Quantitative tightening (QT) – how does the tool work?

4 min read

Quantitative tightening (quantitative tightening, QT) is another monetary policy instrument of central banks. As the name implies, this is counterpart to quantitative easing (QE). In other words, the instrument affects liquidity in the banking system through reserves and at the same time interest rates are affected almost along the entire length of the yield curve.

How does this tool work?

As already mentioned, quantitative tightening is the opposite of quantitative easing. The aim of quantitative easing is to get as much liquidity into the banking system as possible. This is achieved by buying assets on the bond market. These are usually government bonds and mortgage bonds. In addition, longer-term interest rates will be reduced, which is another incentive for investment.

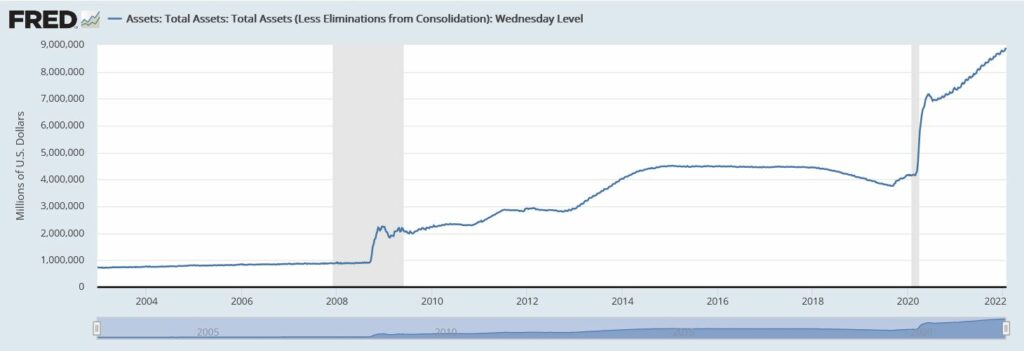

One clearly visible result is that the central banks then hold on to their balance sheets huge volumes of trillions of assets. A beautiful example is the balance sheet of the Federal Reserve Bank – currently it is almost $ 9 trillion. The first US central bank started in 2009. From some $ 900 billion in assets, it jumped to more than $ 2 trillion in a matter of months.

Subsequently, QE continued in many waves until 2015. It is in 2015 that you can see that the curve flattened, which lasted until 2017. That is, at that time the Fed no longer bought new assets, but at the same time maintained its current balance sheet at the same level.

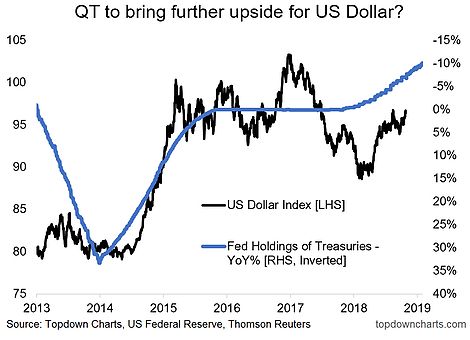

Which changed in 2017. You can see from the attached chart that the volumes of assets held in the balance sheet are slightly declining. As a result, the central bank began to reduce asset volumes at a certain pace. Generally speaking, this is the opposite of what is the case with QE. Quantitative tightening results in the withdrawal of liquidity from the banking system. Among other things, interest rates can be expected to rise. So it’s another way to get inflation under control.

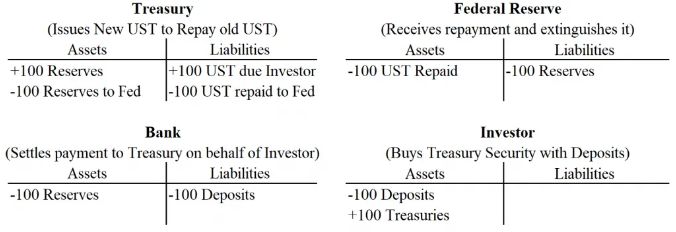

But how does it work mechanically? I came across a very big simplification that quantitative tightening actually means the sale of assets by the central bank. But it’s nonsense. However, the mechanism itself is much more complicated – for connoisseurs you have it in the attached picture and in the accounting. So let’s look at it step by step.

The Federal Reserve holds assets that have maturities. If fed wants to reduce its balance, will keep them to maturity (ie does not sell them). As soon as they receive the principal after maturity, they do not buy additional assets for them (newly issued government bonds). Then they clear the entire principal and yield by pressing the button.

Previously created reserves within QE simply disappear from the banking system with a few keystrokes. In any case, the federal government needs to take the money somewhere. They must therefore issue new government bonds. Therefore, their supply on the market will increase, which will cause interest rates to rise. Instead of the central bank, the buyers are now non-bank investors.

Quantitative tightening – consequences

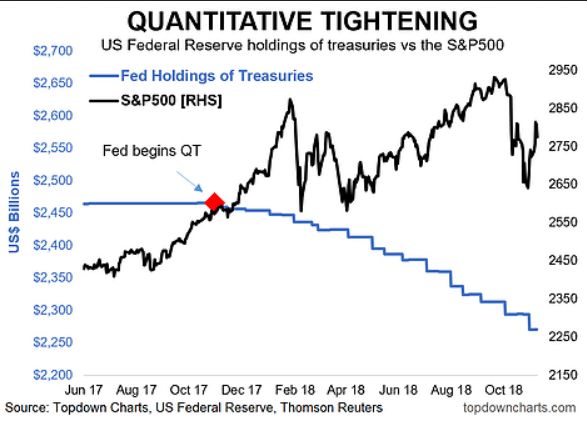

As can be seen from the previous text, quantitative tightening has previously been used. The Fed operated QT from 2017 to 2019. From less than $ 4.5 trillion, the central bank managed to reduce its balance sheet to less than $ 3.8 trillion. So the pace was not aggressive at all.

Although the Fed reduced its balance sheet quite modestly, the stock market reaction was indeed negative. This is a period when the S&P 500 stock index suffered a lot. It wasn’t a bear market, but it was a big problem to move technically anywhere.

And do you know what BTC was doing then? A few months after the start of QT BTC began its bear market, which lasted until the turn of 2018/2019. Which is the time when the Fed ended the reduction in asset volumes on its balance sheet. Financial markets simply do not like quantitative tightening, especially risky assets such as stocks and BTC.

This is, of course, due to the fact that the growth of interest rates will increase competition on the part of the bond market and partly about expectations. Investors are reluctant to see the Fed go de facto against the market. While QE increases risk appetite, QT does the exact opposite.

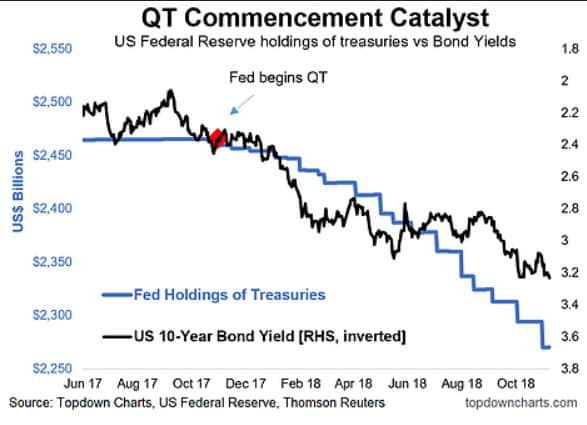

In the next chart, we observe how the decline in the balance correlates negatively with yields on 10-year federal bonds. As a result, yields on 10-year bonds are growing steadily.

The last graph tells us that the gradual dissolution of the balance sheet has a positive effect on the dollar index. So the value of the US dollar is rising.

In conclusion

Quantitative tightening has a major impact on financial markets. Therefore, it is good to understand this tool in principle. Then you can understand how it really affects the market. You just can’t work without it.