Types of inflation – what are the differences between them?

4 min readTable of Contents

In the next educational article, we will address a topic that is quite related to the previous text on quantitative easing – inflation. High inflation is definitely a problem for the whole of 2021, and somehow there is a risk that we will continue to face it in the years to come.

The truth is that the last decade has been a period of historically very low inflation. There was therefore an exceptional situation which, however, would not last forever. The logical outcome is that it will either turn into deflation or high inflation will come who can be here with us for many years.

Try an earlier educational article on Quantitative easing – how does this central bank tool work?

Types of inflation

When inflation is said, most people imagine prices rising. Which is not a mistake, but in economics it can have several meanings. Economic concepts they are not exactly unambiguous and always understandable. This problem stems from the fact that economists seldom agree on anything. Therefore, every school of economics perceives certain concepts differently, and inflation is one of them.

It should come as no surprise that the Keynesians are thinking of rising consumer prices (consumer price inflation). Keynes in his work General theory of employment, interest and money explains that money supply growth alone does not automatically imply price growth. Respectively, when the money supply increases by one percent, it does not immediately mean that in the economy the prices of goods will rise by the same.

According to the Keynes doctrine, more or less all central banks operate in modern states. In addition, Keynes is a foundation taught in economics. Then there are the monetarists, who understand the term monetary inflation (monetary). Which also implies that they are watching the growing supply of money in a given economy.

Thus, monetarists are not interested in rising prices as such, but in the money supply that circulates in the economy. What do we actually perceive as money? Mostly by that is meant cash a deposits in current accounts, which contains the monetary aggregate M1.However, the aggregate is currently being monitored M2, which on the one hand includes M1 and a plus to that term deposits in commercial bank accounts and other deposits with banks.

It still exists inflation in asset prices such as stocks, bonds and real estate. Consumer goods inflation is easily perceptible because we buy food and services every day. Monetary inflation however, it is practically invisible. Asset price inflation there is something in between. It’s pretty easy to see how fast real estate and stock prices are rising, but most people don’t care much. An ordinary mortal will buy only a few properties in his lifetime, so he is only interested in the price at that moment.

So which inflation is the “real” one? The truth is monetary inflation is a starting point for the other two. It is quite logical that when the amount of money in the economy increases, it must be reflected in inflation in the prices of assets and consumer goods. However, there can also be a theoretical paradoxical situation called past liquidity. But we will not deal with that today.

Monetary inflation vs. consumer price inflation

Monetary inflation therefore has a major impact on rising commodity and asset prices in the economy. That is why it is very important to take it into account. Especially at a time when the money supply is expanding sharply. As I just explained in an article on quantitative release, it is consequence extremely low interest rates and massive credit expansion.

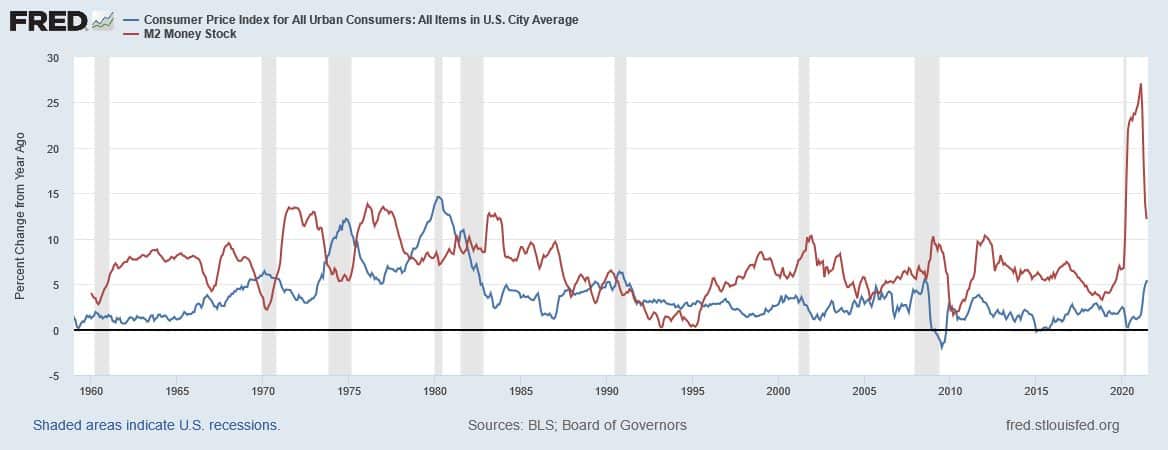

As can be seen from the attached chart, the annual change in monetary and consumer price inflation at a glance correlates. In fact, regression analyzes prove it. Thus, the data clearly show that monetary inflation is for us key. By that I mean that it is nonsense to rely only on officially measured inflation.

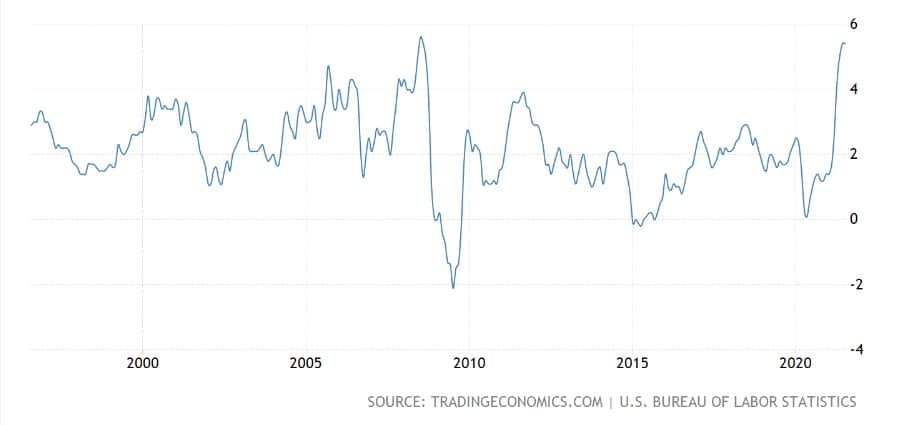

In addition, there are many different methodologies for measuring inflation through the consumer basket. Then the result is quite misleading, because not all goods in the selected basket prices rise at the same rate. Measured inflation may therefore be 5%, which is enough, but at first glance it may not seem like a tragedy.

But if the prices of basic foodstuffs in this basket have risen by as much as 20%, the overall measured value is misleading. Therefore, the real costs, for example for the poorest, are much greater than the 5%. Not to mention that some methodologies can measure headline inflation underestimate.

A brief current look

If we look at the first attached chart, we find that the money supply in 2010 blew madly. In January 2020, the M2 aggregate had more than $ 15 trillion, while at the end of the year over $ 19 trillion. Thus, the extreme growth of the money supply must logically have manifested itself primarily in asset prices. From this point of view alone, it is indisputable that there is a monstrous financial bubble in the stock market.

In conclusion

Today’s article aimed distinguish individual types of inflation, because it is popularly called a mess. For example, Wikipedia states that most economists define inflation as the rise in the price level of services and goods. This is not true at all, and if any economist does not take into account monetary and asset inflation, he cannot. It is necessary to understand that monetary inflation is always fundamental.