US Treasury yield curve highlights signs of recession, analyst believes that will be ’10 times worse than global economic crisis’

2 min read

Concerns about the recession and the 1970s-style stagflation economy continue to plague Wall Street and investors as further reports show that recession signals have intensified. With rising oil and commodity prices, Reuters reports that investors are “recalibrating their portfolios for the expected period of high inflation and weaker growth.”

Wall Street fears a recession, an analyst believes global markets are collapsing this year

Several reports have emerged this week that have raised concerns about the 1970s-style stagflation economy and early economic impact. Three days ago, Reuters author David Randall noted that US investors fear the central bank’s actions, soaring oil prices and the current conflict in Ukraine. Randall spoke with Nuveen’s chief investment officer for global fixed income, Anders Persson, and the analyst noted that there was no stagflation yet, but it was approaching that point.

“Our case is still not the stagflation of the 1970s, but we are close,” Persson said.

Energy stocks, precious metals and global commodities skyrocketed last week, setting new records. On Saturday, the popular analyst Pentoshi tweeted about the coming “bigger depression”.

“The most interesting thing this year. Global markets will collapse. Any market that trades above 0 will be too high. They will call it “The Great Depression, which will be 10 times worse than the Great Depression.”

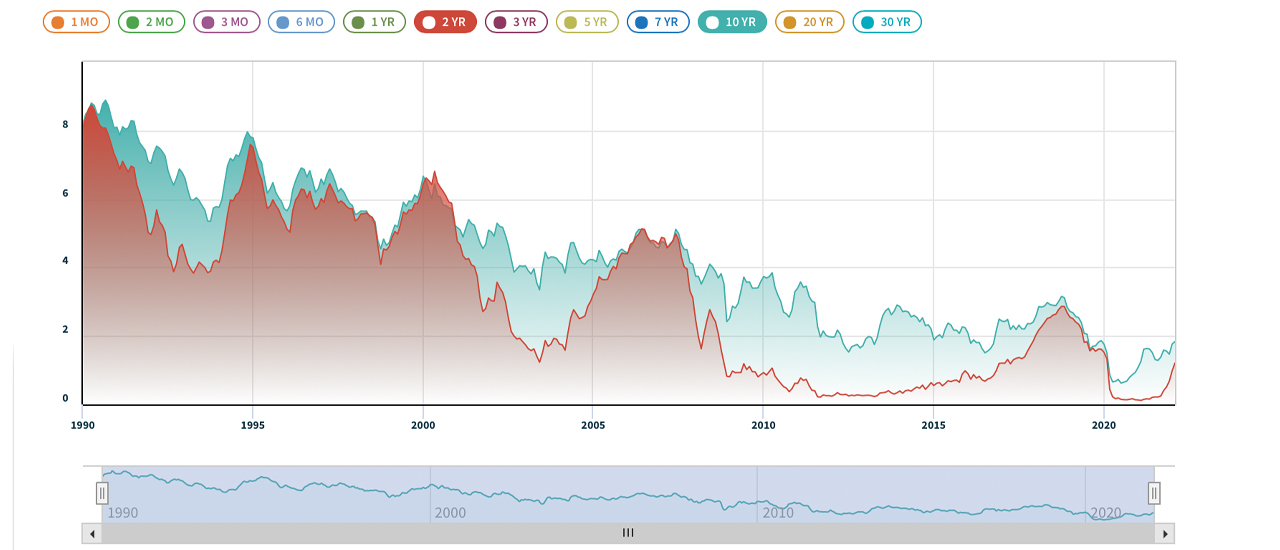

The US Treasury yield curve highlights stronger signs of recession

The following day, Reuters author David Barbuscia said that “fears of a recession are already more pronounced in the yield curve of US government bonds.” The data in his report emphasize that “the closely watched difference between the yields on two- and 10-year bonds was the narrowest since March 2020”.

Numerous financial publications highlight how rising oil and commodity prices are usually associated with the impending recession, including CNBC, which also reported that it had acquired a $ 5 billion stake in Occidental Petroleum and also doubled stake in Chevron, according to recent Berkshire Hathaway filling by Warren Buffett.

TOP cryptocurrencies for staking with passive reward up to 80%