The Fed is dealing with stablecoins, what will this mean for the market?

3 min readTable of Contents

BTC is entering a new week with an average price and optimistic fundamentals. BTC is still at a support level of $ 30,000, but it doesn’t excite traders too much. As the recovery in mining continues, everyone is playing a “wait and see” game. What awaits us in the coming days?

The dollar strengthens as stocks calm the process

It’s a classic summer picture on the exchanges. This time of year is notorious for its lack of action, and even recent changes on a larger scale mean little.

The US dollar gained some strength due to a slight shock to the shares and the US dollar currency index (DXY) climbed to 93 points. The inverse correlation of DXY with BTC remains in the spotlight for some – the short-term peak of the index may correspond to the price pressure on BTC / USD.

Further attention will be focused on oil in connection with the reduction of tensions between OPEC + members and the new agreement to increase production. Although traditionally has less of an impact on BTC behavior, any unexpected volatility can provide fuel for the low-volume cryptocurrency market.

The US Fed may be more important this week. The Stablecoins Task Force will gain the attention of Finance Minister Janet Yellen when convened for “in-agency work.”

Risk of decline to $ 29,000

In spot markets, Monday began with hope for the future rather than confidence in current price events. Over the weekend, BTC / USD kept moving up and down, still unable to overcome resistance at $ 32,000 or higher, but also managed to avoid support tests at $ 31,000.

Talk about whether and when the BTC price could reach the bottom remains the main topic of discussion. The decline from the last historical maximum of USD 64,500 has been going on for three months, which is the second longest period in the bull cycle.

Given that public opinion expects it to fall below $ 30,000, Van de Poppe argued that the bottom may not be as dramatic as expected.

“The bottom usually doesn’t look great because most people expect further downward movements in the markets.”

– he told his followers on Twitter.

The difficulty exceeds expectations

Unlike the price, the foundations of the network continue to strengthen after the unprecedented events of May and June. The network hashing speed, which is still above the local minimum of 83 EH / s, did not experience any other significant complications as miners move from China. However, the real signs of progress are difficult.

With the automatic adjustment this weekend, the difficulty decreased by a slight 4.8% – a pleasant contrast to previous estimates. Two weeks earlier, the difficulty was expected to fall more than ever, by almost 29%, slowly improving over the two-week cycle.

BTC is now well on its way to the first positive readjust since before the May price crash.

Funding rates remain fine

The indicators on the chain are everything, but not bearish, but they are the lasting nuances that are on the radar this week. In particular, cross-stock financing rates have remained neutral or slightly negative throughout the recent price volatility, which is a promising insight into traders’ thinking.

Big whales seem to be alone in being able to sell at current levels, while other investor profiles are buying the offer.

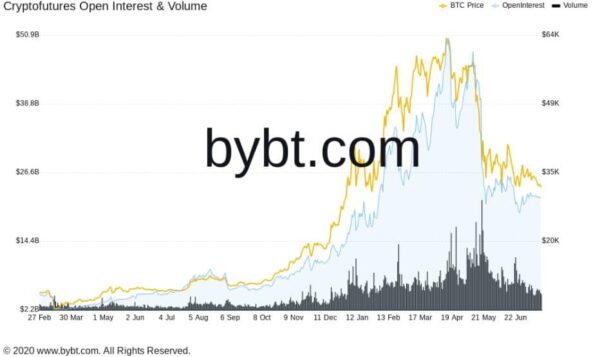

However, in terms of volume, BTC for $ 30,000 is predictably uninteresting. Both futures and PayPal volumes have fallen sharply, with the former returning to levels at the end of last year.

Bitfinex’s infamous shorts are “unfolding”

The weekend price action was accompanied by fluctuating bets among high-volume investors.

The short positions in Bitfinex, which are the driving force behind short-term volatility, as we have seen in recent weeks, have alternated.

What I’m watching:

Shorts unwinding since July 15th.

Probably nothing. 👀#BTC … Get some. pic.twitter.com/GLWVeoab6y

– Dr. Jeff Ross (@VailshireCap) July 18, 2021

The number of shorts continued to decline on Monday as the market waited for hints about the overall direction.

Conclusion

So these are things that are worth watching this week. Do you also have these events in your viewfinder?