Why Putin’s “gold standard” will fail?

5 min readTable of Contents

US dollar critics and fans of the gold standard are feeling very confident these days. The reason for this is the alleged intention of the BRICS countries to issue their own currency. The US dollar alternative should be gold-backed and thus win the trust of its holders – at least that’s the theory.

Russia’s monetary special operation

The motivation behind the new gold currency is simple: the dominance of the US dollar is a thorn in the side of the BRICS countries. Russia in particular had to experience this painfully when the country’s US dollar foreign currency reserves were frozen in the course of the war of aggression against Ukraine.

All countries whose relationship with the USA can be described as tense have thus become impressively aware of their dependence on the current key currency. Accordingly, one now wants to step on the gas pedal and take advantage of the general uncertainty in the foreign exchange sector.

No money without trust

The basis of any currency is the trust placed in it. However, the BRICS countries, especially Russia, do not exactly have the most trustworthy reputation. As a substitute for trust, the envisaged gold cover is therefore invoked.

This in turn raises the question of whether the gold backing can be trusted. In what proportion should the currency be backed by gold? Can the currency be converted back to gold at any time? What powers over the gold do the BRICS countries have with their newly founded financial institutions? So far one can only speculate.

BRICS gold currency a mammoth project

Building such a gold currency regime together with several countries is a mammoth project. Even if Russia steps on the gas pedal here, it is doubtful that such a project can be implemented in a few months – without it directly backfiring.

Each individual BRICS state would like to assert its interests in such a construct. However, not every state is equally powerful. China has the most say in this round. South Africa, on the other hand, would have it much more difficult.

Nor are the BRICS countries an association of friends. India in particular has no interest in hiding under the bushel of China. As if that weren’t enough, Russia is a ticking time bomb. How much longer will Putin be able to guarantee domestic political stability? China will not blindly take any risk just to put a damper on the US dollar. Especially since they want to roll out their central bank digital currency (CBDC) further, which could conflict with the BRICS gold currency.

Victim of their own success

Suppose all the criticisms listed turn out to be unjustified reservations and the planned BRICS gold currency becomes a complete success. Even then, the question arises as to whether the BRICS countries are really doing themselves a favor.

After all, it is only a supranational second currency, as a supplement to its own national currency. So the situation is completely different from that of the US dollar, which was gold-backed until 1971. If the BRICS gold currency were to become a major export hit, the project could even backfire.

After all, more and more money would flow from the ruble, renminbi, etc. into the gold currency – all fiat currencies not covered by gold would devalue against the BRICS gold currency. The repayment of foreign debt could quickly lead to a new debt crisis given the devaluation pressure.

Fort Knox instead of Moscow

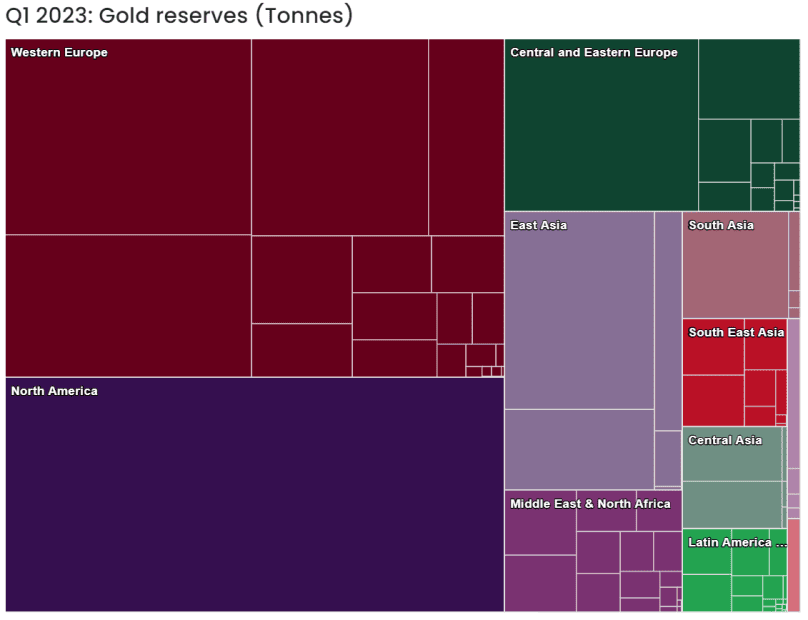

If one further assumes that the importance of gold in the currency context will continue to increase, the BRICS countries would lose out to the West here as well. Most of the state-owned gold reserves are still in the vaults of the West, as illustrated in the chart below. Even if China is believed to be acquiring more gold than officially stated, the gap between BRICS and the West is enormous.

More internal accounting unit than global currency?

Against this background, the impression arises that the BRICS gold currency could be more of a “currency light”, an exclusive, internal unit of account. This would have nothing to do with a “real” currency open to private individuals or outside actors to buy or trade with. As a closed system, which is only accessible to the participants, one would not even have the opportunity to enter the global currency competition qua construction. A threat to the US dollar looks different.

Instead, the BRICS gold currency could serve more as a special currency for foreign trade, which is used as collateral for loans. For example, if South Africa buys commodities from Brazil, then the BRICS gold currency could be used instead of the US dollar for that trade.

But even if the US dollar dominates as the key currency in commodities trading, the BRICS countries do not need a supranational currency for this. More and more foreign trade transactions or credit financing by international players are already taking place without the US dollar.

Better bitcoin than gold

If the BRICS want a dollar-agnostic payment infrastructure whose store of value is not subject to inflation, then it would be much easier to agree on bitcoin. Transactions could not be blocked, nor could funds be frozen. No one has to trust the other and fear that the other will gain an advantage in the newly created system.

While gold is expensive and prone to fraud due to its physical limitations, this would not be the case with the native digital bitcoin. Rather than having to trust a corrupt country like Russia to honestly report its gold holdings, it would be far more reliable and easier to take a look at the Bitcoin blockchain. This same intention also coincides with the statement by BlackRock CEO Larry Fink, who recently spoke about Bitcoin’s role in international trade.

Putin’s wishful thinking will fail in reality

At first glance, the promises of a gold-backed currency may sound enticing to many people. Confidence in our monetary system has continued to decline in recent years. Now, however, to believe that a gold-backed currency of the BRICS countries will pose a threat to the US dollar is unlikely to work.

Instead, the new gold currency is probably primarily a matter of wishful thinking on the part of the Kremlin, which not every BRICS country is enthusiastic about. This would also explain why so far only Putin’s media outlet Russia Today and gold lobby sites like Kitco goods that present the BRICS gold currency as a done deal.