Will State Mining Propel Bitcoin to $100,000?

5 min readState mining is here. Generally indirectly and at arms length, but at least three countries most likely have what we’ll call a bitcoin strategy.

Venezuela, North Korea, and Iran are probably at the early stages of what in years to come might turn out to be the dawn of bitcoin based international trade.

All three countries are under sanctions, with little known about North Korea’s bitcoin strategy except bitcoin has been mined there since 2018.

For Venezuela there are reports the army or police seizes asic miners and then mines itself with this being a very failed state. So less a strategy, here it’s probably more basic revenue for food.

Iran however is a different league. It has a functioning state, a generally educated population, and a GDP of some half a trillion, more than Belgium and many other countries.

As such, politics aside, its strategic embrace of bitcoin can influence the price in predominantly two somewhat interrelated ways.

Currently bitcoin miners earn about $12 million a day, halved from $20 million a day just prior to the bitcoin halvening.

Much of this $12 million a day goes to pay for expenses like electricity, and therefore is generally sold on the market for fiat, so putting price pressure.

If however one is running a country and wants to have a bitcoin strategy to move it to commerce, the electricity would be somewhat free in that you produce it yourself, and your initial investment basically amounts to buying bitcoin because you’re spending fiat on all these necessary things in order to get bitcoins.

You could then turn that bitcoin into fiat, but you have fiat already and since you have a central bank you can print it at zero cost, so why would you do that?

Now obviously it isn’t the state itself doing all this as you instead provide the plans, the guidance, the blueprints, and the orders through policy or even investment or subsidy and then ‘guide’ the market.

Still however looked holistically and at the macro level, it amounts to the same thing. The entrepreneur or the businessman who initially mined bitcoin may well still sell it like an ordinary miner, but he’d be selling it to someone who needs it not for speculation, but to perform a function.

There are laws against trading with Iran at least where America is concerned and those laws don’t care if you are using bitcoin or fiat, but there are plenty of countries who don’t care about American laws, like Russia and if Germany wanted, also Germany with the latter still part of that deal of moving towards normalization.

Yet, if Iran wanted to buy Siberian timber from Russia, they still may have to go through American correspondent banks in a hub and spoke system where the Iranian bank to finalize the transaction has to go through the bigger usually American bank that then connects with the Russian one.

Obviously the American bank is not going to finalize the transaction, which means America also doesn’t care whether Russia cares about their laws because Russia doesn’t have much choice at least in this example.

Until bitcoin. Now the Iranian table maker can buy bitcoin from the Iranian miner or the market potentially even in cash, and send that to the Siberian timber manufacturer, who either converts it back into cash or keeps it because the timber maker presumably needs to buy tools, maybe from outside the country.

So we have a lot of conversion here in and out of fiat, but realistically regardless of this conversion these bitcoins are taken out of circulation as far as price is concerned.

Let us suppose, and this is a completely made up number, one million coins are used for commerce on a regular basis.

These coins are not available to you to hodl because they need them and they don’t care what the price is as they’re moving in and out of fiat.

This fiat movement then suggests a better example is let us suppose $10 billion worth of bitcoin is regularly used for trade. Price goes down, they buy more bitcoin while spending the same amount of fiat, price goes up, they buy less bitcoin, but that $10 billion worth of coins is not available to you, it’s instead a constant exchange of hands which at a macro level where price is concerned amounts to infinite holding – at least for as long as they want to spend this $10 billion.

That’s how usage or demand affects price and therefore how this $10 billion changes is hugely relevant for a trader or long term holder.

If this $10 billion is trending up, then price might fluctuate in the short or medium term because of this in and out of fiat, but it will head up.

Likewise if a serious trend develops where this number is going down, either because this specific market function has reached maximum potential or because for some significant reason the market is using something else or just doesn’t want to use bitcoin anymore, then price will follow that trend unless there’s some other market function that counters it.

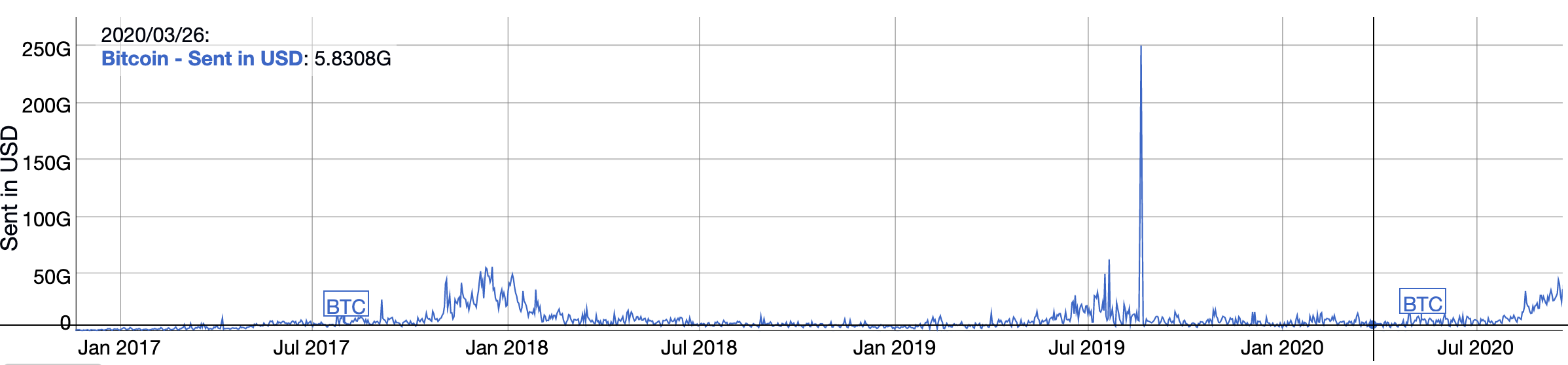

That trend is currently up and is set to increase with some $35 billion worth of bitcoin moving in the past 24 hours.

If we had some sophisticated tools we probably could reach a fairly precise estimate of how much of that is likely to be trade, rather than trading, and thus how much of it is ‘pure’ demand.

You do that by subtracting exchange and OTC movements, but while accounting for the fact that moving in and out of exchanges is part of how you trade with bitcoin.

So the most succinct way of putting it is that you’d check what activity appears to be stable and what activity is volatile, with the former meaning it’s people that don’t care about price, while the latter are speculating on how the activity of these ‘don’t care people’ is likely to change.

This is how much has been moving daily with this number having some qualifiers due to the technical nature of bitcoin.

So although $5 billion a day seems to be the stable base since July 2017, it’s probably more about $1 billion, or 100,000 bitcoins.

That’s a lot in some ways and it’s pretty much nothing in some ways but if we were to do a traditional valuation, then bitcoin is processing some $365 billion a year, times it by 10, gives it a market cap of $3.6 trillion.

That’s not revenue, but if bitcoin trade rises, then the price should rise too and since Iran is moving to facilitate a bigger bitcoin mining scene, then you’d think such trade will rise.