Uniswap analysis: When is the price breakout coming?

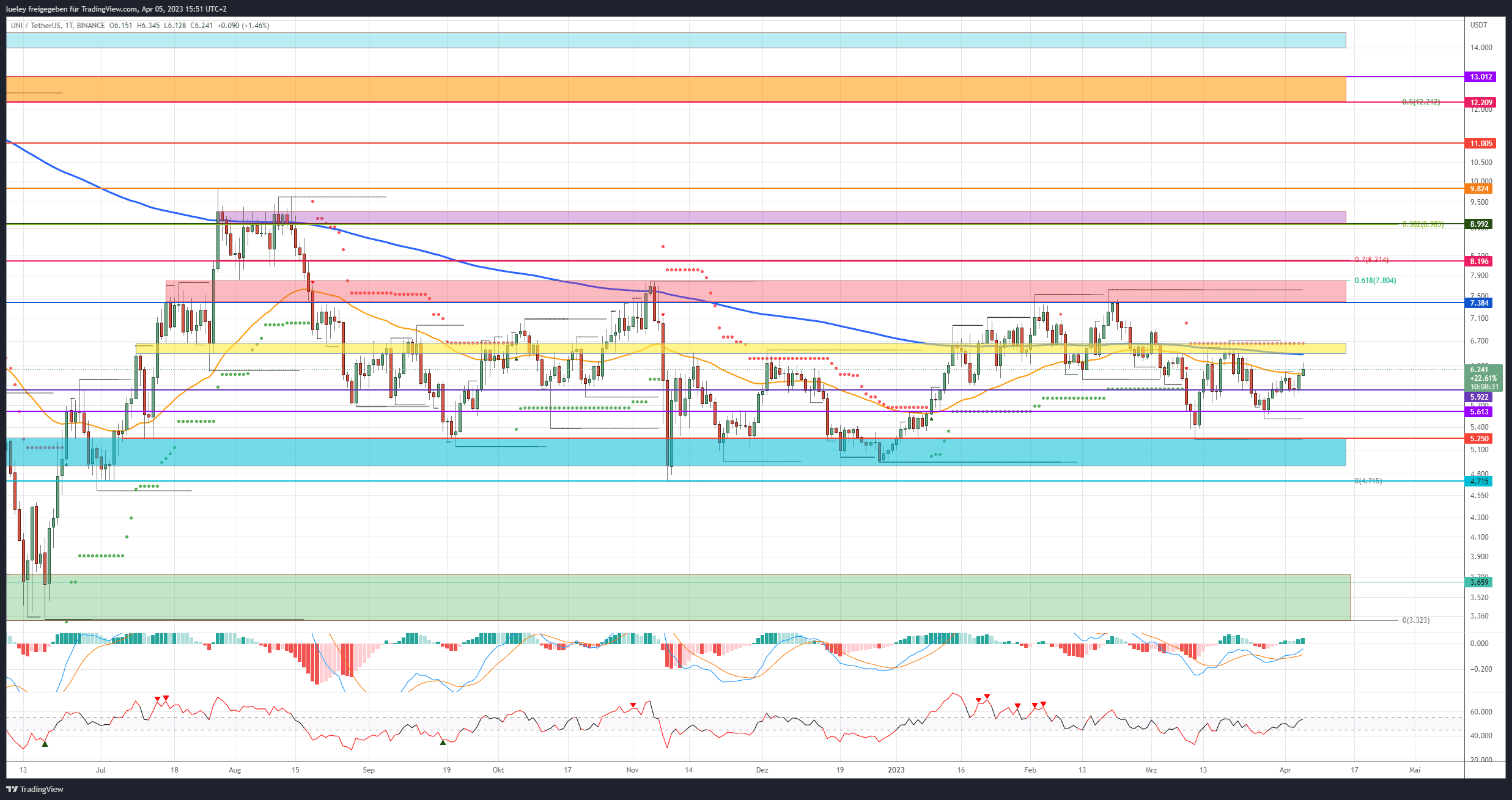

3 min readDespite a significant increase in trading volume, the price of the decentralized crypto exchange Uniswap (UNI) has so far not been able to match its price strength from the past. However, given ongoing regulatory issues and the CFTC lawsuit against leading centralized crypto exchange Binance, the trend of a shift from centralized trading venues towards more decentralized ones is likely to continue. A positive development for Uniswap in perspective. In the last few trading days, the UNI price moved towards its previous month high of 6.70 US dollars. If a reconquest is successful, the high for the year would come back into the eyes of investors and the chart picture would brighten further.

Uniswap: Bullish price targets

Bullish price targets: 6.48/6.66 USD, 7.38/7.80 USD, 8.20 USD, 8.99/9.28 USD, 9.82 USD, 11.00 USD, 12.20/13.00 13.97/14.54 USD.

In the last 24 hours of trading, the UNI course was able to recapture the EMA50 (orange) – a first bullish indication. To confirm an attempt to rise, Uniswap must first clear the yellow resistance area. In the zone between US$ 6.48 and US$ 6.66 there are two strong resistances with the moving average line of the last 200 trading days (EMA200) (blue) and the supertrend. A daily close breakout will activate the next target area between $7.38 and $7.80. The UNI course failed here in November 2022 and in February of this year. In addition, the golden pocket of the current price movement also runs here.

Only when Uniswap stabilizes above this mark and can free itself via the intermediate station at 8.20 US dollars can a price surge in the direction of the summer highs from the previous year between 8.99 US dollars and 9.28 US dollars be expected. This is also where the overarching 38 Fibonacci retracement of the downward movement from the all-time high runs. The recapture of the historical high at 9.82 US dollars would be seen as a liberation.

The UNI course should then quickly march through to 11.00 US dollars. Perspectively, the orange resistance area would then come into focus again. In addition to the overarching 50 Fibonacci retracement, there are several highs from the first trading quarter of the previous year between USD 12.20 and USD 13.01. This area acts as the maximum derivable target area.

Bearish price targets for the coming trading weeks

Bearish price targets: 5.92 USD, 5.61 USD, 5.25 USD, 4.89 USD, 4.71 USD

The bear camp also failed to push the UNI price back towards the low for the year. However, as long as Uniswap remains capped below the yellow resist zone, a new setback can be expected at any time. If the support at $5.92 is dynamically abandoned again, a drop back to the horizontal support line at $5.61 should be planned. An abandonment of this price level would once again focus on the low for the year at 5.25 US dollars.

The turquoise zone has represented a solid area of support for the past seven months of trading. The buy side is likely to want to take over again here. Only if Uniswap were to break below USD 4.89 at the daily closing price would the low following the FTX bankruptcy in November 2022 come into focus as a target. For the time being, this course level is to be regarded as the maximum, bearish price target.

Looking at the indicators

The RSI as well as the MACD indicator are currently trending north again. This positive development supports the bullish outlook. However, only when the MACD indicator regains its 0-line and the RSI breaks through the upper edge of the neutral zone at 55 will Uniswap receive stable buy signals.

A similar scenario can be seen in the weekly chart. Here, too, both indicators are trending upwards, but so far have not shown any long signals.