In early May, the Terra, LUNA and UST ecosystem collapsed. The project’s demise – which had to be restarted – coincided with a significant drop in the crypto market as a whole, especially BTC.

However, contrary to what many thought, the fall of BTC does not result only from the collapse of Terra (LUNA). Instead, BTC’s decline had other, more important reasons.

According to a recent report by Chainalysis, “the collapse of UST and LUNA did not happen in a vacuum.” After all, a number of other crypto assets, including BTC, have also fallen into what some have said could be the start of a third “crypto winter.”

But the UST collapse was not solely to blame for this decline, according to Chainalysis. The analytics firm attributes BTC’s drop to general disinterest in technology-related investments:

“While it was definitely a factor, we found that because BTC’s decline was so aligned with the downturn in non-crypto assets – especially tech stocks – its price action may have been more connected to the tech dip than the UST dip. ,” the company said.

Correlation with technology stocks

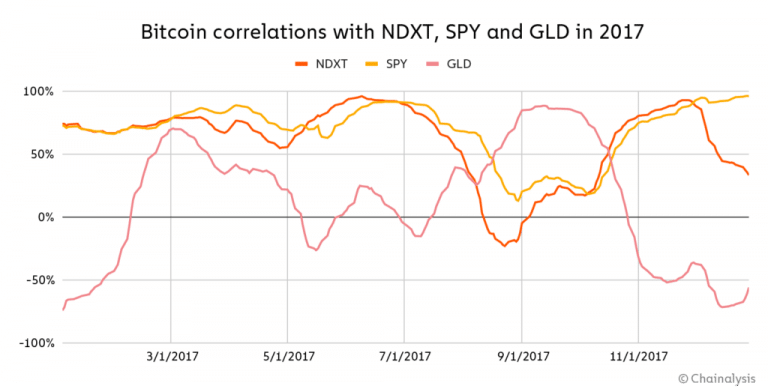

As the report highlights, correlation is a relatively new development. The chart below shows the correlation between the price of BTC and that of several other asset classes in 2017.

BTC Correlations with NDXT, SPY and GLD in 2017

According to the analysis, while there were “waves” of correlation between BTC and tech stocks, this is typical of assets with no significant relationship.

This pattern reinforced the narrative that BTC was uncorrelated. Therefore, BTC was seen as a “safe haven” during market downturns.

However, that changed in 2022. After all, today BTC seems to move in tandem with these assets.

“BTC has maintained significant price correlations with NDXT and SPY this year while remaining uncorrelated with GLD. So when NDXT and SPY started to fall, BTC followed suit,” Chainalysis said.

Short impact on BTC price

Anyway, for a few days, the UST collapse may have accelerated BTC’s decline.

And that was no surprise. That’s because the Luna Foundation sold billions in BTC to try to recover the stablecoin UST. However, Chainalysis says this was short-lived.

“The accelerated decline ended around May 13, approximately towards the end of the UST collapse, when BTC price action returned to align with non-crypto tech assets.”

Netflix launches NFTs game from the series Stranger Things, but users complain: “fraud”