Why Ethereum Is So Undervalued Compared to Bitcoin In 2020

2 min readEthereum is currently undervalued and is poised to increase in the long-term, potentially reaching market cap parity with Bitcoin, some analysts claim.

Ethereum Might Be Bullish In the Long-Term

As Ethereum is getting closer to its 5th anniversary, some market onlookers are waiting for its revival, especially amid the context of the awakening altcoin season.

On Monday, John Lilic, who works for blockchain firm ConsenSys, reminded the crypto community that ETH is slowly but steadily moving towards market cap parity with Bitcoin, citing an older tweet that he made on January 5.

As of today, Bitcoin’s market cap figure exceeds $170 billion. Ethereum is in second position with less than $27 billion. However, at the beginning of the year, the discrepancy was even wider in favor of Bitcoin, so it seems that the oldest cryptocurrency is losing ground indeed.

“ETH is undervalued and we are headed towards market cap parity,” he concluded.

Other Metrics Also Point to Undervalued ETH

Before Bitcoin supporters start laughing, they should look into other metrics that suggest ETH might be undervalued. One of the key indicators that the Ethereum network is being currently used more than ever is Gas usage.

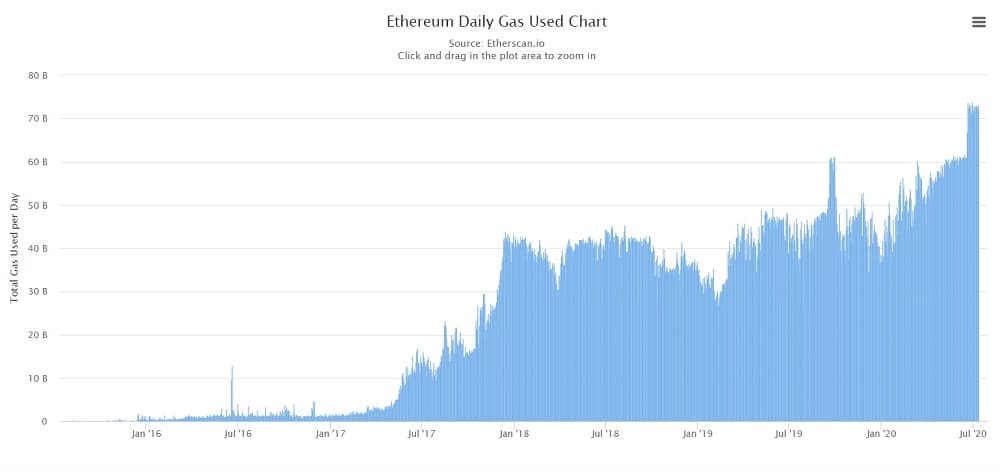

On Ethereum, gas is burned for every transaction made on the network’s decentralized applications (dApps) – for instance, when trading on decentralized exchanges or playing NFT games. The point is that the higher the gas usage is, the more demand for Ethereum dApps, which is a positive sign for the long-term price of ETH.

The amount of gas used on Ethereum hit an all-time high at the beginning of July and is now fluctuating around that peak.

At the end of May, German crypto research firm Blockfyre mentioned gas usage along with three other metrics as clear signs that ETH was undervalued.

On top of that, Bitcoin has got all the attention due to the halving and its safe-haven status, which might have caused some overvaluation, even below $10,000. Investors should probably also pay attention to the ETH 2.0, the upgrade that may change the network forever.

However, the chances are that Ethereum might never reach market cap parity with Bitcoin, as it is threatened to be collectively overtaken by other tokens, including ERC20 ones, such as LINK and VeChain.

You might also like: What Is Yield Farming? The Rocket Fuel of DeFi, Explained