative easing, or abbreviated QE. In the United States, specifically the Fed, the instrument Large Scale Asset Purchases (LSAP). Both names mean the same thing. Let’s say brief first history tools, let’s describe his mechanism and we will show the resulting on the data consequences.

In my analyzes and streams, I talk about QE quite repeatedly, and I’ve explained a few times how it works. Therefore, I decided that it would not hurt to write a separate article on this topic. Unfortunately, this topic is very difficult and in many respects there is no complete agreement between economists, how to actually perceive quantitative easing.

Quantitative easing in Japan, USA and EU

Quantitative easing was first used in 2001 in Japan. Japan already had problems in the second half of the 1990s and burst dotcom bubble from the turn of the millennium, the last nail in the coffin was imaginary. The Bank of Japan (BoJ) has been stimulating the domestic economy for years by cutting interest rates.

Once there was nothing to reduce, it came up with QE. Japan suffered from deflation, so the goal was to kick the domestic economy. It was not until much later that it became clear that quantitative easing had saved Japan from economic collapse, but did not solve the problem. Risk deflation is still ubiquitous, GDP is stagnating, The Japanese banking system is considered one of the most risky.

The BoJ has been implementing this policy to date, respectively, with a tool used in waves, not continuously. It’s been a few years since they also buy stocks. This seems to be happening only in Japan – at least I don’t know that another central bank in a developed country would do anything similar.

In the United States and the EU, QE was joined only after the financial crisis of 2008. Over time, we can say that the instrument was specifically very effective in rescuing the stock market. In the United States, this stimulation was carried out in a total of four waves by the end of 2014. In March 2020, the LSAP program was renewed.

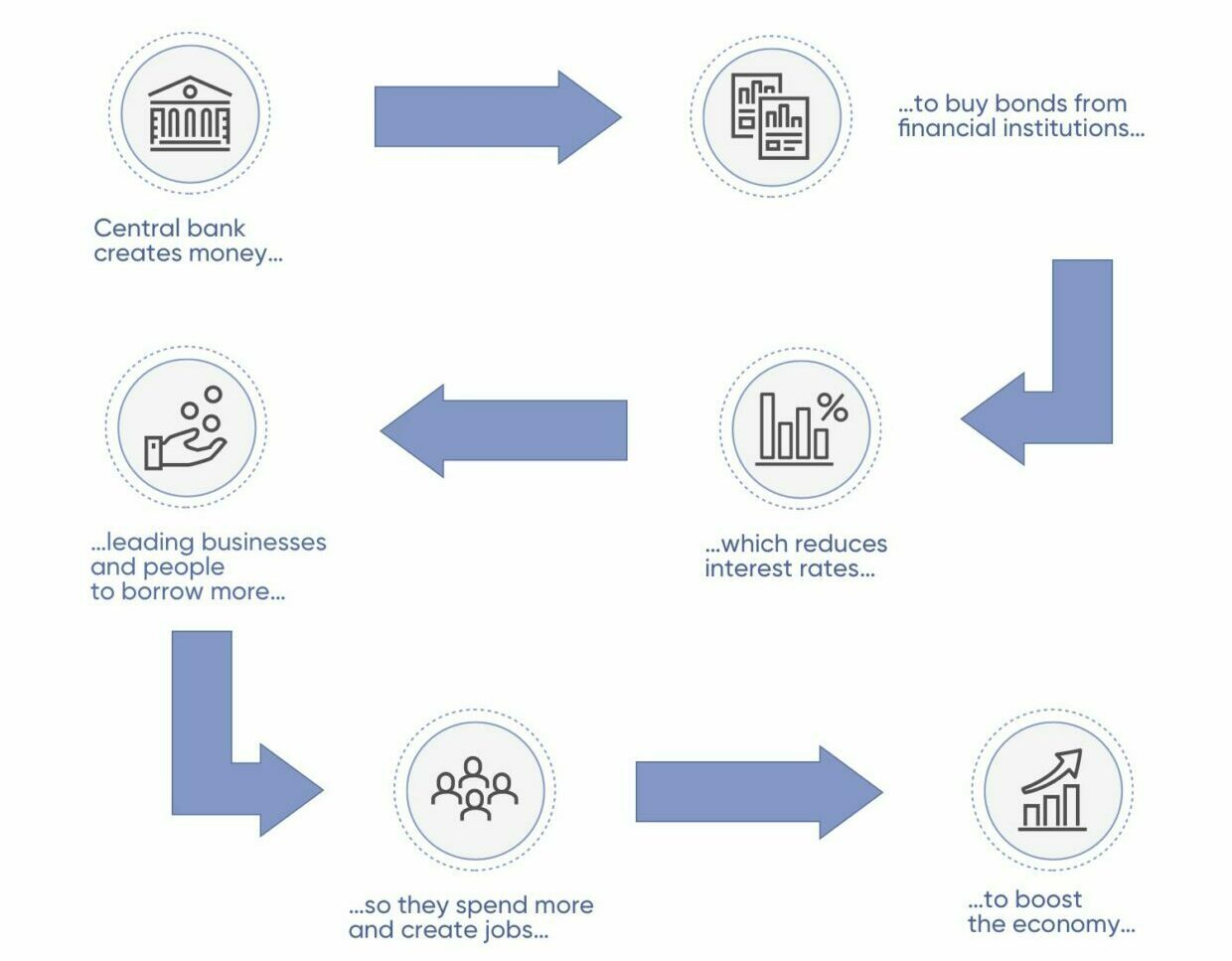

How does quantitative easing work?

Quantitative easing is generally considered to be an unconventional instrument of monetary policy. In short, it is not something that is used every day. The problem, however, is that although unconventional, central banks are increasingly resorting to it. In any case, what can we imagine under the term quantitative easing?

Again, in general terms, QE is calculating the purchase of government bonds, but we know from historical experience that this is not the end of the wall. As I said, the BoJ is even resorting to buying stocks, which I would dare call a tragedy. So there are purchases all domestic assets from commercial banks and non-banking units.

Specifically, the Fed buys not only federal bonds but also those corporate and the so-called Mortgage-Backed Securities, which can be translated as mortgage bonds. It is about huge sums of money, which will logically be reflected in the balance sheets of central banks. Over the last twelve years, central bank balance sheets have swelled immensely as they still hold most of their assets.

Which is wrong, because they should get rid of it after the program ends. Central banks therefore keep complete waste on their balance sheets, which has no value at all. The result is anyway increase liquidity in the reserve accounts of commercial banks with the central bank. Therefore, the money generated remains in the Fed.

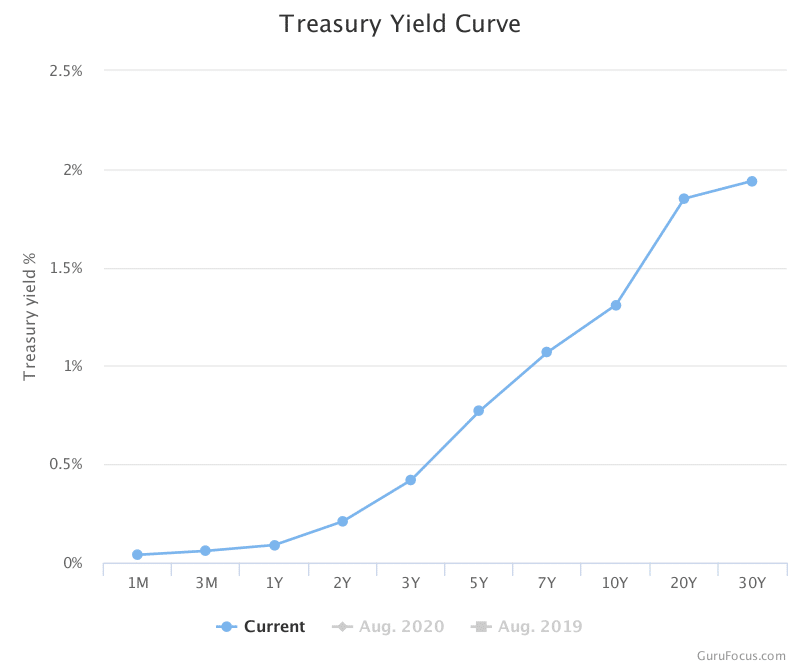

The goal of QE is to reduce the steepness of yield curves. Respectively, market interest rates will fall rapidly, making them much higher credit expansion (also due to higher reserves of commercial banks). Consumption, wages, investment and GDP are growing. The central government can also borrow more at low interest costs.

As can be seen from the attached graph, the interest at the short end of the yield curve (1M, 3M, 1Y,….) Is almost zero. The Fed mainly buys government bonds with short maturity and in such large volumes that their profitability is almost non-existent.

Consequences of quantitative easing

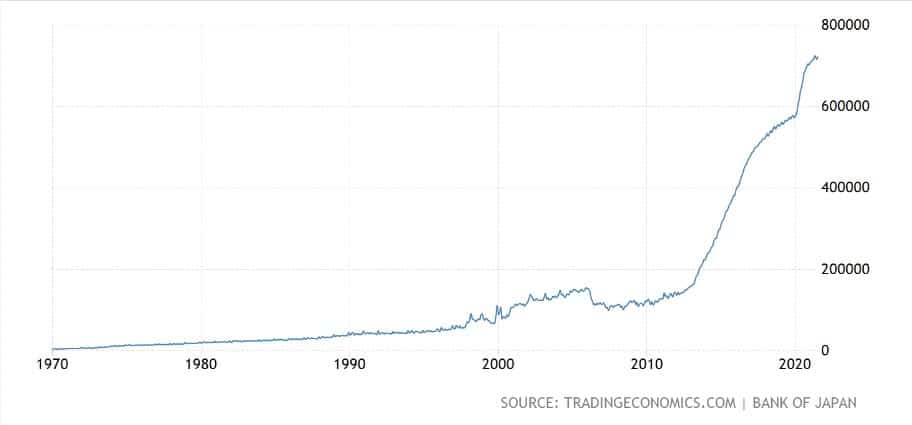

As we have already said, thanks to QE up bizarrely inflate balance sheets central banks. When we look at the Fed’s balance sheet, it is striking how their asset volumes grew in 2008 and 2020.

Basically, each wave of QE caused an increase in the volume of assets held, but these years are immediately visible. Then it is still possible to easily identify purchases from the period of the fourth wave of the QE program, which was operated between 2013-2014.

The balance sheet of the Bank of Japan is the worst. From the development of the assets that the BoJ holds, it almost looks like quantitative easing has been operating continuously for those twenty years. As I have already said, a substantial volume of these assets are shares of Japanese companies. Bank of Japan tak in fact, it owns a relatively large part of the private sector.

Another consequence is, of course, the extreme growth of monetary aggregates. It is from this that the presumption that quantitative easing is pure printing of money. Indeed, QE is sometimes referred to as such in the professional literature, but it is very pejorative a wrong. As we described in the text above, the money generated will not come from the Fed.

All indications are that this money will not be reflected in monetary aggregates in any way. The money supply is rising sharply, mainly due to credit expansion – this is how new money is created. And besides, as market interest rates are at historic lows, everyone sits on dollars like hens on eggs.

Respectively, the money accumulates in bank accounts Because in a period of zero rates, it makes no sense to invest with minimal interest. Only the stock market and BTC offer a good real return that will cover inflation several times over. That is why a substantial part of the funds goes here.

Why isn’t hyperinflation coming?

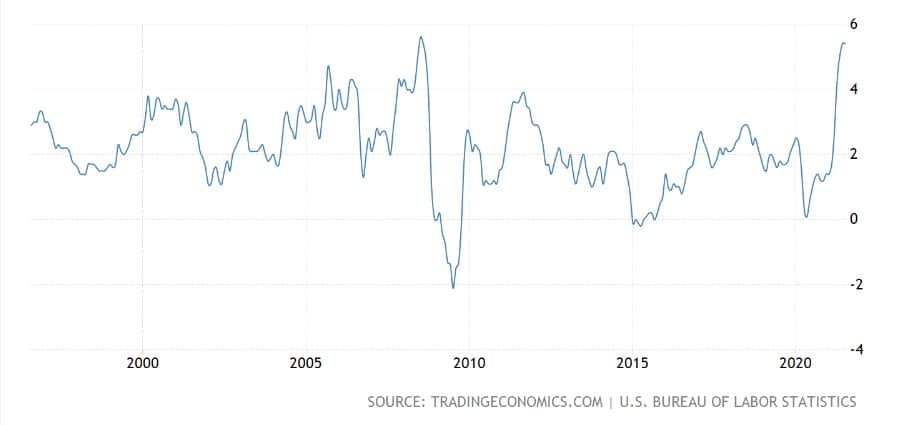

As we have said twice, the money created by the Fed remains with them. Therefore, they cannot have a direct effect on inflation. Indirectly, however, QE logically causes inflationary pressures, as the money supply grows enormously due to credit expansion. Nevertheless, since 2009 inflation has been hovering around 2% for most of the period.

Quantitative easing has been running since March 2020, and higher inflation did not come until April 2021. Inflation of around 5% is already high, but it is far from hyperinflation. How is this possible when the money supply has increased by about 175% in the previous 12 years?

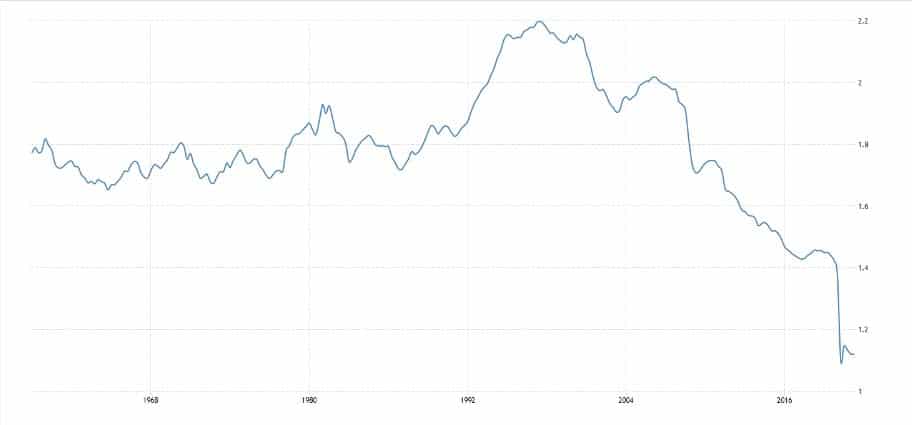

The answer can be found in the turnover of money, which is at historical lows. Dollars are not spun, so inflation is not possible. There are even opinions that attribute low inflation to QE. The answer is in the historically lowest interest rates, so there is no reason for so many transactions to take place.

The money therefore lies as deposits in current accounts. They are imprisoned with exaggeration and do not really get into the economy. Paradoxically, quantitative release causes low turnover. Low money turnover in turn results in deflation. On the one hand, QE has an inflationary effect (credit expansion) and on the other hand, it has a deflationary effect.

It depends on the willingness of economic entities to borrow. If credit expansion stagnates, QE can indeed do the exact opposite than most people would think – to act deflationary.

In conclusion

Quantitative release is not an easy-to-grasp tool and it is quite possible that over time we will find ourselves in a situation where this article will need revision. Over time, new facts may emerge that will change the view of the topic diametrically.

In principle, it is still possible to pejoratively refer to this tool as “printing money”, because it is actually created from practically nothing. But it is necessary to realize that a genuine printing of money in such volumes would immediately completely destroy the dollar. But the mechanism is much more sophisticated and probably causes the opposite.