The mood in the derivatives market is negative

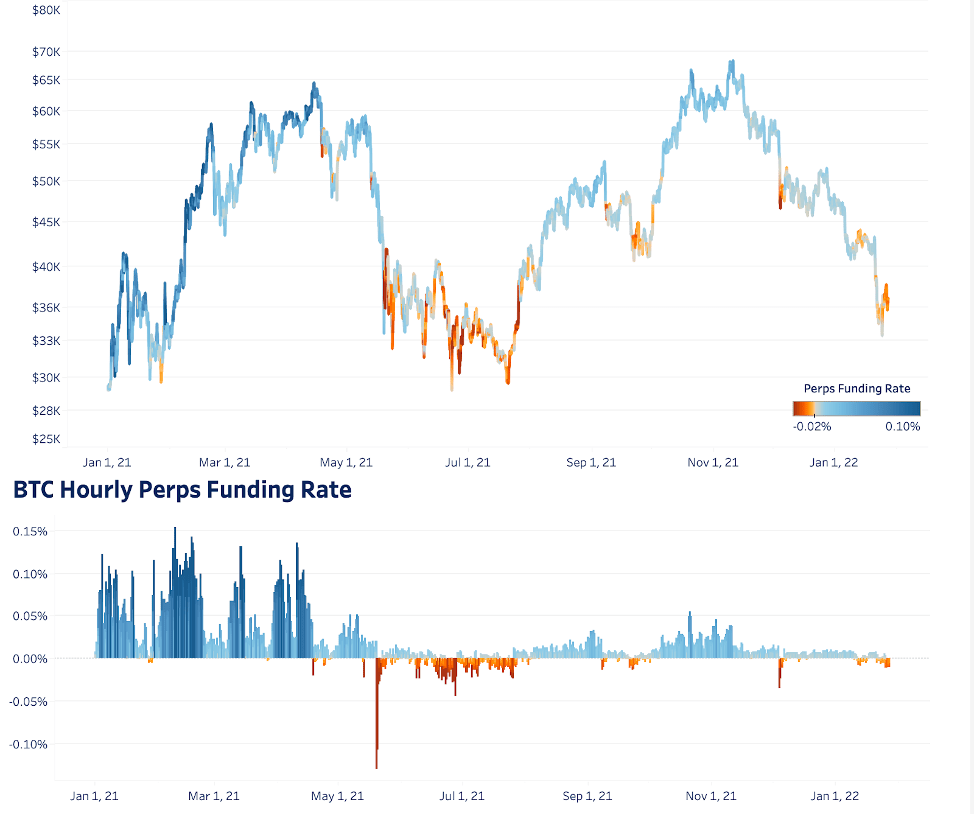

2 min readBTC Perpetual Swap, the most liquid and most tradable futures instrument, is a contract that allows traders to speculate on the price of BTC using leverage. The position of these contracts in relation to the spot price of BTC indicates either a bullish or bearish trend in the derivatives market.

When the contract price of a perpetual futures contract (open-ended futures contract) exceeds the price of BTC on the spot market, the funding rate will be positive, which means that long positions pay shorts a certain percentage of their position size. And vice versa.

The mood in the derivatives market

Funding has recently turned negative, suggesting that perpetual futures are trading below the spot value, not as a result of cascading liquidations, but rather a change in mood and expectations of market movements.

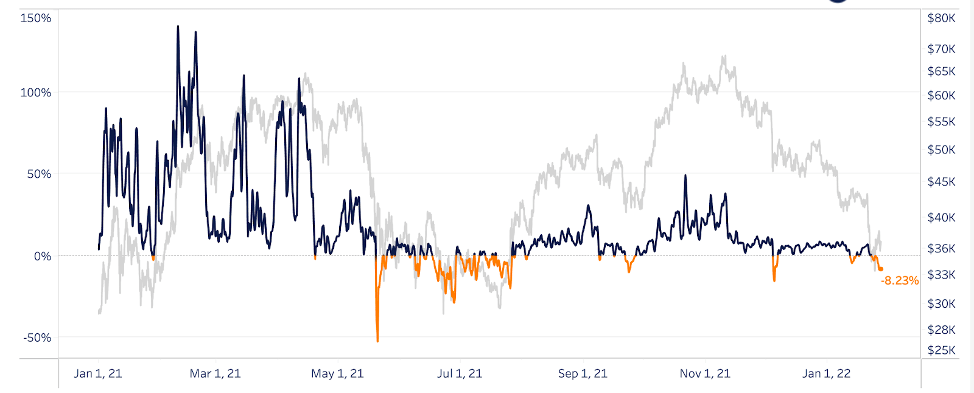

Over the last 24 hours, the rate of perpetual futures financing has been negative at -8.23% year-on-year, which means that shorts pay 8.23% per year for longs in the size of their position. While it is certainly possible that the recession will intensify due to the increasingly uncertain macro outlook and Fed policy, which is a good sign for BTC bulls as it helps maintain negative funding levels.

What to look out for in the coming weeks is the rise in negative funding rates associated with the rise in open futures positions, as seen in the summer of 2021.

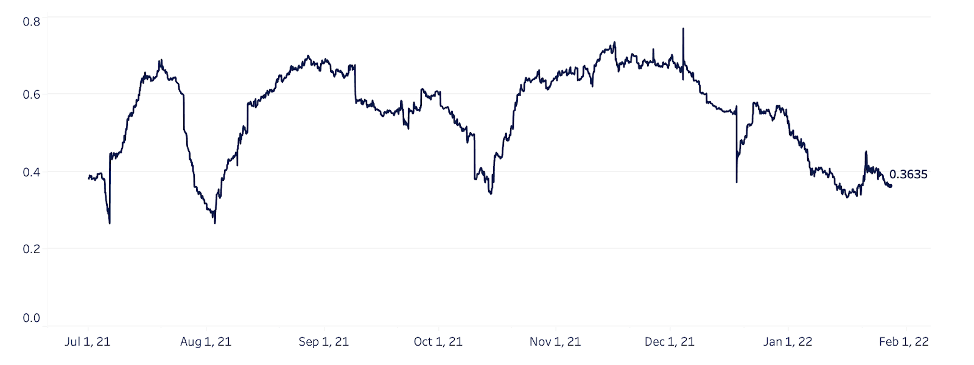

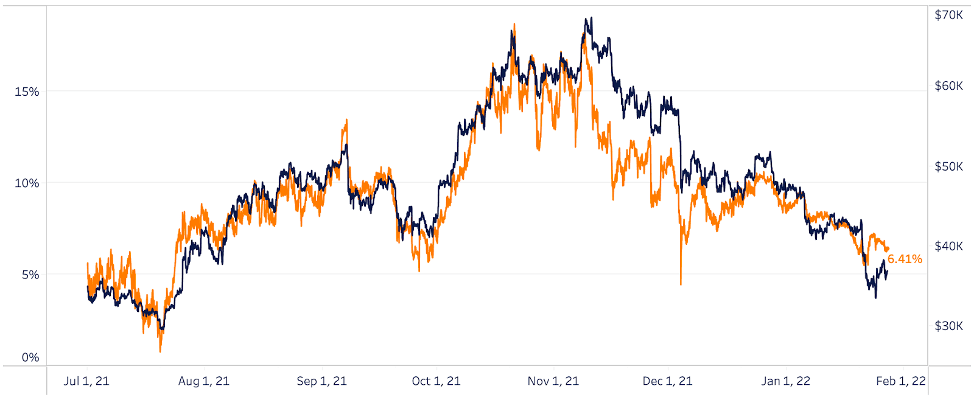

Similarly, the quarterly futures basis (It reflects the relationship between the cash price and the futures price – when trading futures, the term “cash” refers to the underlying product – basis is obtained by deducting the futures price from the cash price), which takes into account the annual spread between the spot market and the three-month price of BTC futures, has been highly correlated with the BTC market for some time. Despite the high correlation between BTC and stocks recently, futures have been very strongly correlated with price since the summer.

With a futures basis of 6.41%, speculation about the future price of BTC is approaching six-month lows, and given that the market remains weak, a 0% basis would signal a bull defeat and a total market reset.

When bull speculation completely disappeared from the market, historically it was an amazing time for capital allocation and we are practically at this point. Leaving aside price agnostics, BTC looks increasingly attractive in terms of the derivatives market.