Prediction of BTC value using quantitative models – part 4

3 min read

Predicting the development of the value and price of BTC is a thorny but at the same time very popular topic. There are several methods that help us with predictions. What do you need to know about them?

Hash rate and estimated price of BTC

In the field of data mining, the term “hash rate” is a security metric. The greater the hashing power, the greater its security and resistance to external attacks. It’s one thing for a hacker to attack your home computer, but it’s another thing for a hacker to try to attack tens of thousands of computers around the world at the same time.

The increase in the hash rate is due to the ever-increasing computing power of mining servers, which also means rising BTC (BTC) mining costs. A simple rule tells us that the activity must be economically viable in order to be sustainable in the long run. He who mines oil from the land must sell it at a price higher than the cost of extraction, he who produces electricity must sell it at a price higher than the cost of production, and so on.

The same rule applies to BTC mining, where the cost of electricity, depreciation of increasingly powerful servers, etc. must be lower than the revenue from the receipt of bitcoins for the activity performed. The increasing demands of BTC mining must therefore correspond to the economic advantage.

Rewards to miners

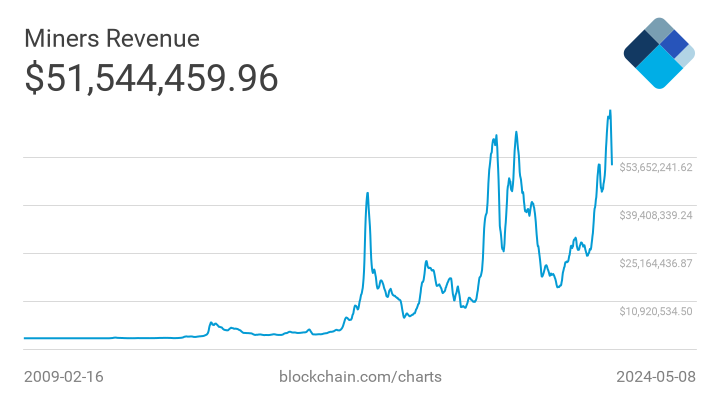

In the first months of 2010, BTC miners paid about $ 10,000 a month. Today, with the rise in the price of BTC, the world’s miners’ network distributes more than $ 50 million a month in wealth – and that value continues to grow.

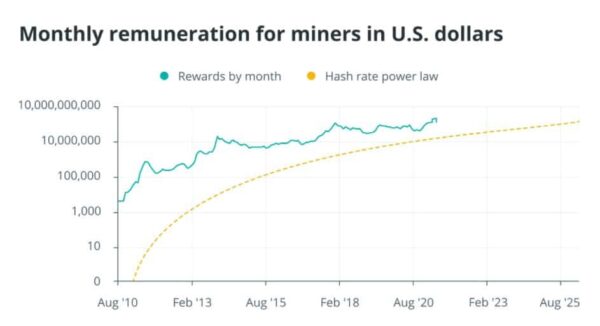

This number is huge, albeit partly commensurate with electricity consumption, but it makes it possible to understand the wealth generation that this “social experiment” is able to create. As we can see from the chart, the growth of the hash rate is higher than the growth of the monthly remuneration. Therefore, in order to correctly estimate the price of BTC based on the hash rate, it is first necessary to understand the evolution of the reward for each hash unit over time.

As can be seen, the dollar fee for the hash rate is falling sharply. This means that security increases almost exponentially over time, but security costs have dropped significantly over time. Thus, for estimating the (non-linear) trend of the decline in the hash rate, the function that best represents this trend is, as always, indirect proportionality.

Once we get this feature, by multiplying the two hash rate growth and payment functions by a single hash rate, it is possible to get a feature that approximates the monthly reward in USD over time. This result does not approach the value of the price of one BTC, but a monthly reward that increases over time.

To estimate the price of BTC, corrected according to this hash rate metric, it is necessary to divide this value by the average number of bitcoins mined in a given month. In this way, we obtain a typical stepwise trend of the previously described stock-to-flow ratio model.

Conclusion

Even with strong volatility and seemingly incomprehensible price movements, the three main factors that drive BTC’s price – scarcity, demand and production costs – can be really useful for understanding the dynamics of BTC’s price movement.