Bitcoin analysis: Is another price correction imminent?

4 min readThe price of the key cryptocurrency Bitcoin (BTC) is currently struggling at the 30,000 USD mark. Last weekend, the BTC price failed again at this psychological resistance level and slid to the support level between 27,995 USD and 27,679 USD at the beginning of the week. Although Bitcoin was able to stabilize here for the time being, it is now trading below the moving average EMA200 in the 4-hour chart. The renewed recovery of the US dollar index DXY is currently acting as a headwind. However, as long as the Bitcoin price is able to remain above the last historical low of around 27,000 US dollars at the daily closing price, the buyer side can launch a new attack at any time. The key interest rate decision by the US Federal Reserve on Wednesday evening and Apple’s quarterly figures on Thursday after the US stock market close should be decisive for the price direction in the coming trading days.

Bitcoin: Bullish price targets for the coming trading weeks

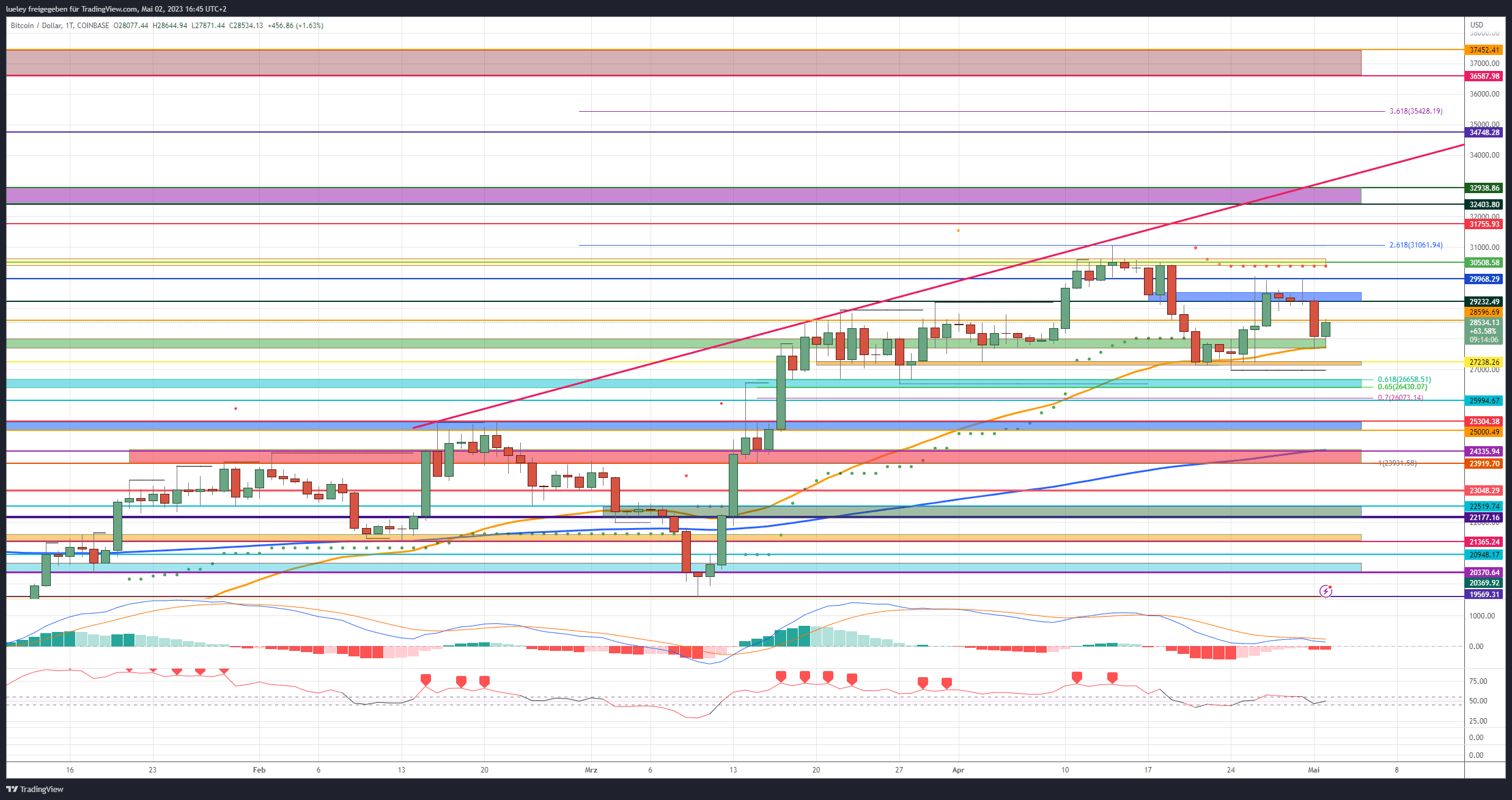

Bullish price targets: 28,596 USD, 29,232 USD, 29,968 USD, 30,385/30,624 USD, 31,061 USD, 31,755 USD, 32.403/32.938 USD, 34,748 USD, 35,561 USD, 36,587/37,452 USD

The Bitcoin course was recently unable to break free and ranged between 30,000 USD and 26,972 USD in the last 13 trading days. In the short term, the buyer side must do everything possible to stabilize the BTC price above the EMA50 (orange) sustainably above the EMA50 (orange) in the daily chart. Only when Bitcoin can subsequently break out of the 28,596 USD mark again can a renewed rise towards 29,232 USD be planned. If this resistance level is also recaptured, a new directional decision will be made just below the 30,000 USD mark at 29,968 USD.

A break of this level will open the way towards the yellow resistance zone between 30,385 USD and 30,624 USD. Here the BTC course failed several times in April. In addition, the supertrend can be found here in the daily chart. If the buyer side then succeeds in breaking through this area in the long term, Bitcoin could take off from the annual high of 31,061 USD towards 31,755 USD. To break through this area, the bulls will have to show strength again. Only when Bitcoin pulverizes this area can a subsequent increase to the next relevant target area between 32,403 and 32,938 USD be planned.

The old historical low from January 25, 2022 at USD 32,938 still acts as the next medium-term price target. The price-limiting red uptrend line also runs not far above it. This is where it will be decided whether buyers have the strength to send bitcoin further north. A first indication would be a stabilization above the yellow chart area around 30,508 USD. If a subsequent breakout of the resistance at 32,938 USD and a breakout of the red trendline are successful, the Bitcoin price should target the next target at 34,748 USD.

In a first step, a march through to the 361 Fibonacci extension at 35,594 US dollars would be conceivable. Bitcoin could then even advance into the brown resistance zone between 36,587 and 37,452 USD.

Bearish bitcoin price targets

Bearish Targets: 27,995/27,679 USD, 27,238 USD, 26,658/26,430 USD, 25,994 USD, 25,304/25,000 USD, 24,389/23,898 USD, 23,048 USD.

So far, the bears have successfully prevented the price from stabilizing above the psychological 30,000 USD. With yesterday’s relapse to the cross support of EMA50 and horizontal support line, the sell side showed its strength again. If Bitcoin falls below the green support zone in a timely manner, a renewed consistency test of the previous week’s lows between around 27,000 US dollars should be planned.

If this support is also undercut, there will be a short-term directional decision between 26,658 and 26,430 USD. The buyer side was able to stabilize the BTC price here several times in the second half of March. In addition, the golden pocket of the last trend movement runs here.

Only a clear daily closing price below would lead the consolidation directly back to the 25,994 US dollars. This would put a retest of the blue support zone between 25,304 and 25,000 USD within reach. This zone continues to act as strong support and represents an interesting buying level for the bulls. If the bears manage to break this support as well, the correction will widen towards the red support zone between 24,389 and 23,898 USD. Here Bitcoin should find support from the EMA200 (blue) and new buyers will come into the market.

Looking at the indicators

The RSI as well as the MACD in the 4-hour chart are currently tending slightly north again after falling back into the oversold area. The RSI is trading back in the neutral zone with a reading of 47. However, only a breakout above 55 would generate a new buy signal here. The RSI indicator can also be rated as neutral in the daily chart with a value of 49. However, the buyer side recently managed to stabilize the RSI within the neutral zone – a positive indication. Although the MACD shows a slight sell signal on a daily basis, it continues to trade above the relevant 0-line.

In the weekly chart, both indicators continue to show buy signals, but the RSI is currently falling slightly to the south. Investors with a long-term perspective need not yet overestimate this trend. As long as the RSI can settle above the 55 mark, everything is still in balance for the buyer side.