Uniswap Holds Vote on UNI Liquidity Farming Renewal as TVL Dumps

2 min readThe world’s top decentralized exchange, Uniswap, has held what it refers to as a ‘temperature check’ poll to determine what will happen with the UNI liquidity farms due to expire today, November 17.

The move comes as liquidity on the protocol slumps in advance of the closure of the four UNI mining pools. The two-month mining program distributed over 20 million UNI tokens to DeFi farmers working out at 2.5 million tokens per pool per month.

The poll asks the community whether Uniswap should distribute the UNI liquidity to farmers as a preliminary vote on further extending incentives.

A community proposal to continue UNI rewards at a reduced rate is currently at the "temperature check" stage.

Vote in this off-chain snapshot to signal your support for or against! https://t.co/Mr0Uwv1MIg

— Hayden Adams

(@haydenzadams) November 16, 2020

If the ‘temperature check’ passes with a minimum of 25,000 UNI, a second consensus vote will be posted to finalize the details of the proposal explained DeFi Rate’s Cooper Turley who made the proposal along with community member ‘Monet Supply’. He added;

“The goal of this proposal is to ‘maintain the status quo’, using reduced incentives as a means to continue distribution as we look to optimize allocations in the medium term.”

The second vote will be on the distribution of UNI for an additional two months. Distribution will go to the same four pools, but at half the rate of the genesis distribution, working out at 1.25 million UNI per month to each of the pools.

At the time of writing, there was over 60% voting for the proposal and 32% against it meaning that the majority wants to continue farming.

Collateral Exodus Begins

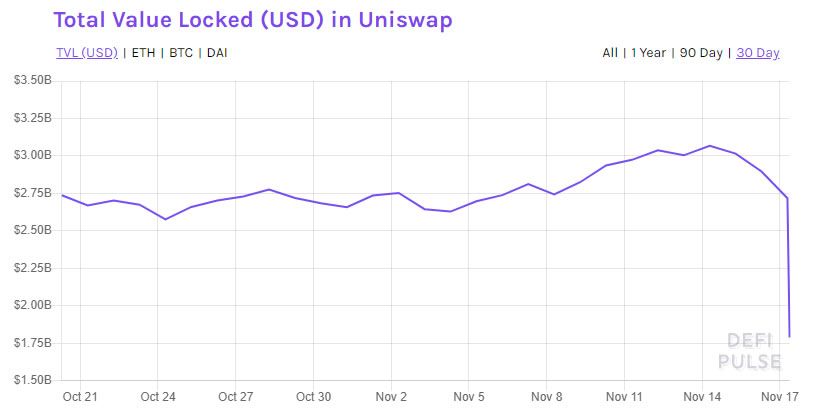

It appears that the last-minute governance action has come too late as liquidity is already flowing out of Uniswap. From an all-time high of just over $3 billion last week, Uniswap has lost 40% of its collateral in a sharp fall to $1.8 billion according to DeFi Pulse.

Over a million ETH has left the protocol in the past 24 hours, though Ethereum prices are up on the day indicating that it is being held or shifted to other DeFi farms.

As a result, its market share has dropped to 19% and it is in danger of losing the top spot to Maker which has seen a TVL increase of 2.8% over the past 24 hours.

UNI Price Update

UNI has yet to be distributed despite the liquidity loss, so there has been little effect on markets and prices with the token trading up about a percent on the day at $3.80.

Prices did take a dip on Monday, dropping to $3.50 but they have since recovered. This week is likely to see more volatility for Uniswap as governance arrives at the party too late.

The post Uniswap Holds Vote on UNI Liquidity Farming Renewal as TVL Dumps appeared first on BeInCrypto.

(@haydenzadams)

(@haydenzadams)

![Decentraland: Review & Beginner's Guide [current_date format=Y] 23 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)