Best DeFi Coins to Invest in

10 min readTable of Contents

Decentralized finance, also known as DeFi , is a large sector within cryptocurrencies that aims to give users power over their own finances by not using third parties. But what are the best DeFi coins for you to buy and add to your crypto portfolio?

- DAI: Decentralized stablecoin pegged to the US dollar

- Wrapped Bitcoin: Bitcoin tokenized into ERC-20 format

- Avalanche: Multichain system ensuring scalability, interoperability and low fees

- Chainlink: Platform injecting off-chain data for implementation of smart contracts

- Internet Computer: A platform that wants to connect billions of people with innovative blockchain applications and tools

- Maker: Token management in MakerDAO and the Maker protocol that allows users to issue and manage DAI stablecoins

- Stacks: Bitcoin’s layer 2 blockchain protocol that improves Bitcoin’s functionality through self-service smart contracts

Best DeFi Coins to Invest in

Now that we’ve had a brief look at the best DeFi coins, we’ll discuss each project in more detail so you can get a better awareness.

1. DAI: Decentralized stablecoin pegged to the US dollar

Dai is the first decentralized, collateral-backed stablecoin. DAI is an ERC-20 token that attempts to maintain a stable 1:1 value with the US dollar by tying other cryptoassets into smart contracts. Unlike other stablecoins that are issued and controlled by a central authority, DAI is a native token of the Maker Protocol – a decentralized, autonomous ecosystem of smart contracts running on the Ethereum blockchain.

Secured loans provide the lender with the opportunity to obtain a loan by locking in the assets it owns. These loans traditionally have lower interest rates than unsecured loans because the locked-in assets can be liquidated to satisfy a portion of the loan.

DAI is a key part of the Collateralized Debt Position (CDP) concept. CDPs are Maker Protocol smart contracts in which users can lock their assets (ETH, BAT, etc.) and generate DAI. It is possible to think of CDPs as safe vaults where you can deposit collateral while receiving liquid, stable cryptocurrency.

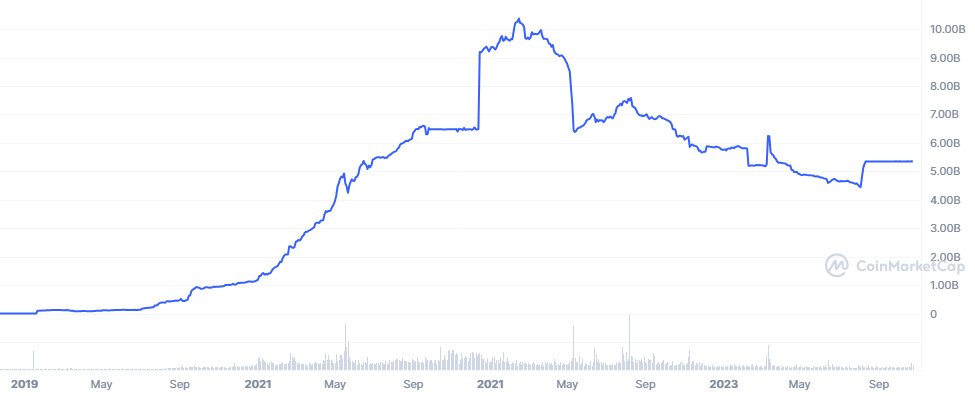

Due to the volatility of collateralized assets, DAIs are often overcollateralized to prevent liquidation. For example, users need to deposit $200 worth of ETH to unlock $100 in DAI. If the price of ETH drops by 25%, 100 USD of DAI is still safely covered by 150 USD of ETH. To get back their secured assets, users must return the borrowed DAI along with an additional fee. DAI is currently the 3rd largest stablecoin with a market cap of 5.345 billion USD.

2. Wrapped Bitcoin: Bitcoin tokenized into ERC-20 format

Other Defi coins worth mentioning include WBTC. With Wrapped Bitcoin (WBTC), a new project was launched on the Ethereum network in January 2019. Behind this ERC20 token is the joint development of Bitgo, Kyber Network and Ren, who wanted to create an interface between Ethereum and Bitcoin network. To this end, WBTC is the first cryptocurrency that is fully backed by reserves in the form of Bitcoin (BTC).

With this project, the organization behind Wrapped Bitcoin wants to create a system that will bring more liquidity to the shared ecosystem. The goal of this development is to use Bitcoin for typical Ethereum services such as dApps or smart contracts. This was not possible until now, and the two networks operated independently of each other. The incompatibility between Ethereum and Bitcoin leads to complex exchange procedures, which in turn are associated with transaction costs.

WBTC can be used directly in DApps such as Compound, Dharma or Gnosis by standardizing to the ERC20 format. The developers thus combine the advantages of both worlds: the liquidity and acceptance of Bitcoin with the decentralized and proven Ethereum ecosystem. In the long term, the developers also plan to create additional use cases that will be implemented on an ongoing basis as the ecosystem continues to grow. In the future, WBTC should also be able to be used for decentralized and derivatives markets.

Basically, WBTC works like a classic stablecoin – only without the stability of value. Stablecoin is backed by stable, regulated fiat currency reserves. Wrapped Bitcoin, on the other hand, is backed by actual BTC reserves owned by BitGo. Because WBTC exactly copies the cryptocurrencies developed by Satoshi Nakamoto, the price of one WBTC always corresponds to exactly one BTC. There are currently 163,954 WBTC in circulation, giving it a market cap of nearly 5.6 billion USD and the 14th spot on the CMC rankings.

3. Avalanche: Multichain system ensuring scalability, interoperability and low fees

Avalanche (AVAX) is a blockchain project dedicated to Web3 and dApps solutions. It relies on the high speed of transaction processing and tries to enable connection to other blockchains (interoperability). Avalanche consists of three blockchains that are interconnected. This is a so-called multichain network.

The Exchange Chain (X-Chain) is responsible for creating and exchanging tokens. Smart contracts are executed through the C-Chain. It forms the technical backbone for NFTs and decentralized applications (dApps). Metadata blockchain Platform Chain (P-Chain) ultimately coordinates validators and enables the creation of other blockchain networks, subnets. The various chains converge in the primary network. Validators within the proof-of-stake mechanism ensure security. You can deposit at least 2000 Avax and receive regular interest payments.

Avalanche is not based on a linear blockchain. The network relies on a directed acyclic graph. This means that a transaction in the network does not need to be confirmed by all nodes of the network. Using this system allows a smaller fraction of nodes to confirm transactions. According to its own information, the network promises up to 4500 transactions per second. In fact, the throughput does not yet reach this value.

Avalanche relies on interoperability. This opens up the project to many use cases. A lot is possible, from trading tokens to staking, to creating dApps, NFTs, assets, subnets and your own blockchain networks. The network manages to keep fees relatively low. Depending on the application, they are between 0.001 and 0.1 AVAX. Once users pay these fees, it’s Avalanche’s turn to burn. Paid fees are burned after each event. This means that the total supply of available tokens shrinks over time. This may ultimately have a positive effect on the price, which is currently 94% below its ATH.

4. Chainlink: Platform injecting off-chain data for implementation of smart contracts

Chainlink is a blockchain platform with support for smart contracts. It works at the interface between blockchains and external data sources. The project has established itself primarily as a provider of price data in the field of decentralized financial services (DeFi). Data providers or node operators are paid in LINK token. The goal of the project is to act as a base layer for smart contracts. To this end, Chainlink has installed a number of so-called oracles that provide offline data for smart contracts.

At its core, Chainlink is a decentralized network of oracles that allows blockchains to interact with real-world data. This is an important value proposition because smart contracts often cannot be implemented without adding data from the analog world. At the time of writing, LINK’s price is almost 85% below its ATH, and it ranks 12th in the CMC rankings.

So far, the Chainlink team has been able to fulfill their vision of providing accurate external data for blockchains. Although Chainlink was created on Ethereum, it was designed to work on any blockchain that has smart contract functionality. Chainlink does not run its own blockchain, instead it is interoperable and runs on many different blockchains simultaneously.

Chainlink node operators can use LINK as a way to make an offer to a data buyer. The node operator must then provide information to the contract that submits the request. Every payout for operators is paid using LINK tokens. This approach incentivizes node operators to continue accumulating LINK. Why? Owning more tokens means access to larger and more profitable data contracts. If an operator decides to break the rules, their LINK tokens will be taken away as a result.

5. Internet Computer: A platform that wants to connect billions of people with innovative blockchain applications and tools

The Internet Computer is a blockchain computer that scales smart contract calculations and data, runs at the speed of the Internet, efficiently processes and stores data, and provides developers with powerful software frameworks. By enabling this, the Internet Computer offers an opportunity to completely rethink how software is created. It offers a revolutionary new way to build tokenized Internet services, cross-industry platforms, decentralized financial systems, and even traditional business systems and websites.

The project was founded in October 2016 by Dominic Williams and has generated a lot of interest in the crypto community. DFINITY raised 121 million USD from backers such as Andreessen Horowitz, Polychain Capital, SV Angel, Aspect Ventures, Electric Capital, ZeroEx, Scalar Capital and Multicoin Capital, as well as some notable early Ethereum backers.

In the latest step towards decentralization, DFINITY unveiled the Internet Computer to the public on May 10, 2021. This important milestone means that the Internet Computer now functions as a decentralized global computer. The entire Internet Computer source code and ICP token utilities have been made available within, allowing tens of thousands of community members to use the Internet Computer to control the network.

Internet Computer has been gaining in popularity recently, but saw its highest trading volume in November 2021, when it reached its ATH of $2.29 the following month. It quickly became a well-known protocol and cryptocurrency. Although its price is more than 99% below its all-time high, it is among the very promising DeFi coins worth watching

6. Maker: Token management in MakerDAO and the Maker protocol that allows users to issue and manage DAI stablecoins

The product was launched in 2015, but it only achieved its breakthrough in 2017. The declared goal is a certain degree of independence from conventional payment methods. In fact, there are already over 400 apps that Maker Coin works with. These include, for example, ValentePOS, an app that issues legal invoices that in turn accept Dai cryptocurrency, or the Argentina Red Cross. At the same time, the token relies on MKR Governance. Anyone who holds this token can be involved in the decision-making process if they want.

Maker is essentially based on a smart contract system, like many other digital currencies that are built on the Ethereum blockchain. Maker Protocol is one of the first examples of successful DAO-powered DeFi projects. The Maker Protocol allows users to generate DAI if they provide sufficient collateral in the form of one of the ERC20 tokens accepted by the protocol. MKR holders essentially vote on which tokens can be used as collateral to create DAI. MKR holders will receive voting rights in proportion to the number of MKR tokens they hold.

Dai is currently the third largest stablecoin in the world and MKR token holders can control the decisions that affect the future of DAI. MKR Defi coins play an integral role in how the protocol works and are commonly traded on most centralized and decentralized exchanges. The voting rights associated with the issuance of DAI tokens continue to increase the demand for MKR governance tokens.

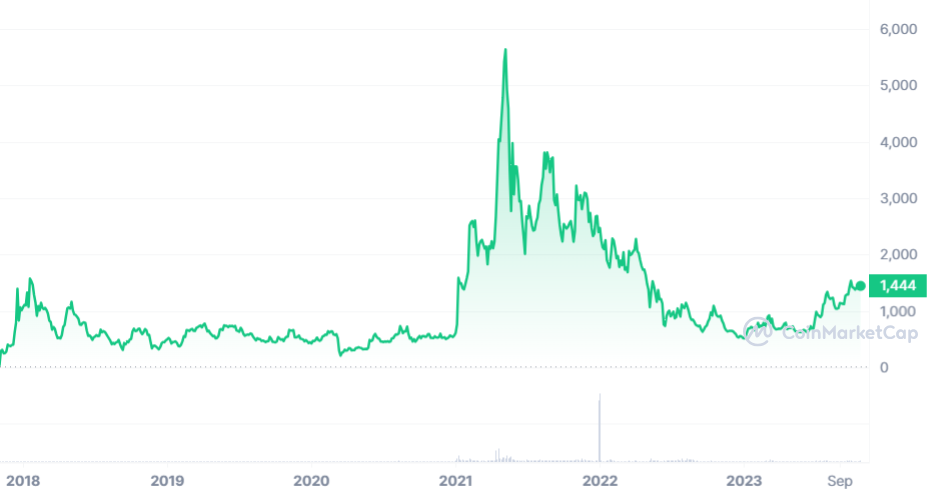

Dai cryptocurrency based on Maker is pegged to the US dollar exchange rate. However, this does not apply to MKR. Fans of the platform can buy, hold or sell the digital asset. The token has been active in the market since 2017. On January 31, 2017, the token was listed at 22.84 USD. It reached its ATH of 6,339 USD on May 3, 2021, but has since fallen 76% to 1,442 USD at the time of writing.

7. Stacks: Bitcoin’s layer 2 blockchain protocol that improves Bitcoin’s functionality through self-service smart contracts

Stacks is an open-source protocol that brings smart contracts and decentralized applications (dApps) to Bitcoin. It enables a higher level of Bitcoin functionality while leveraging the network’s security and decentralized nature. Stacks was created by Muneeb Ali and Ryan Shea under the startup Blockstack PBC. Their goal was to develop a decentralized, user-owned network.

The official token of the Stacks network is STX. To fund the development of the project, Blockstack held an initial token offering in 2017, where the team raised around 50 million USD. Blockstack then offered a public sale in 2019. With the increase in listings after the public sale, STX experienced significant growth, reaching an all-time high of 3.61 USD in 2021. However, the growth was unsustainable and the token gradually fell by more than 86% to 0.688 USD at the time of writing.

The unique process that confirms blocks on the Stacks blockchain while running parallel to the Bitcoin blockchain is called Proof of Transfer (PoX). In Proof of Transfer, a miner spends BTC to generate a block, then writes a new block to the Stacks blockchain and receives the newly created STX as a reward. Miners send BTC to specific addresses participating in the PoX consensus. Through random selection, miners compete for the right to generate the next block of Stacks and receive STX DeFi coins in return. The Stacks protocol works with Bitcoin’s underlying layer without changing it, as it ultimately settles transactions in its own token.

Stacks is building a Web3 ecosystem that provides a set of decentralized applications, DeFi protocols, and a thriving Bitcoin NFT market, all with the enhanced security of the Bitcoin blockchain. Stacks aims to empower people to control their data and resources. It is also committed to bringing decentralized finance to Bitcoin as it continues to build towards a more decentralized economy as one of the few Bitcoin layers created to date. This layer 2 protocol on Bitcoin has the potential to become the most important Bitcoin layer in the coming decade.